Trading on Trump’s Tweets

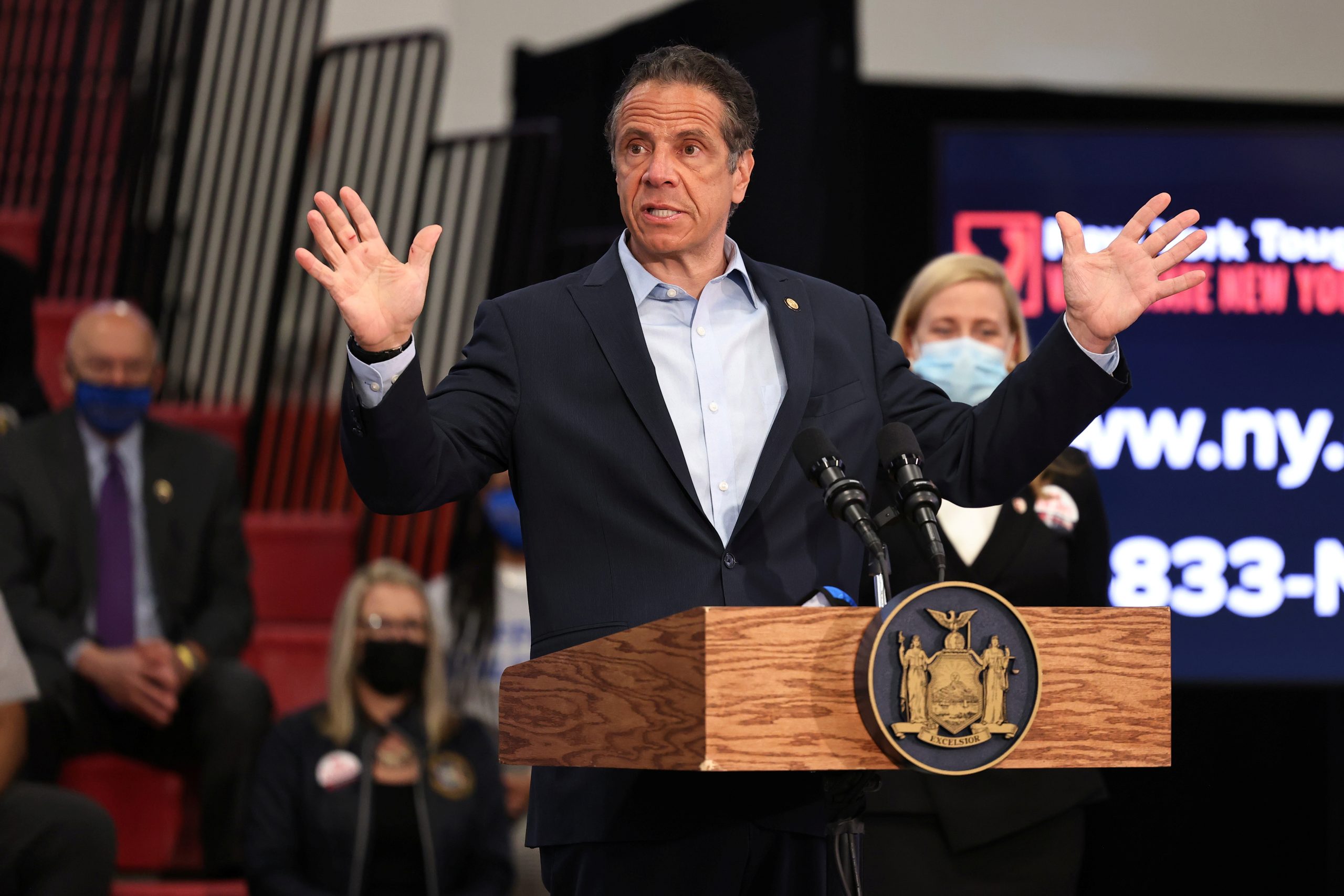

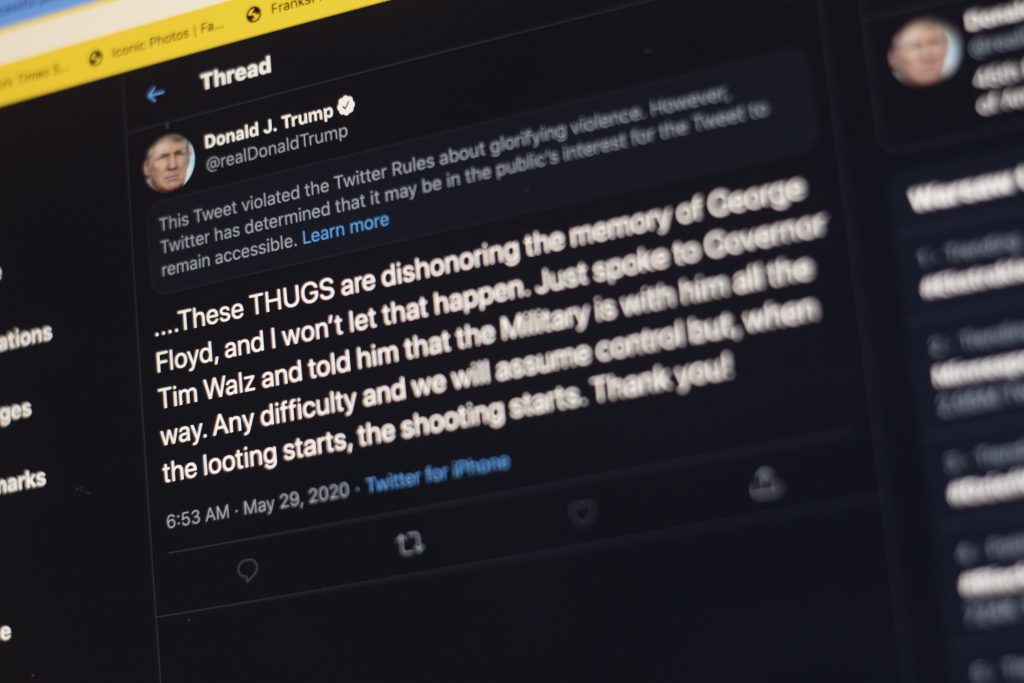

Twitter found itself in the media spotlight after President Donald Trump last Thursday signed an executive order targeting social media platforms and their protections under Section 230 of the Communications Decency Act.

The act, explored in depth in a previous Luckbox book review, protects companies such as Twitter and Facebook from being held liable for content published by users of the platforms, but after Twitter labeled two of Trump’s tweets as “potentially misleading,” the President fired off that “big action” would follow.

Twitter has now shown that everything we have been saying about them (and their other compatriots) is correct. Big action to follow!

— Donald J. Trump (@realDonaldTrump) May 27, 2020

At the order’s signing, Trump argued censorship and bias signaled social media companies were not neutral platforms, thus not protected under Section 230. He later doubled down, tweeting, “Section 230 should be revoked by Congress. Until then, it will be regulated!”

Twitter is doing nothing about all of the lies & propaganda being put out by China or the Radical Left Democrat Party. They have targeted Republicans, Conservatives & the President of the United States. Section 230 should be revoked by Congress. Until then, it will be regulated!

— Donald J. Trump (@realDonaldTrump) May 29, 2020

Despite criticisms that the executive order is political theater, and that the Federal Communications Commission would be unlikely to do much in response to it, some looked upon the spectacle as an opportunity, particularly those with their eyes on the tweet markets on prediction market platform predictit.org.

The tweet markets on PredictIt aim to forecast how many tweets will be published under the @realDonaldTrump, @POTUS and @WhiteHouse Twitter handles in a given week. Big news events, such as the signing of an executive order, have a tendency to dramatically move the markets, some predictors say.

In Episode 15 of Luckbox’s The Political Trade podcast, super trader and Luckbox columnist Derek Phillips explains how the tweet markets work, how to strategize forecasts in them, and how to profit from them.

Below is a lightly edited transcript of the episode.

Jeff Well, Derek, we want to start by recognizing that it’s been a while since you’ve been on with us. You were on episodes, I think, five and six with us, I believe. As I said, you beat James Carville, in fact, as being the most-listened-to episode of The Political Trade, but we will.

Derek And Scaramucci, too, I take it.

