How 0 DTE and 45-day Strategies Took This Trader To 24 Mil

Meet the latest active investor in tastylive's Rising Stars series

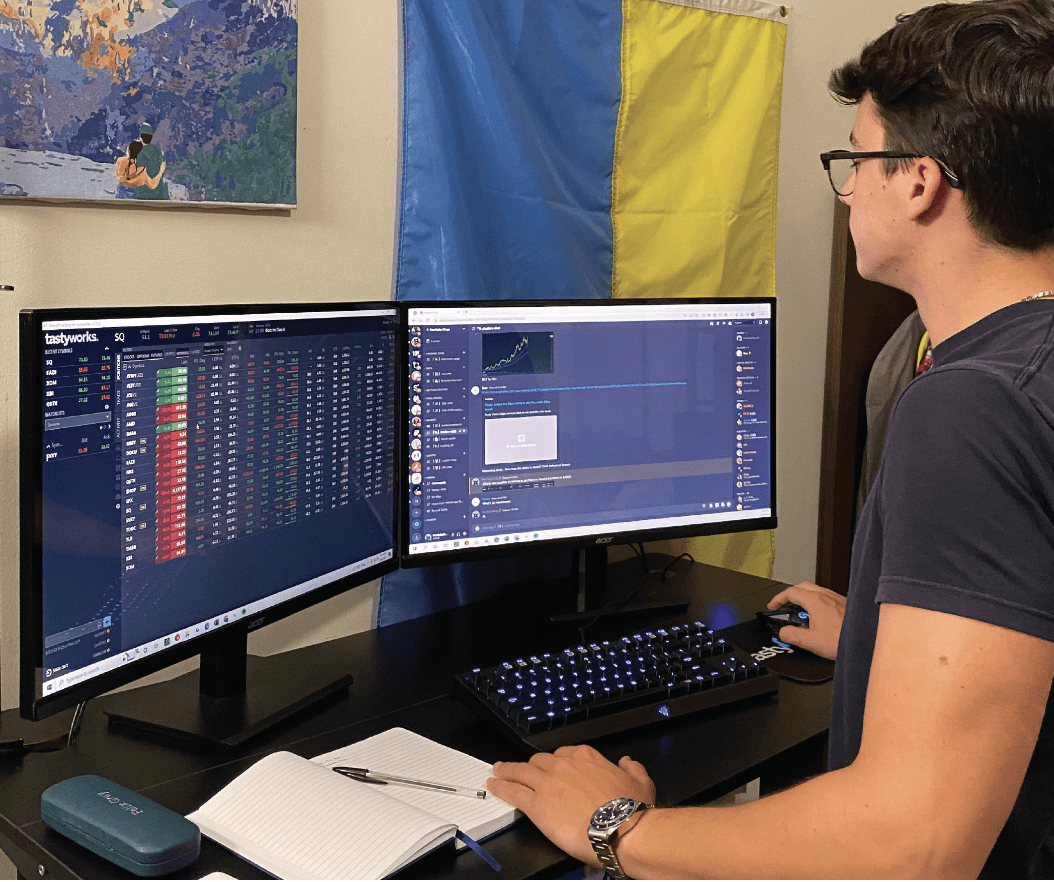

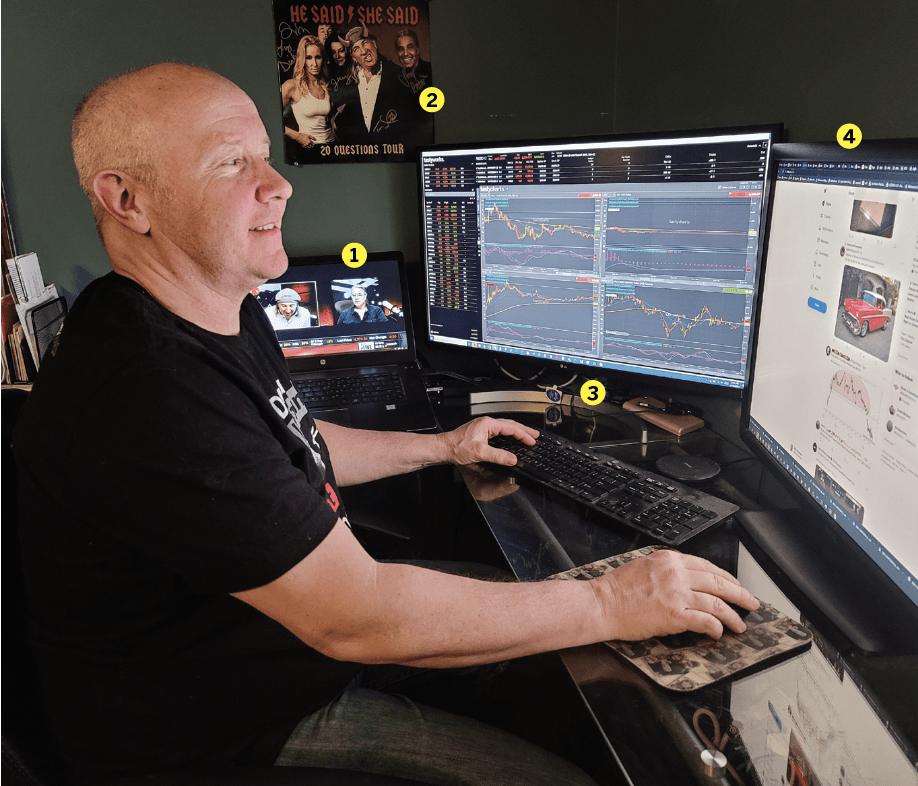

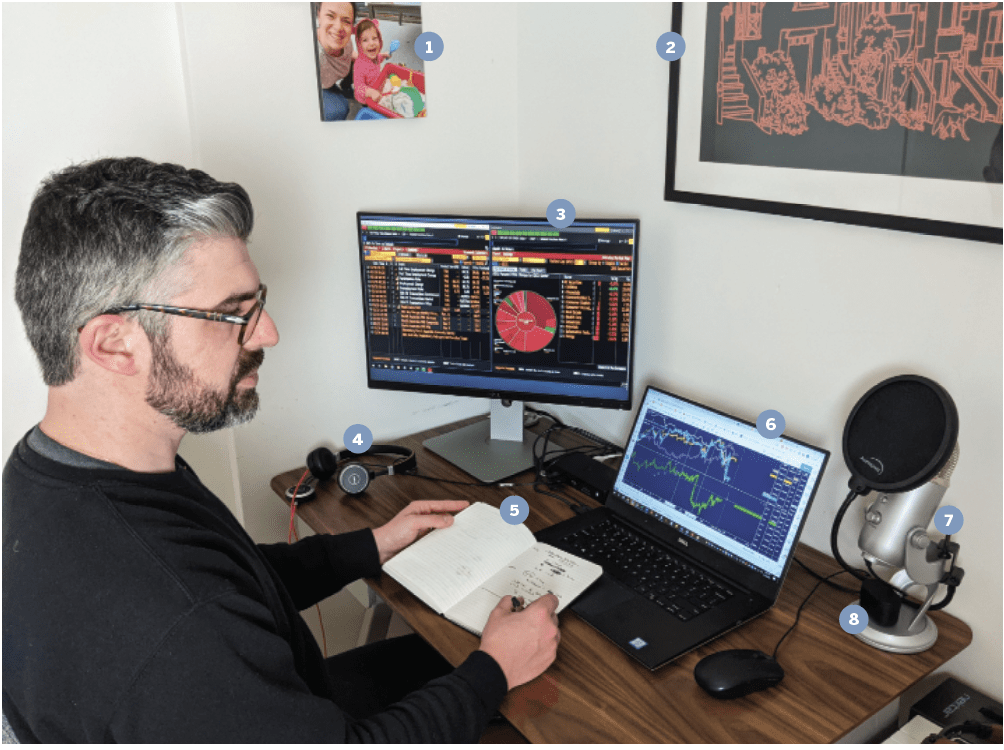

Azhar Mahmud Pasha, 54

Meridian, Mississippi

Years trading: 4

Physician-trader Azhar Mahmud Pasha, formerly of the Pakistani city of Hasan Abdal, once lost $4 million in a devastating market drop. But he doubled down against all advice and deposited $10 million more in his trading account.

