Chips, Picks & Shovels: Luckbox is all in on AI

Look for this recurring recap in subsequent issues.

Beyond the blue links

Search will soon have a new look. At its annual I/O conference in May, Google announced generative AI results would soon assume top billing on its search pages, nudging the familiar “10 blue links” farther down on the results page.

But the changes won’t end there. As conversational AI becomes ubiquitous, users will simply ask a question and the chatbot will respond with the answer instead of a list of sites.

Greener grass?

Besides clicking on fewer links, users can look forward to personal AI co-pilots and interactive appliances. They’re certain to open endless possibilities for professional productivity and lifestyle hacks. (“Hey toaster, make my toast browner.”)

Conversational computing will also create new platforms for advertisers. “Making your toast browner? Don’t forget Scott’s Turf Builder can make your brown grass greener!”

That’s amusing, but the ads could have a darker side, too, says Louis Rosenberg, chief scientist for both the Responsible Metaverse Alliance and the California-based predictive analytics firm Unanimous AI.

Something called “conversational influence” is worrying Rosenberg.

He defines it this way: “AI-powered virtual spokespeople that look, speak and act like authentic users but are designed to push the interests of third parties.”

Those spokespeople could bring the dangerous “potential deployment of real-time interactive experiences that are designed to persuade, coerce or manipulate users as a form of AI-powered targeted influence.”

Purple progress

Manipulative advertising aside, AI also has lots of potential for good. Take the example of identifying people susceptible to pancreatic cancer.

The disease has the highest mortality rate of all major cancers, and long-term survival is extremely uncommon—just 2% to 9% of patients at five years. Early-stage pancreatic tumors don’t show up on imaging tests, so people often don’t receive a diagnosis until the cancer has metastasized.

An AI tool can accurately identify individuals most likely to fall victim to pancreatic cancer up to three years before their actual diagnosis based solely on their medical records, according to a new study in Nature magazine by researchers at Harvard Medical School and University of Copenhagen.