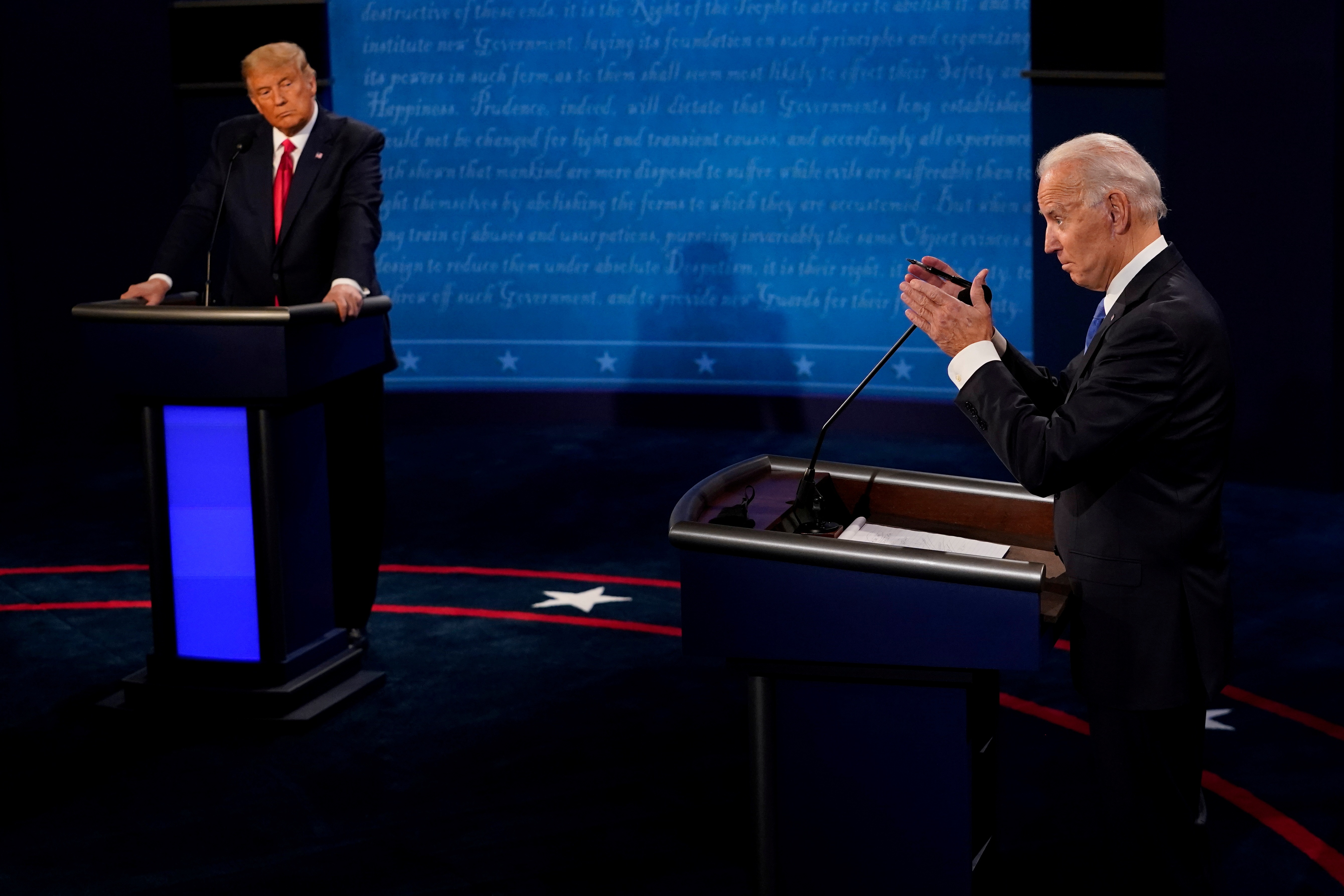

Jeff That’s right Scaramucci and Carville. That’s correct. So we were looking back at some of the reasons for why and a lot of it has to do with your trading prowess. Of course you’re certainly among the most credible traders in the prediction market universe today. And we wanted to look over some of your last recommendations to our audience. So we took a look. In your most recent appearance on episode six, you ring the bell for us when we asked who will win the 2020 Oregon Democratic primary. You had a pound-the-table bell-ringing NO on Bernie and a YES on Joe. It was a trade that resolved very well for you. At the time, Biden was trading for around 80 cents. And he ultimately won, of course, and Biden got 67% of the vote to Bernie’s 20%. So that was a nice margin, a nice, great return on a high-probability outcome based on what the actual results were.