No stranger to loss and pain, he an extensive history, including as an anesthesiologist and a interventional Pain Physician by training. He grew up in Pakistan and was actually trading stocks during his time in Medical school with his scholarship money. He ended up doing some trading for my friends during that time we made a little bit of money .

“We used to have to check the quotes in the newspaper the next day I used to go to the Lahore stock exchange to hang out I was bitten by the bug,” Pasha says.

“I came to the United States in 1995 and I finished my training in 2003 and I’ve been in an independent interventional pain and anesthesia practice. Since then I’ve been successful professionally and I was able to generate extra capital so I could use that to be an entrepreneur and do a lot of other business ventures,” he says.

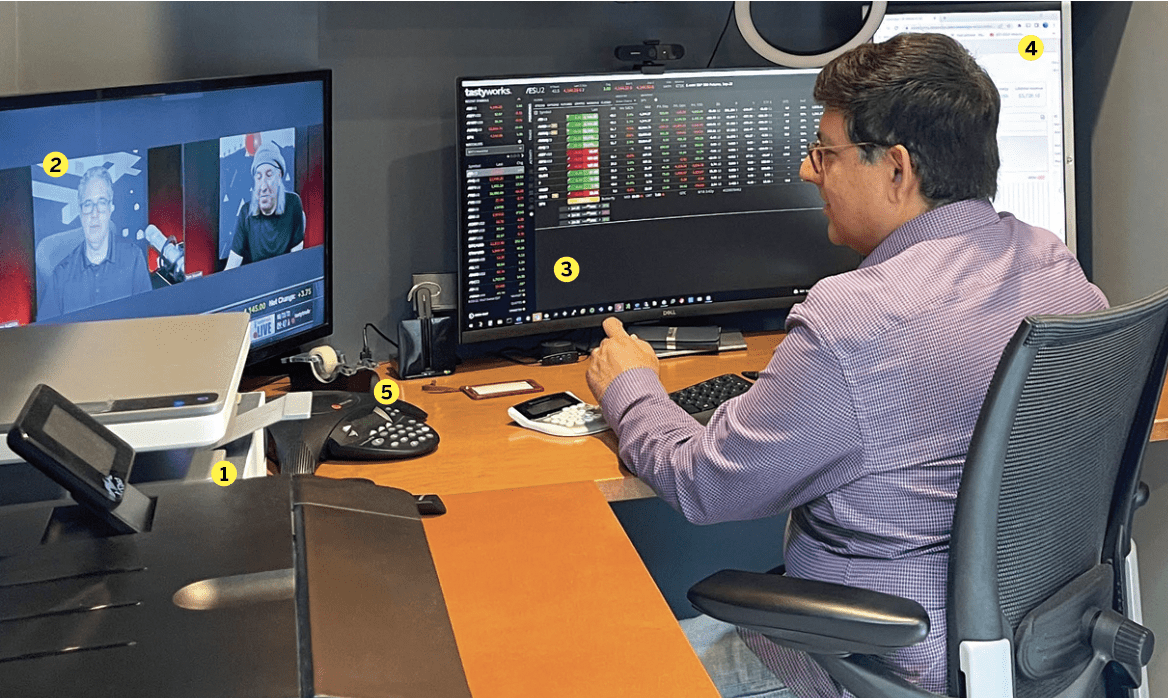

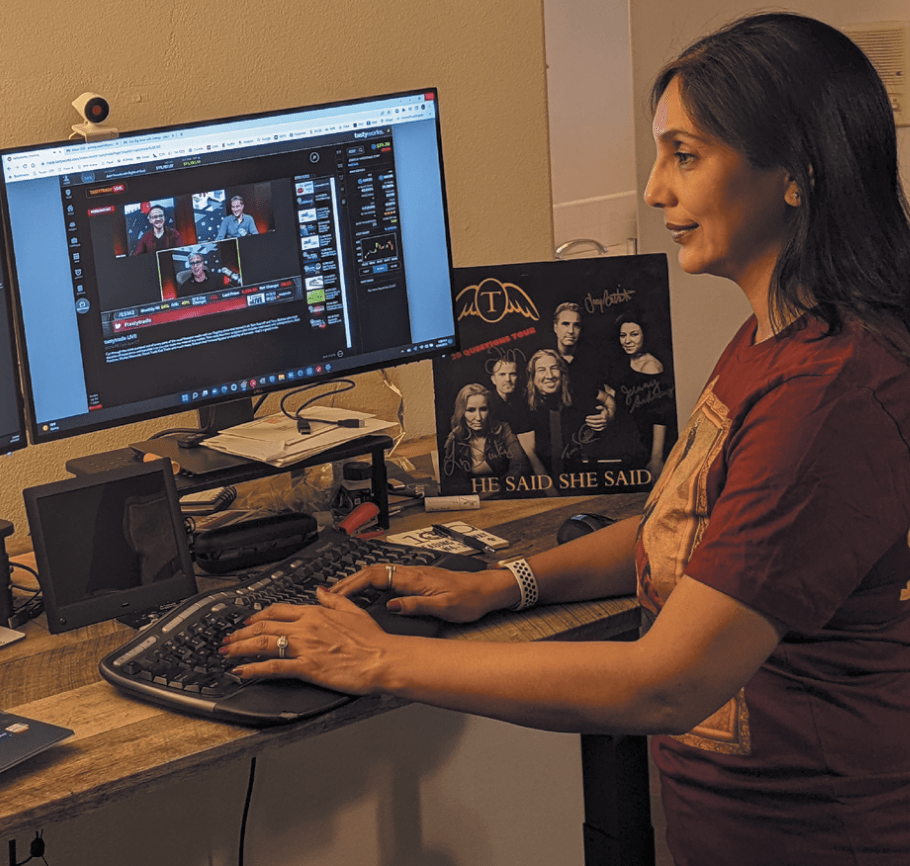

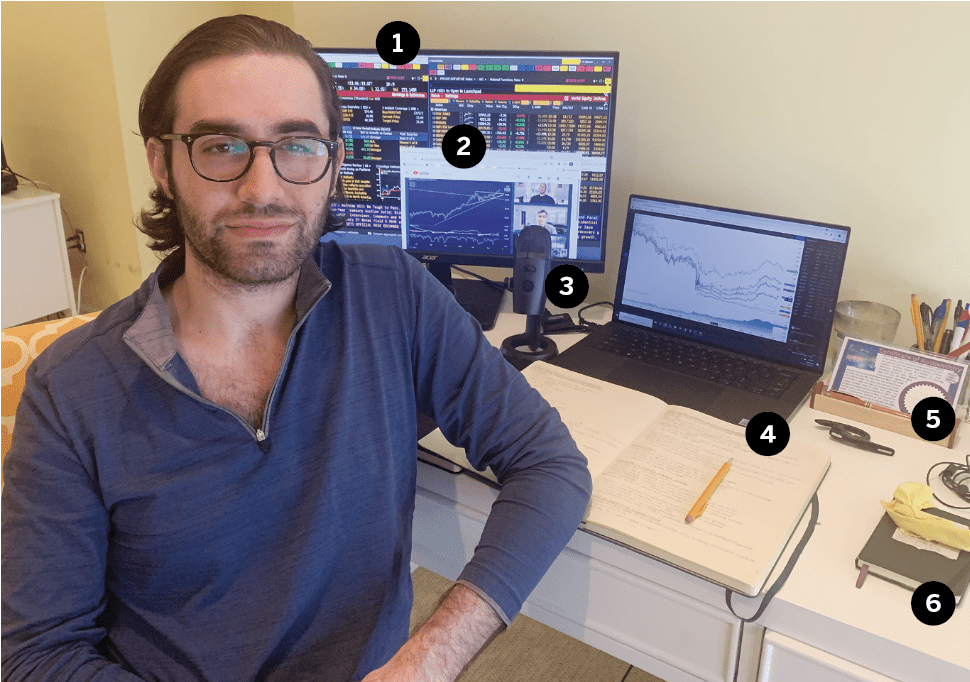

He started trading options in early 2021 and I was able to get started using some of the tastytrade education that he found on the tastylive channel and on YouTube and he had initial success like some retail traders typical do at first.

“Then unfortunately in 2022 when the market went down, I had a big drawdown however I was able to persevere and learn from my mistakes so to speak, and I have had a 30% positive returns in 2023 and 2024,” he says.

NOw he’s energized to move forward in 2025 he says he’s done better with trading in the last two years than he did in his medical practice. SO then he decided to liquidate and sell two of his car dealerships for a decent profit and was able to put all that capital into the stock market.

“I have some accounts at other platforms, but I am in the process of moving them to tastytrade and I’m considering retiring from my medical practice and will be starting a Hedge fund managing my own capital and some of my family and friend’s capital as well,” he says.

