Business Forecasting Models

Combining related forecasting questions into clusters can reveal bigger-picture insights for businesses and industries

Forecasting is an essential part of business. Companies use historical data and economic trends to make informed estimates of future sales, profits and losses.

Amazon (AMZN) and Google (GOOGL) rely on predictive algorithms to highlight specific products or search results for their customers. Shopkeepers arrange their display windows based on their predictions of demand. Some of the forecasting is narrow and company-specific. The more challenging part has to do with broader questions, such as overall market outlook.

Consider this question: What will market conditions look like after the pandemic?

That question is of great relevance to any business decision-maker, but it’s so broad that it could be approached from many different angles, using multiple definitions.

“Market conditions,” for instance, involves multiple factors, from industry-specific trends and interest rates to consumer spending and supply chains. How do we intend to measure this? What time frame are we looking at?

Much more tractable is a narrower question: On Jan. 31, 2022, what will be the average U.S. tariff rate on imports from China? But in checking all the boxes to craft a rigorous question, narrow topics may lose their relevance to decision-makers trying to determine the prospects for their business down the line. This is the rigor-relevance trade-off.

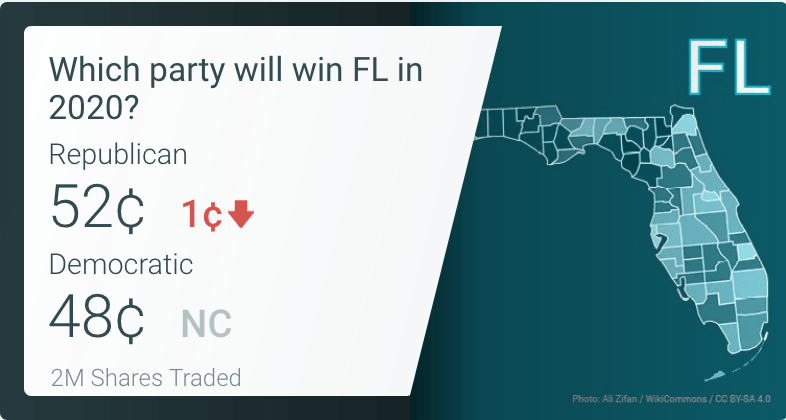

To tackle the relevant strategic questions that decision-makers ask with the rigor that accurate forecasting requires, Good Judgment crafts sets of questions about discrete events that, in combination, shed light on a broader topic. Good Judgment calls this technique “question clusters.” Good clusters will examine the strategic question from multiple perspectives—political, economic, financial, security and informational. These days, a public health perspective is also usually worthwhile.

Aggregating the probabilities that the Superforecasters assign to such specific questions generates a comprehensive forecast about the strategic question, as well as early warnings about the deeper geopolitical or business trends underway.

The Good Judgment team developed this method in a research study sponsored and validated by the

U.S. Intelligence Advanced Research Projects Activity from 2011 to 2015, where the Superforecasters outperformed the collective forecasts of intelligence analysts in the U.S. government by 30%.

Since then, the Superforecasters have refined and expanded their approach to evaluate emerging consumer trends, inform product development and understand the factors driving commodity markets.

As an example, in a question cluster forecasting the technological landscape, the Superforecasters estimate emerging trends in electric car sales, hydrogen-fueled vehicles, the growth of Starlink services and social media regulation, among others.

Independently, these forecasts are crucial for some companies and investors and informative for the discerning public. Taken together, they point to trends that are shaping the future of the business world.

The same technique can be applied to Amazon. The traditional approach of security analysts is to build a fixed model that predicts valuation based on dividends, cash flow and other objective metrics. A question cluster approach can uncover critical subjective variables and quantify them—such as the risk of a regulatory crackdown or shifts in labor relations—to make the analyst’s model more robust.

“In business, good forecasting can be the difference between prosperity and bankruptcy,” says co-founder of Good Judgment Philip Tetlock. Successful businesses rely on forecasting to make better decisions. Using clusters of interrelated questions is one way to ensure those forecasts are both rigorous and relevant.

Boost forecasting accuracy with Good Judgment’s Online Training

Based on the book Superforecasting by Phil Tetlock, this course is designed for people who want to improve their forecasting accuracy using scientifically validated methods and Good Judgment’s practical expertise. The course provides a solid foundation for novice forecasters in such fields as finance, strategy and consulting.

Special for Luckbox readers: Use code Luckbox20 at checkout on goodjudgment.com for 20% off.

Warren Hatch, a former Wall Street investor, is CEO of Good Judgment Inc, a commercial enterprise that provides forecasts and forecasting training based on the expertise and research of the Good Judgment Project. @wfrhatch