Derek Yeah, there were kind of a lot of those hanging around at the time where people just didn’t know what was going to happen with the primaries, whether they would get canceled whether, and this was, you know, kind of ridiculous looking back, whether Joe Biden would drop out, and there were just opportunities all across the board to pick up 10 cents here, 15 cents there. I think Oregon was the most juicy, but if you invested a lot of money in Joe Biden to win those primaries, chances are you walked out with a pretty good profit.

Jeff You also had another recommendation in that same episode, which was to the market “Will there be a recession in Trump’s first term?” You liked the YES shares, and at that point they were trading around 80 cents. That market is still open and it’s still available for traders. YES shares are trading around 96 cents today, which of course 96 cents means a 96% probability of that outcome occurring, according to the constituents of traders on the prediction market platform. Is that what we’d call a lockbox to pick up those remaining four cents?

Derek Yeah, it feels like it. I think a lot of the time, with markets like those, you just get people that want to cash out—people who think that the four cents that they’re giving up is worth not having to wait for the market to pay out. I don’t know if PredictIt can resolve that one early, but I guess people just don’t want to tie up their money until the end of the year, and they’re giving you a premium there. So I don’t see any problem taking the four cents. I think the probability of it happening is virtually guaranteed. But then again, you know, if liquidity is an issue for you, it’s probably better just to stay out of it and to use your money on markets where, you know, you can get a better return.

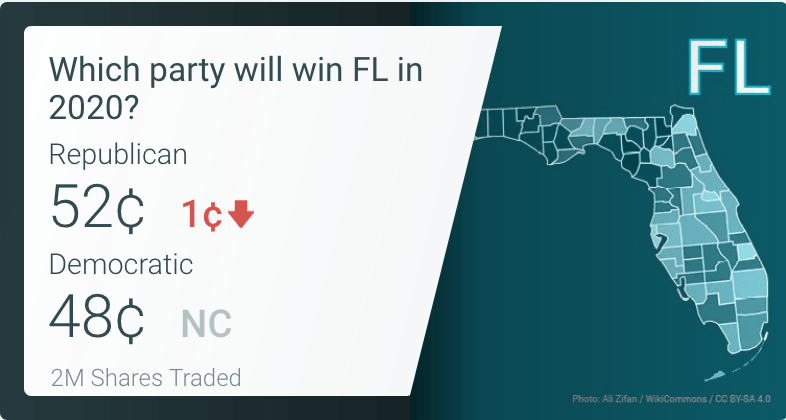

Jeff And that’s a reminder to our listeners when we speak of the prediction markets they’re quoted in pennies, which range from one to 99 cents. And those pennies also reflect the probability of what the market thinks that outcome might be. So if Joe Biden is 52 cents to win the presidency, the markets say there’s a 52% probability of that outcome, and you can hold it until the November election to win that dollar if you are correct, or you can trade it anytime between now and then. And that’s what much of the trading volume on PredictIt is, it’s traders making trades long prior to the contract expiration so you have both the long tail opportunity of holding an investment until it resolves, or you can trade in and out on a daily basis. Perhaps on an hourly basis, which is something you once discussed with us as well, so that trade’s still open, and it was a good position of yours. Another trade you mentioned in that last episode was which party will win Minnesota in the general election? And you had a YES on the Democrats that was trading around 75 cents then. It still is today. Prices have fluctuated a little bit. Prices were as high as 83 cents, but it’s still around 70 cents, 75 cents today. What’s your position, any update to that?