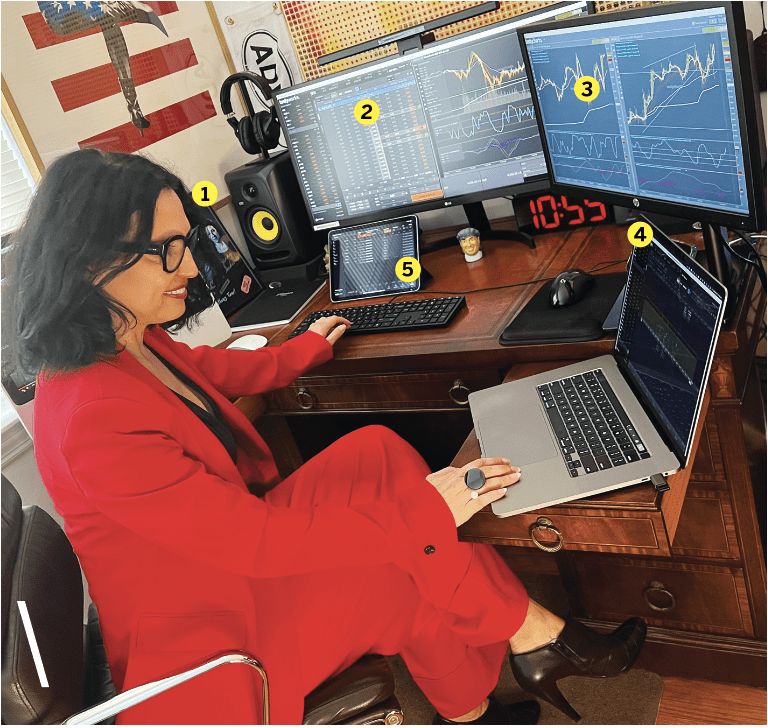

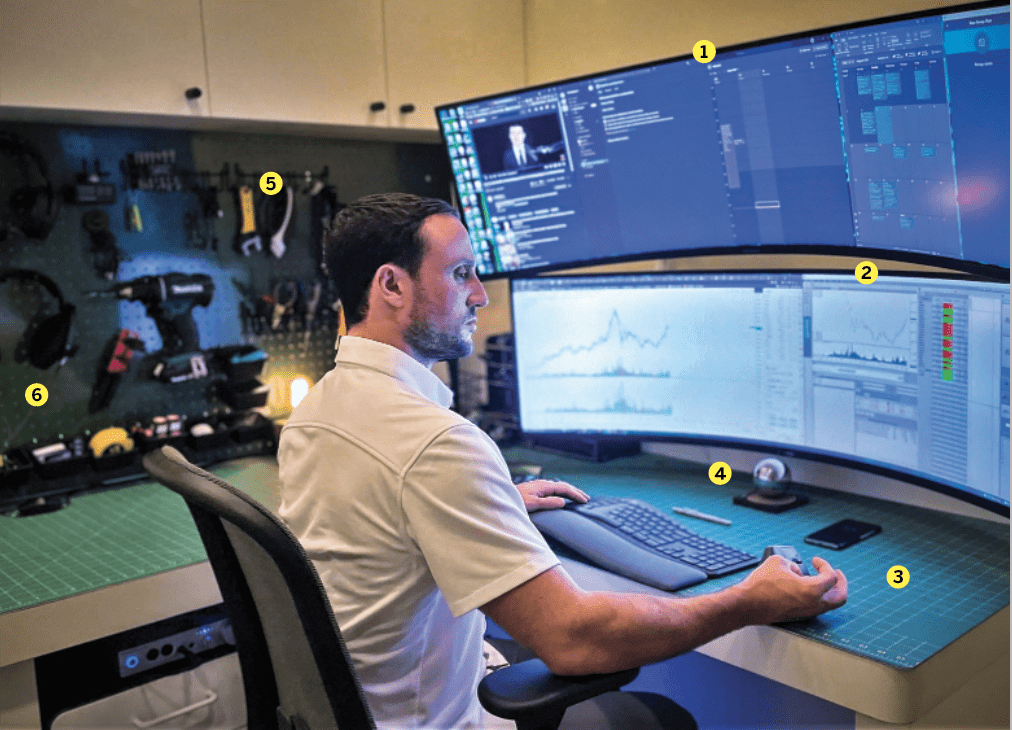

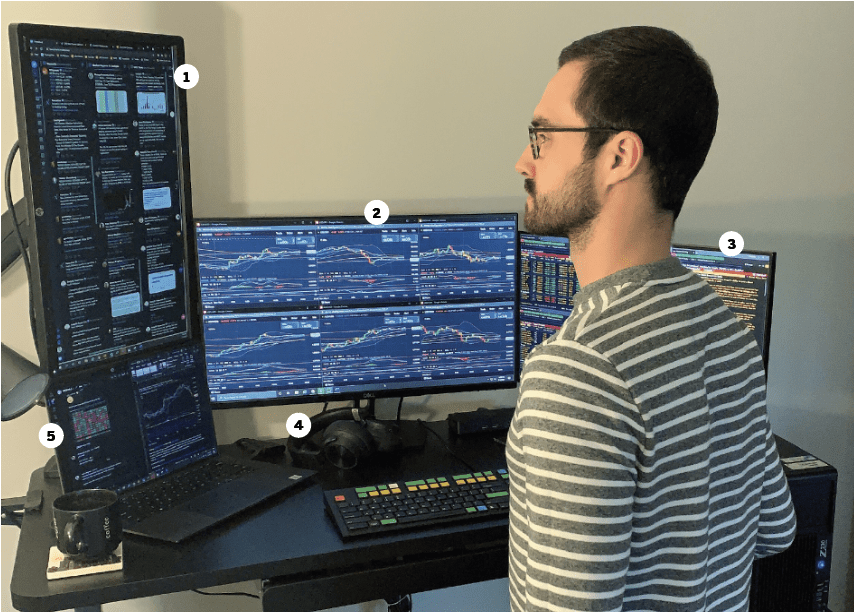

Currently, he’s managing 100+ positions with 60% in naked options and has generated 20%-40% annual returns while still practicing medicine full-time. Learn his approach to selling premium and why he believes market volatility creates the perfect trading opportunity.

