Symbotic (SYM) is a Leader in AI Robotics, But Is Its Stock Underappreciated?

After an accounting-related selloff, shares of Symbotic look attractively priced

- Symbotic is revolutionizing logistics with AI-powered robotics, driving automation and improving efficiency in warehousing for retailers like Walmart, Target and Albertsons.

- Despite its stock’s volatility, the recent price drop could present an attractive opportunity, with analysts indicating notable upside potential.

- For investors looking for diversified exposure to the sector, robotics-focused ETFs like BOTZ and ROBO offer a solid alternative, helping to mitigate the risk associated with individual stocks.

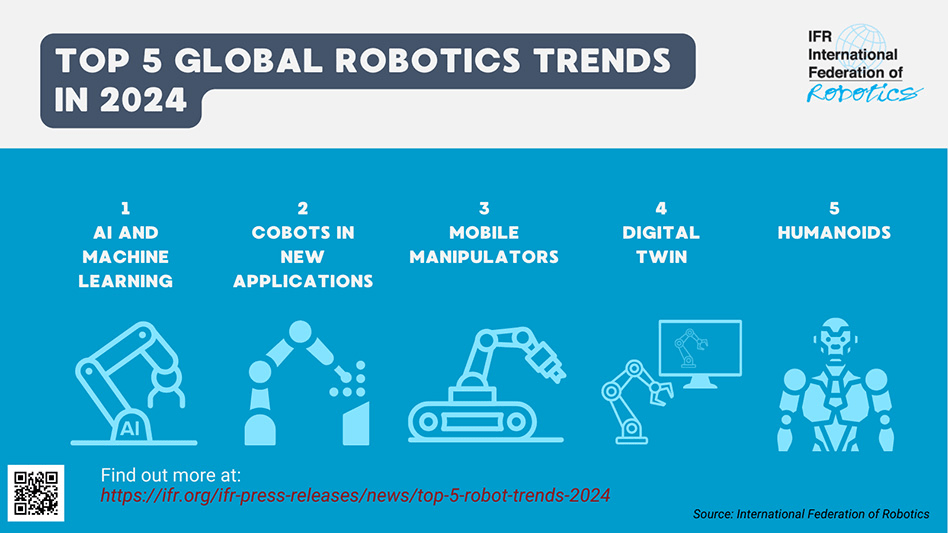

This year’s CES, which was formerly called the Consumer Electronics Show, has set the stage for a thrilling glimpse into the future, unveiling robotics innovation that could fundamentally alter how human beings interact with technology. From AI-driven personal assistants to autonomous delivery drones, it’s as though science fiction has leapt off the screen and into our everyday lives. But many of the products and services showcased at CES are still years away from becoming commercially viable. In the meantime, today’s robots—powered by recent advances in AI—are already a disruptive force in the market.

Symbotic (SYM) is a prime example of how AI-powered industrial robots are no longer just a vision of the future but a driving force in today’s economy. In logistics and warehousing, these robots are already reshaping how businesses operate, replacing manual labor with automation that boosts efficiency and accuracy. Instead of waiting for distant innovation, Symbotic is seizing the moment, delivering real-world products and services that are catching the attention of retailers and transforming supply chain operations. And as demand for these cutting-edge systems has grown, Symbotic has seen a surge in both sales and deployments, proving the robotics revolution isn’t just coming—it’s already here.

Today, we take a closer look at Symbotic and dissect its valuation to assess the attractiveness of its shares. We also highlight a couple of well-known robotics-focused exchange-traded funds (ETFs), such as the Global X Robotics and Artificial Intelligence ETF (BOTZ) and the Global X Robo Global Robotics & Automation ETF (ROBO). They may represent attractive alternatives for investors seeking more diversified exposure to the sector.

Pushing the boundaries of logistics automation

Symbotic has firmly established itself in robotics by concentrating on warehouse logistics. By integrating AI with robotics, Symbotic has developed a cutting-edge, end-to-end automation platform that improves the efficiency and accuracy of warehousing. The company has already seen success by deploying its platform with retailers like Walmart (WMT), Target (TGT) and Albertsons (ACI). Additionally, Symbotic’s partnership with SoftBank through the GreenBox Systems joint venture seeks to bring AI-powered logistics to smaller companies, expanding its reach in the industry. These examples highlight the fact Symbotic is one of the few companies successfully merging AI and robotics in logistics.