Derek Yeah, I think when I first suggested that as a good opportunity, I said that it’s one of those positions that you can take where you’re kind of on a free roll. So if Joe Biden picks Amy Klobuchar to be his vice presidential nominee, then you’re virtually guaranteed to win that contract. It doesn’t look like, in my opinion, Amy Klobuchar is really running anymore. And I’m sure we’ll talk about that at some point. And I know that a lot of people disagree with me. So that part of the bet is not something that I am super excited about anymore. However, I do think there’s more than a—I think there’s more than a 75% chance that Biden still wins Minnesota. So I still am comfortable making that bet. But it’s the kind of a bet that’s changed, since Klobuchar is kind of faded in the VP stakes.

Jeff And that’s worthy of note, that’s a pretty impressive record on just those three recommendations alone, that they’re either profitable or hanging in there with no losses to record anywhere. So thanks for the update on Minnesota, and when we get to the trade segment at the end of the episode where you are going to share your best trades with us, I know we’re talking about the VP market. So we’ll revisit that. And in our second segment, we’re going to, in our tactics segment, where we ask our super trader to kind of share something that is a method of trading that accounts for much of their trading profit and their disciplined approach, I know you’re going to speak about the tweet markets, but there is some news worthy of talking about right now. Earlier this morning, the President signaled via Twitter, ironically, that fairness was coming. That was the theme of one of his tweets here earlier this morning. He was using the meme of Game of Thrones. But what he was speaking to is the fact that Trump intends to write an executive order today that would essentially roll back the liability protections that are enjoyed by tech companies under what’s referred to as Section 230 of the Communications Decency Act, something we’ve actually written about at Luckbox Magazine in the past. Section 230 of the Communication Decency Act is what provides broad immunity to websites that curate and moderate their own platforms, and it’s been described by legal experts as the 26 words, you’re going to hear that phrase a lot over the next couple of days, the 26 words that created the internet. And essentially those 26 words are “No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider,” which essentially comes to mean that, with exceptions, websites and internet service providers are not liable for the content that they post, regardless of the accuracy or how incendiary that content might be or how vile or even if it includes hate speech. So that’s going to happen today. We haven’t seen it. We’ve been watching closely because it does impact the tweet markets that we’re going to be talking about. The expected order prompted Facebook CEO Mark Zuckerberg and Twitter CEO Jack Dorsey to somewhat come to odds with each other because they, they come forward to reiterate their differing approaches to freedom of speech. Of course Zukerberg said, somewhat famously not too long ago, that he doesn’t plan on engaging in fact checking of political ads. Whereas Jack Dorsey, within the last couple days actually did fact check one of President Trump’s tweets, which is what has, has brought this event to end this likely executive order coming later today to this point. So all of this obviously has some impact on a really important market, which is the tweet market, which I know we’re going to be talking about in the tactics section as to how you actually approach that market. But what’s your overall thought on this and how it might influence the volume and activity of the tweet markets and PredictIt going forward.

Derek So I kind of read this a bit as a publicity stunt, as a means of getting more people to pay attention to, to his tweets and as a means of getting people to take sides in the sort of war that he’s having with the technology companies. So I think it’s going to help PredictIt. I think it’s going to bring people in to talk about the tweets in the comment board. And then, hopefully, you know, when they’re going to talk about it, they’ll maybe spend a little bit of money as well.

Jeff Well not to take anything for granted. And just step back for a moment. The tweet markets on Predictit.org are a fascinating market because what you’re actually wagering on as the investor or the trader, or the gambler, is the amount of tweets—those three different handles that the President uses and tweets on—how many tweets that he’ll post in the course of a week. And the way those markets are structured is that question: How many tweets will @POTUS make from this to this using a one week interval. And there’s typically, is it nine brackets I believe?

Derek Nine. It’s nine now, it used to be seven.

Jeff Typically nine brackets, and the brackets then would be what investors might refer to as a tranche. It would be a series of numbers. So it might be from 100 to 110 tweets would be bracket number one, 110 to 120 bracket number two. And so you have these nine different brackets where you’re betting on where the final count ends up. And that determines how the market resolves. And there’s a whole strategy that you’re going to be sharing with us in the next segment. But I guess what this news event on this executive order, which ironically, is going to be arbitrated most likely on Twitter, and this and other news events, like what the nation is going through, particularly in Minneapolis with the the appalling and tragic death of George Floyd and some of the subsequent protests and riots that have occurred in the state since all these primary news events contribute to tweet activity. So how do you use that? How do you calibrate that? What would be an example of a primary news event, and if you know it’s coming, how do you use that to calibrate and to extrapolate what you believe tweet activity is going to be and then of course use that to your advantage in wagering in those markets?