He says his story is compelling because of ofthe risk-taking mentality of his personality. “I actually learned myself how to fly a plane as a challenge and and have multi engine and an instrument pilot rating and currently have on 14:00 hours and fly my M 600 Piper plane that I used to fly around the country for fun,” he says.

In the video below, Abdal describes how he transformed $2 million into a $24 million portfolio using primarily zero DTE options strategies.

How (and why) did you start trading?

I started stock trading in Pakistan in 1991 through 1995. Around 2005 I started buying some municipal bonds and using this for tax advantaged returns but it was too passive an investment for my personality. I started trading stocks and options in late 2021.

Favorite trading strategy?

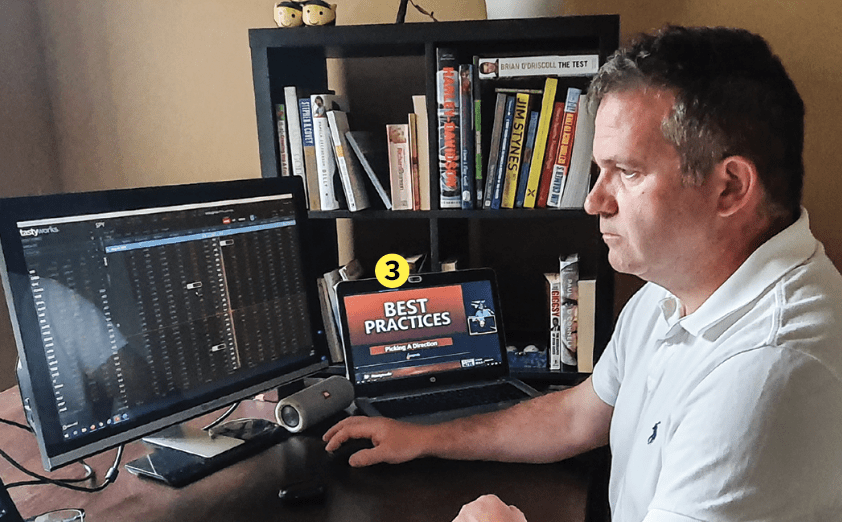

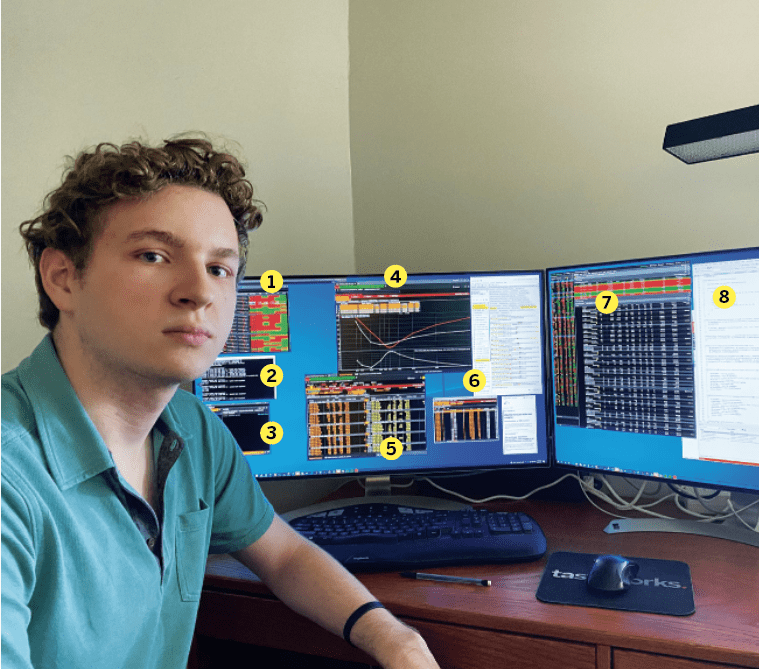

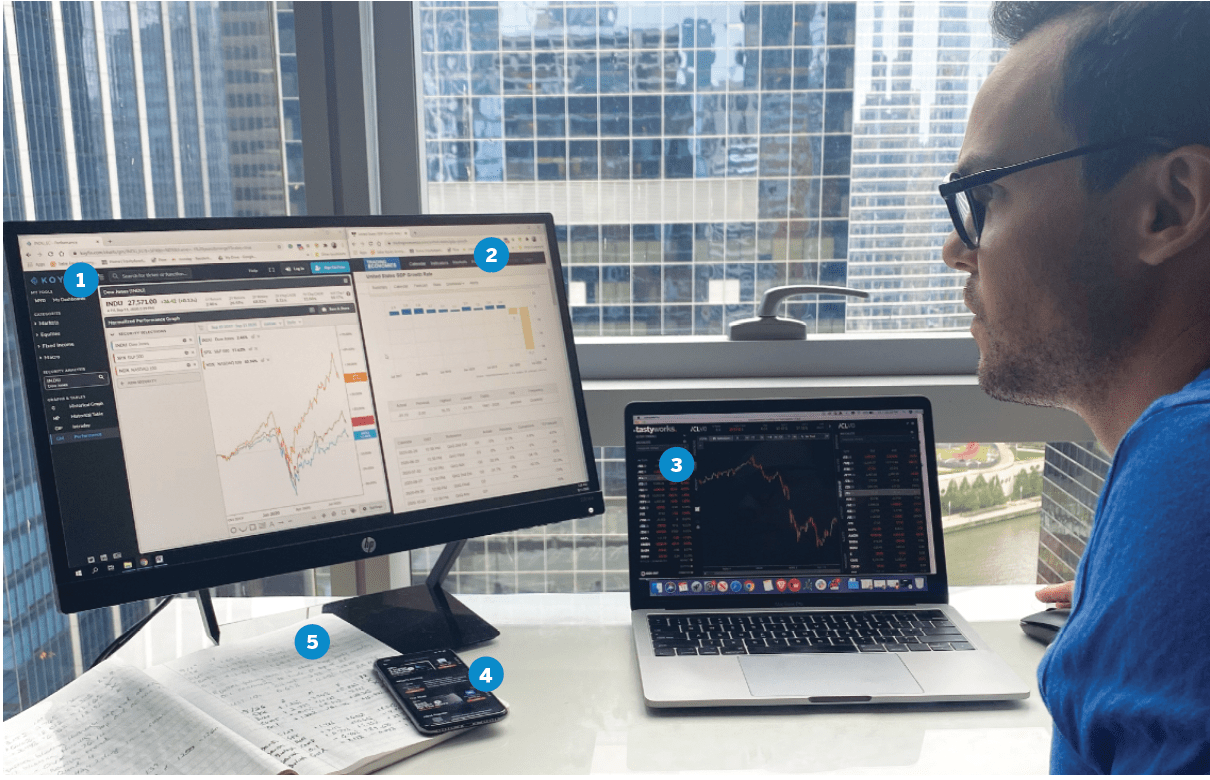

I follow some trades with the tastytrade plan for selling options 45 days out and managing at 21 days or sooner. I also use zero DTE SPX options with iron condors and call credit spreads, mainly selling premium.

Which financial instruments do you most frequently trade?

All liquid options, MAG 7 and SPX.

Tell us about your success as an active investor.

I have had 35% returns in 2023 and 2024. I had an initial 50% drawdown in August 2022, but luckily I had more significant capital to invest so I was able to bounce back from 2022 and continue my trading journey.

What was your worst trading moment?

Aug. 26, 2022. It was the Federal Reserve Jackson Hole summit and Jerome Powell gave his speech. I had an iron condor zero DTE on and after the speech I think market fell 3% and it kept falling for next week or so. It led to my biggest drawdown to my account.

Yesenia Duran — not an alien, not a zombie; just an editor.