Barely in the black

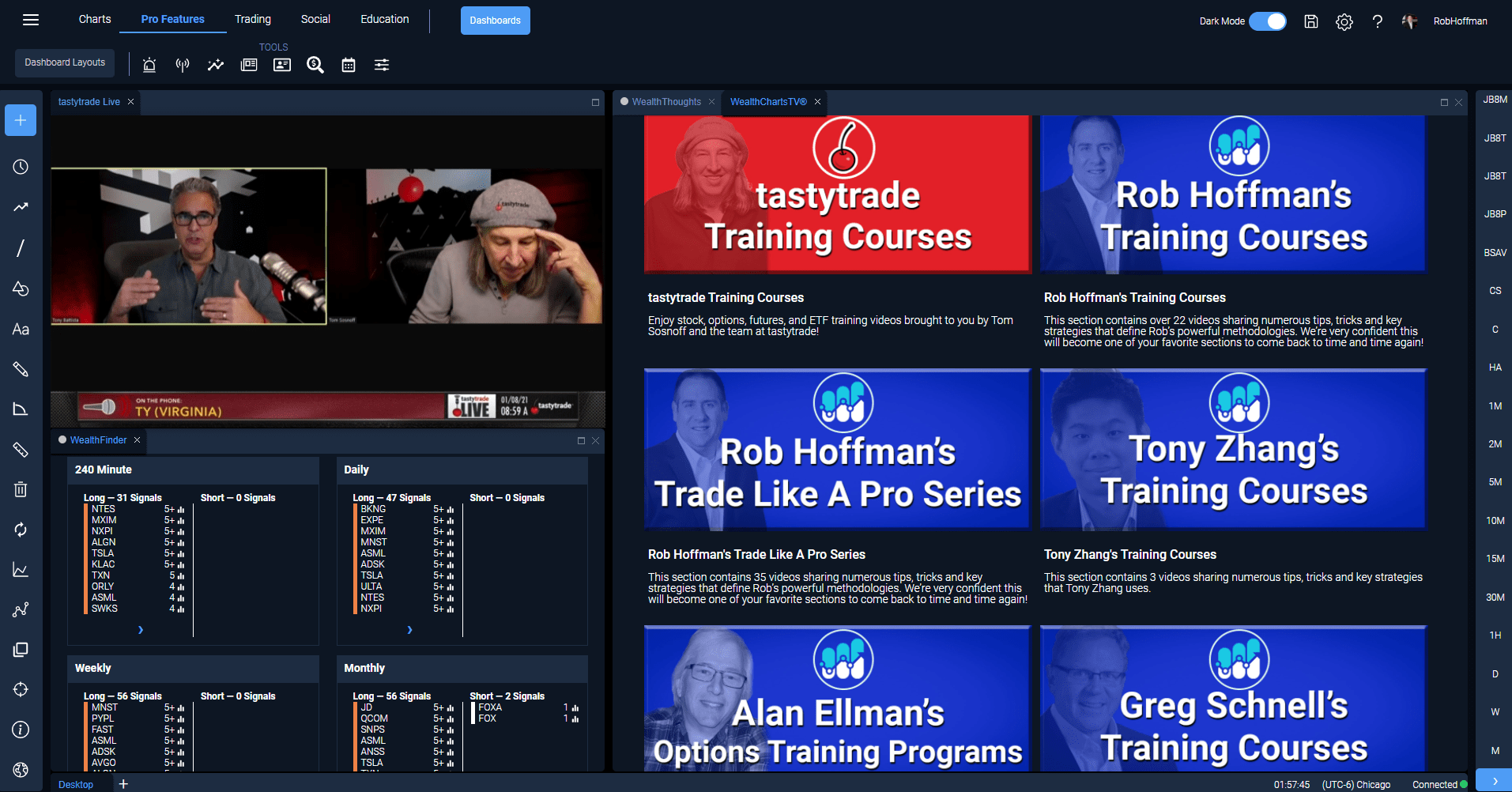

AI can benefit investors, too. If your trading account is in the red, new research at the University of Florida suggests “incorporating large language models into the decision-making process can yield more accurate predictions and enhance the performance of quantitative trading strategies.”

Meanwhile, Alejandro Lopez-Lira, co-author of a research paper called Can ChatGPT Forecast Stock Price Movements?, told Luckbox that ChatGPT sentiment scores exhibit a “statistically significant predictive power on daily stock market returns.”

In the paper, he describes AI’s “advanced language understanding capabilities, which allow it to capture the nuances and subtleties within news headlines.”

That got our attention. But when we pressed Lopez-Lira on defining “statistically significant” (a detail suspiciously absent from the research paper), he cited a 13 basis point next-day increase in stock prices.

“It’s not huge, but it’s not that small either,” he observed.

