Kalshi: The Exchange for Everything

Investing in the outcome of events is nothing new, but this federally regulated events exchange is

Longtime Luckbox readers are well aware of the educational and financial benefits of reliable forecasting. From the political prediction markets of PredictIt to the leaderboards of Good Judgment Open, bragging rights and profits abound for those with a prophetic edge.

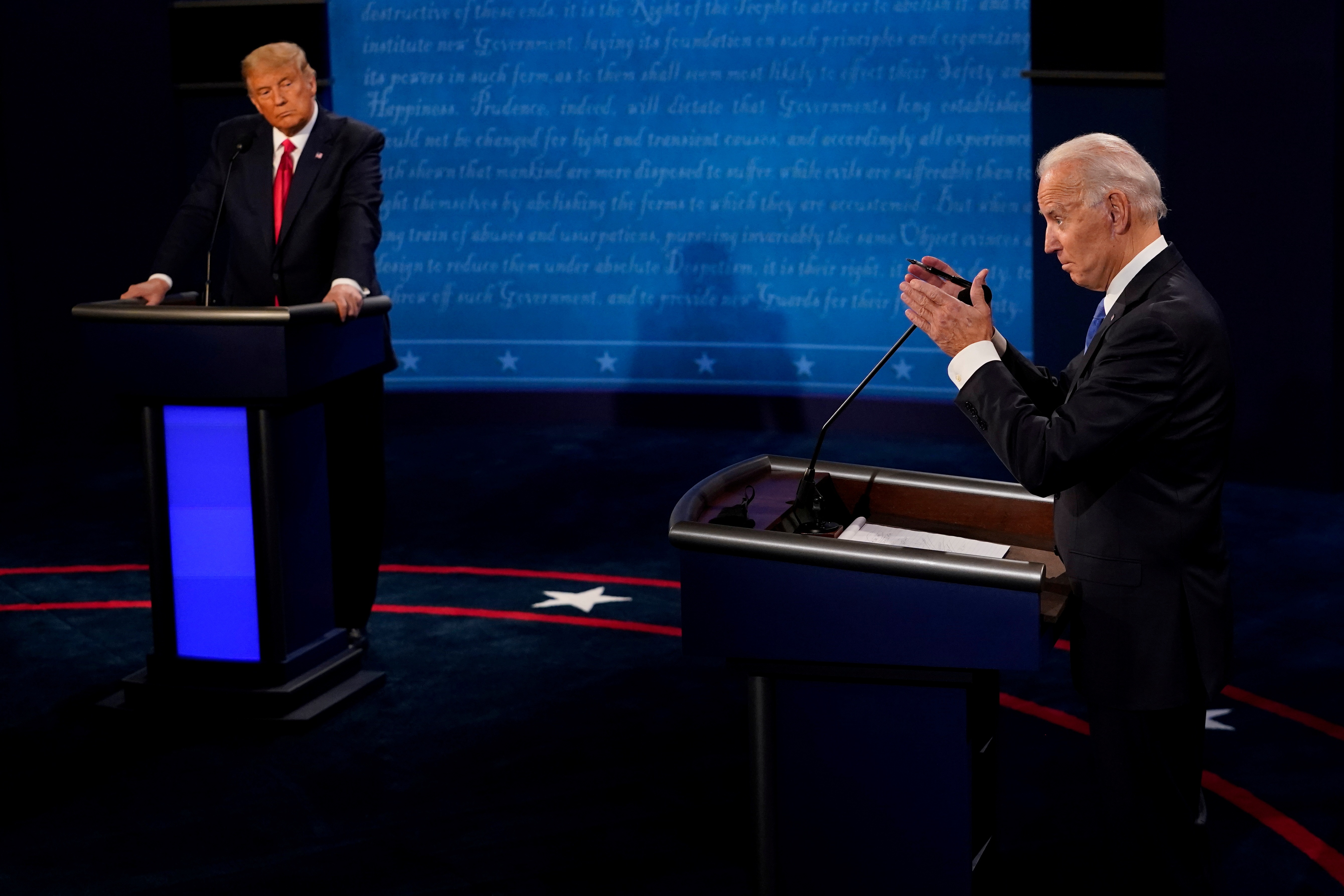

But exceptional seers often face challenges when attempting to turn prognostication into full-blown occupations—or merely a consistent source of supplemental income. In return for unhindered operation, prediction markets in the United States are typically constrained by strict regulatory no-action letters that, among other drawbacks, drastically limit traders’ bet sizes and therefore their potential profits.

The political prediction market PredictIt, for instance, must adhere to a 5,000-trader limit on any given contract within a market, and each trader may invest no more than $850 per contract.

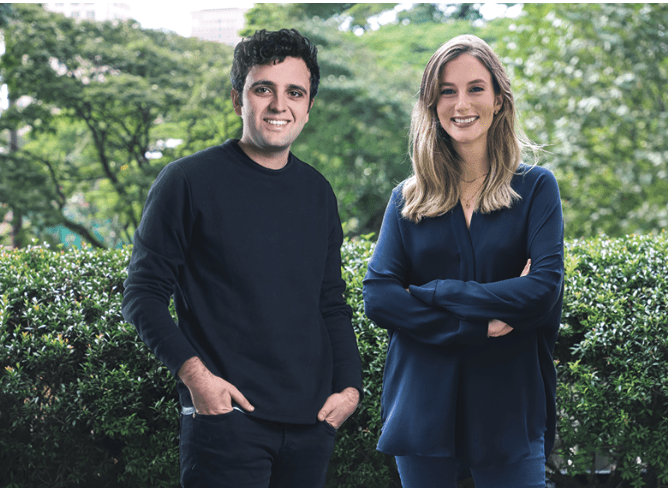

The predictive landscape is changing, however, thanks to two recent MIT grads. Tarek Mansour and Luana Lopes Lara co-founded the first-ever federally regulated events exchange in Kalshi, which derives its name from a similar pronunciation of the word “everything” in Arabic.