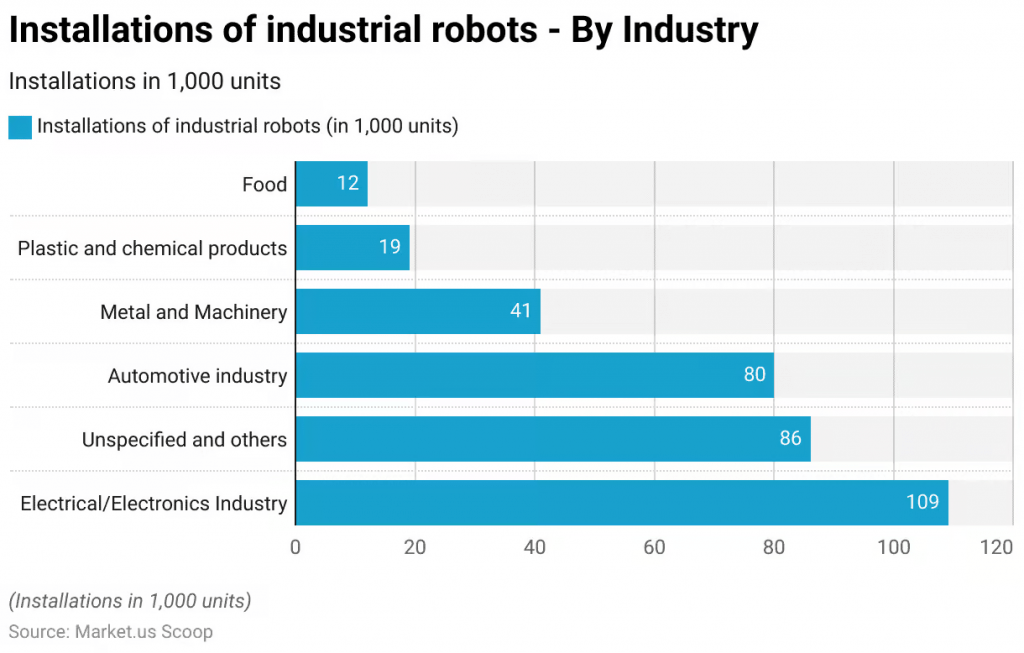

In terms of practical deployment, most of the robots used for commercial purposes today are in manufacturing, with particular emphasis in electronics and automotive applications (highlighted below). Symbotic is building on this trend by focusing on logistics automation, an increasingly important niche in robotics.

Symbotic’s system employs a fleet of autonomous robots, known as SymBots, which navigate high-density storage structures to manage inventory. They perform tasks such as sorting, storing and retrieving products with high precision. The platform’s AI-powered software orchestrates them optimizing workflows and adapting to changing demands. This integration enables retailers to streamline their supply chain operations, reducing reliance on manual labor and improving productivity.

Growing revenue and profitability potential

Symbotic’s latest earnings report for Q4 of fiscal 2024 paints a picture of healthy financial growth, although not without challenges. In Q4 alone, the company posted revenue of $577 million, a remarkable 47% increase year-over-year compared to $392 million in Q4 of 2023. This growth is a testament to the strong market demand for Symbotic’s AI-driven robotics systems. On top of those impressive sales figures, the company booked $28 million in net income, an turnaround from a net loss of $45 million in the same quarter last year.

For the full fiscal year 2024, Symbotic reported a 55% increase in revenue, reaching $1.82 billion. While the company still posted a net loss for the full year, the adjusted full-year EBITDA of $96 million highlights operational progress and cost management improvements in 2024 compared to 2023. Moreover, cash reserves stood at $727 million at the end of the fourth quarter, indicating the company possesses the liquidity necessary to support growth and innovation.

Looking ahead, Symbotic’s expects robust growth for the first quarter of 2025. The company is projecting revenue will fall between $480 million and $500 million. Adjusted EBITDA is expected to be between $12 million and $16 million. While the company is undergoing a transition toward higher gross margins, the improvements seen in Q4 suggest the company is on track to achieve more consistent profitability, though potential challenges remain in terms of project execution and the speed of system deployment.

An accounting-related setback

In autumn 2024 Symbotic identified an issue with its revenue recognition practices, prompting the company to restate its fiscal 2024 earnings. The discrepancy arose when some goods and services related to milestone achievements were expensed before the corresponding milestones were reached, resulting in accelerated cost and revenue recognition. This timing issue led to minor adjustments in previous quarterly financial results, but these restatements didn’t materially affect the company’s full-year fiscal 2024 results.