The case for Nvidia & Advanced Micro Devices

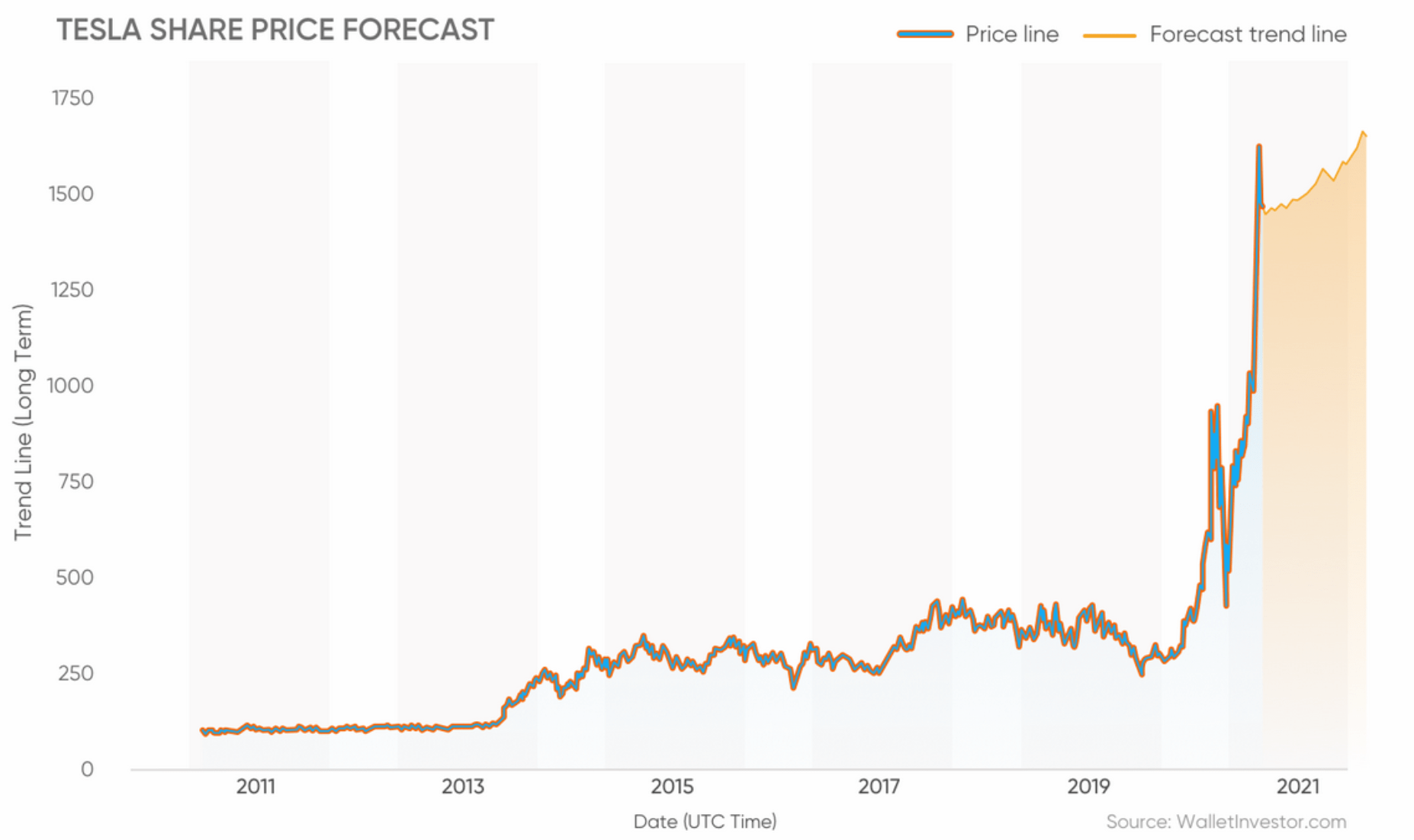

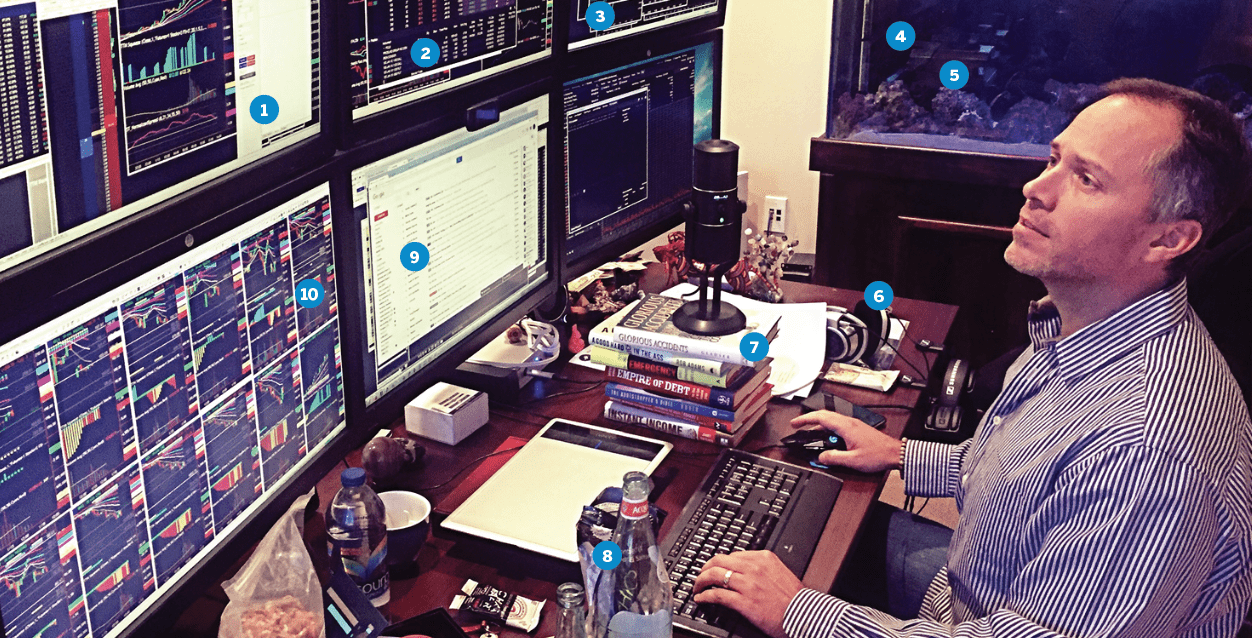

Cutting-edge, large-language-model AI systems require the latest high-capacity AI-specific chips. Older AI chips are slower and expensive to scale. But even with state-of-the-art AI chips, training an AI algorithm can cost tens of millions of dollars, which is why a sizable portion of AI spending is on graphic processing unit (GPU) chips.

Chip leaders

Nvidia (NVDA) and Advanced Micro Devices

They all need state-of-the-art GPUs to be competitive. Regardless of which company sells the most products, Nvidia and AMD will be the beneficiaries. The AI gold rush is on, and these two are the classic “pick and shovel” players.

AMD could earn $400 million in AI revenue in 2024, and perhaps as much as $1.2 billion, says Morgan Stanley semiconductor analyst Joseph Moore.

Short stack

While the intermediate and long-term cases for both companies are exceptionally compelling, Nvidia is richly priced relative to AMD. Both have significant China/Taiwan geopolitical exposure. While AMD is worth a nibble at current prices, these companies should lead your watch list for opportunities to accumulate shares on weakness.