After a long and challenging two-and-a-half-year approval process with the Commodity Futures Trading Commission, Kalshi officially launched in public beta this July. And as the close Arabic translation of its name implies, Kalshi’s market topics transcend just politics.

“The beta, we think of it as a ramp-up period as we’re getting all these pieces of the puzzle running together,” Mansour said on the Luckbox podcast The Prediction Trade. “But this is real. This is real trading—it’s open for anyone now.”

Think a recession will hit thisyear? There’s a market for that. Will it rain in Seattle on Friday? There’s a market for that, too.

Visitors to the exchange are met with broad market categories spanning climate, economics, world events, COVID-19, politics, transportation and even entertainment. Think a recession will hit this year? There’s a market for that. Will it rain in Seattle on Friday? There’s a market for that, too.

“This is just the beginning,” Lopes Lara noted. “We’re going to expand a lot from the contracts that are currently there.”

At press time, 40 markets were active with trading volume on Kalshi. The exchange operates with a self-imposed downside exposure limit, or the most one could lose, of $25,000 per market. And that limit, Mansour said, will be increasing over time.

Also likely to increase are Kalshi’s trading hours. The exchange currently operates from 8 a.m. to 10 p.m. Eastern Time seven days a week, already a novelty among equities markets. But the goal, according to the co-founders, is to get as close to 24 hours—minus regular maintenance time—as possible.

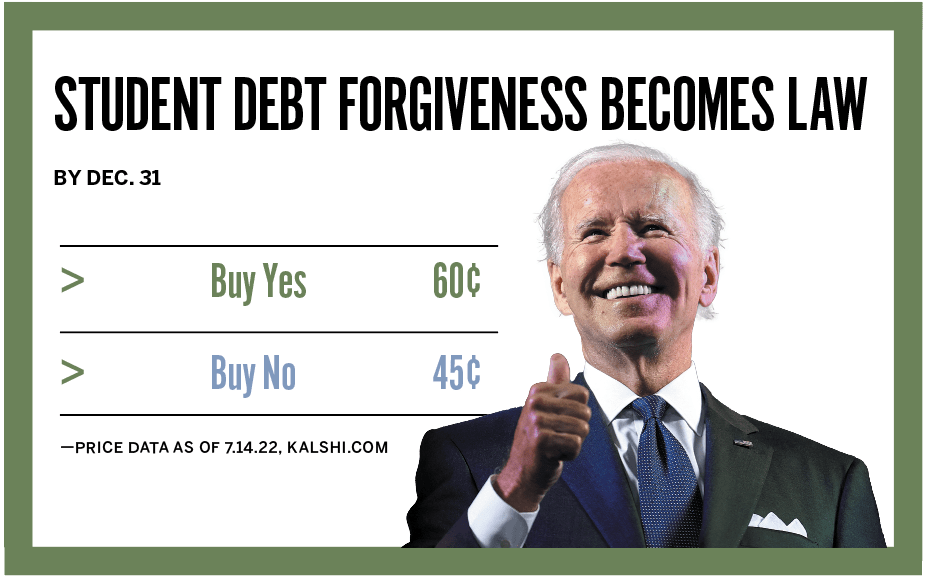

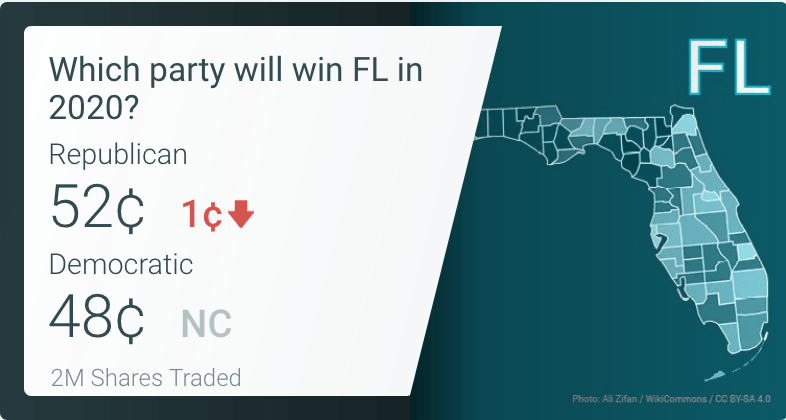

Presently, all of Kalshi’s markets are structured like binary options, meaning traders invest in either “Yes” or “No” shares to a market question. The share prices reflect market sentiment toward a given outcome and are valued at a fraction of a dollar.

After a result is determined and a market is settled, incorrect shares become worthless and correct shares pay out for a dollar—not including fees, which Mansour said average between 1% and 2%.

While it’s too early to tell what impact Kalshi will have on the field of professional forecasting, expectations by its founders are high. Event contracts, Mansour said, represent a new asset class more human and accessible than any that preceded it.

“People understand events,” he said. “They understand financials a little bit less so. And, for us, it’s the natural next step in this sort of continuum—one that can really bring in the masses, anyone, into trading on their interests.”