Tax Tips for Traders

Some active traders—including side hustlers—may want to qualify for Trader Tax Status

Active investors can take advantage of “trader tax status” (TTS), an IRS designation that some accountants call “tax-loss insurance.” It enables traders who meet certain criteria to deduct all sorts of business expenses.

Consider an example of the potential savings. Suppose an active trader’s TTS business expenses and home office deductions add up to $20,000, and her federal and state tax bracket is 35%. Income tax savings would amount to about $7,000 annually.

The catch is it’s not always clear exactly who qualifies as an “active trader.” It’s encouraging that in some instances the IRS confers active-trader status on some busy side-hustle traders who still hold down a day job.

Yet it’s still not always easy to figure out who gets the tax break. Congress hasn’t passed a law with objective tests for eligibility, and the IRS rules can seem vague.

In the absence of clear definitions, interpretation of subjective case law has led to a two-part test to qualify. First, trading activity must be substantial, regular, frequent and continuous. Second, the trader must seek to catch swings in daily market movements and profit from short-term changes instead of generating income from holding investments long-term.

Those terms may seem authoritative, but perfectly reasonable stakeholders interpret them in wildly differing ways. Left in the lurch, IRS agents often refer to four factors to determine whether trading activity qualifies as a security-trading business.

The four criteria include the typical holding periods for securities bought and sold, the frequency and dollar amount of trades during the year, the extent the trader pursues the activity to produce income for a livelihood, and the amount of time the trader devotes to the activity.

Once again, the words “substantial, regular, frequent and continuous” aren’t precise. Case law doesn’t provide any exact numbers, either. Still, experienced accountants can begin to quantify the standards based on what they’ve discerned in courtroom trends. Call them the “Golden Rules.”

Golden Rules

Let’s begin with the big three requirements that the IRS can verify more easily than other qualifications:

Volume: Making 720 trades a year (two per day) appears to qualify a trader as active. The buy and sell count as two trades. That amounts to about four trades per day, close to four days per week. It’s 15 trades per week and 60 trades a month.

Frequency: To prevent the IRS from challenging a TTS claim, it’s wise to trade nearly four days per week or 75% of available trading days. Court cases have denied TTS with a 50% frequency.

Holding period: Active traders make mostly day trades or swing trades. The IRS has named the holding period as the most critical factor and has said the average holding period must not exceed 31 days.

The IRS can verify volume, frequency and holding period with some accuracy, but encounters more difficulty with the following factors:

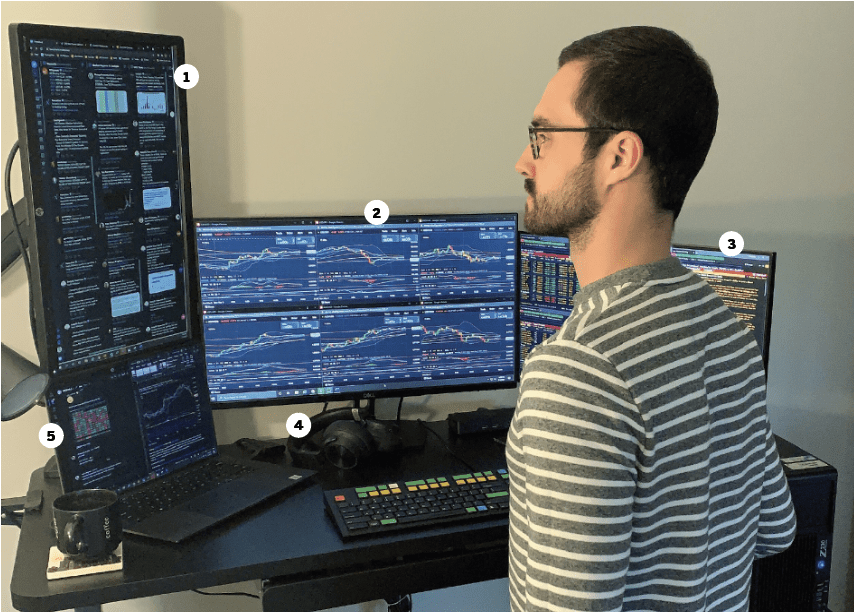

Hours: To qualify as active, traders must spend more than four hours a day, almost every market day, working on trades. All trading activity counts, including the execution of trade orders, research, administration, accounting, education, travel and meetings.

Lapses: Active traders seldom stop trading for extended periods during the year but can take vacations, sick time and personal time off.

Intention: Traders should plan to run their market activities as a business and make a living—but not necessarily as a primary means of making a living.

Operations: Requirements for TTS include having business equipment, using business services and operating from a distinct office. Active traders tend to have monitors, computers, mobile devices, cloud services, trading services, subscriptions, education expenses, high-speed broadband, wireless and a home office.

Account size: Active traders may consider having $25,000 on deposit with a U.S.-based broker to achieve “pattern day trader” status. Accountants prefer clients have more than $15,000 available for trading other financial instruments.

Robert A. Green serves as managing member of GNM, a CPA firm focused on traders, CEO of greentradertax.com.