As part of this process, the company issued some slight revisions to its financial outlook. For the current quarter, the company lowered its revenue projection to a range of $480 million to $500 million, down slightly from the previous range of $495 million to $515 million. Adjusted EBITDA is now projected between $12 million and $16 million, compared to the earlier range of $27 million to $31 million. These revisions stem from the revenue recognition change, with the company’s business fundamentals remaining intact.

While this issue has tarnished the company’s reputation, Symbotic’s decision to address this issue voluntarily reflects its commitment to transparency and accurate reporting. The company’s proactive stance, along with its ongoing efforts to strengthen internal controls, also suggests this will not be a recurring issue. However, some investors might feel uncomfortable with this accounting irregularity and choose to avoid the stock or wait on the sidelines to ensure no further infractions are uncovered.

Stock down, optimism rebounding

Symbotic has become a magnet for both enthusiasm and skepticism in robotics and automation. On one hand, investors are drawn to its rapid growth of revenue, innovative technology and strong market position, viewing it as a leader in a promising sector. On the other, the company faces its share of skeptics, partly because of the recent accounting issue. The short interest in the stock is roughly 39% of float, which is well above the 20% threshold usually considered “significant.” This tug-of-war between optimists and critics has resulted in a rollercoaster ride for Symbotic’s stock. Over the past 52 weeks, shares have ranged between $17 and $52, with the company’s valuation briefly topping $30 billion at the high point.

The company’s market capitalization stands at around $15 billion, less than half its peak value. While this sharp decline may seem alarming, it also brings the stock into a more reasonable range, especially considering the company’s P/E Non-GAAP TTM of 21, which is in line with the sector median of 19. This shift could point to a potential undervaluation, offering an enticing entry point for those still bullish on Symbotic’s long-term prospects. Analysts appear to share this optimism, with 16 firms covering the stock, nine rate the shares “buy” or “overweight,” six maintain a “hold” rating” and only one rates the shares a “sell.”

Ultimately, Symbotic’s near-term valuation will be shaped by continued growth of revenue and, importantly, its ability to transition toward profitability as it scales up. Unlike many early-stage companies, Symbotic is already producing substantial revenue and has grown impressively, which suggests a high likelihood it can continue to deliver. The average analyst price target for Symbotic is roughly $33 per share, and with the stock currently trading at about $25 per share, there’s considerable upside potential. For those bullish on the company, the current valuation may therefore present an attractive entry point.

Diversifying with robotics-focused ETFs

Investors interested in the robotics sector—but looking to mitigate the risks of owning a single stock like Symbotic—have a couple of strong alternatives. Two robotics-focused exchange-traded funds (ETFs)— the Global X Robotics and Artificial Intelligence ETF (BOTZ) and the Global X Robo Global Robotics & Automation ETF (ROBO)—offer diversified exposure to the expanding robotics and automation market. Both funds have performed well over the last 52 weeks, each posting gains of around 10%.

BOTZ, for instance, includes top holdings like Nvidia (NVDA), which makes up 13.12% of the ETF, alongside Intuitive Surgical (ISRG), which accounts for 10.46%. Other key holdings in BOTZ include ABB (9.04%), Keyence (6.78%), and Fanuc (3.95%), among others. These companies represent a broad spectrum of the robotics and automation industry, from AI and industrial robotics to surgical robotics and automation for factories.

On the other hand, ROBO’s top holdings also feature Intuitive Surgical, which makes up 1.78% of the ETF, along with Harmonic Drive Systems (2.57%), Hiwin Technologies (1.97%), and Fanuc(1.82%). ROBO’s exposure is more diversified across international players in robotics, including companies like Teradyne (TER, 1.80%) and Rockwell Automation (ROK, 1.72%), which focus on both robotics and automation technologies.

Investors may want to choose between these ETFs—or even use both—based on the specific exposure they seek. For example, the presence of Nvidia in BOTZ might appeal to those looking for exposure to AI and semiconductor growth, given Nvidia’s pivotal role in powering many robotics and AI applications. On the other hand, ROBO offers a slightly more diversified global exposure with companies from various regions and industries, including a heavy focus on industrial automation. Either choice provides a strong way to invest in the robotics theme without the risk associated with individual stocks.

Andrew Prochnow, Luckbox analyst-at-large, has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.