Derek We actually just had one of these events yesterday, and it was the launch and then, well, the scheduled launch and then the scrubbing of the SpaceX rocket down in Florida. Those of us who have been trading in the tweet markets for a while have known that when there are events like this, a lot of people in the administration get really excited. Mike Pence in particular, the White House Twitter account will be retweeting a lot of the tweets coming out of NASA and the NASA director’s Twitter account, all of these tweets are kind of coming over onto the main feed of the White House. So when the schedule came out, or even before then, when we found out that the President was going down to Florida for the launch itself and that he’d be giving remarks and touring the facility, when we knew that, it was a big deal. We knew that there would be, you know, maybe 40 to 60 tweets coming out of it. So the smart players were able to buy the lower brackets, the ones that suggested that the account would be tweeting a lot for a cheap price on the night before. And then, you know, when those tweets started coming, we could sell for a good profit. And then when it was scrubbed because of weather, we were able to get into the lower brackets because it meant that those tweets would no longer be coming. The ones that we were expecting that Trump would be canceling his remarks that Mike Pence would be going home to Washington without going on a tour. And we just knew that the activity would be slowing down. So playing tweets a lot of the time is just knowing when there’s going to be activity, knowing when things change. We know how to kind of respond in the tweet market before others do and to, you know, capitalize on that sort of activity.

Jeff I want to accentuate the importance of this discussion because to some new listeners, this may sound a little obtuse speaking about these, the tweet markets, but you have, as we’ve mentioned earlier, famously shown extraordinary profit as a result of your participation in prediction market trading over the last four years, we wrote about it, we had an episode about it. It’s one of the reasons you’re the most listened to of our guests in terms of the amount of money that you’ve accumulated as a result of successful trading. And from a prior conversation you and I had, I know that the tweet markets, because they occur every week and there’s three different markets represents a significant portion of your overall earnings. So it means as a potential trader, in prediction markets, if you want to be positioned for the same opportunity that you’ve enjoyed, it’s a market that someone really needs to master so can you say a little bit more about that? Can you give us an idea of percentage wise, I’m sure it’s subject to fluctuation, but how much of your overall trading profits and revenue really would you assign to the tweet markets

Derek These days? Certainly after the primaries have ended, I would say I make about 80% of my weekly income from the tweet markets. I think, one time somebody at PredictIt mentioned that they consider the tweet markets to be sort of slot machines, you know, they’re the things at the front of the casino that just catch people’s eye when they come in. And that may be a good way of looking at it because you can get a huge return on investment in only a week. The winning bracket for the White House Twitter account, which ended this morning. The winning bracket was a 15% probability yesterday. So if you invested in it, if you invested, you know, $100 in that bracket yesterday, you would make… OK, I’m blanking on the math here…

Jeff Let’s say your $150 would be $1000.

Derek Okay, there you go. So $150 would be $1000. And you can make that every week if you choose the right bracket because at some point, the winning bracket is always going to be that low or, you know, most of the time it is at least. And there are three of these markets running every week. So you can really make a lot of money playing these markets. And you know, if you’re good at it, it can be pretty reliable as well.

Jeff And that’s really the reason that we’re emphasizing that market in this episode, because it’s such an important market in terms of trading volume and trader activity. And we’ll talk about that in a moment as well, but just the sheer opportunity it represents, and on a personal basis, you’re right, some of our other super trader guests have memorably referred to the tweet markets as the Wild West. And from my own personal story, I’ll tell you at the early outset, when Mike and I both started embarking on increasing our activity of trading as we know, went through this journey on this podcast as well. In a relatively short period of time I tripled my account value that I began with, and most of it through, let’s call it nickel flipping because I haven’t really developed a knack for penny flipping. So let’s say nickel flipping and negative risk for sure. Once we got our arms around negative risk, that became a significant portion of return. And then some 50/50 bets paid off well, that represent the bulk of my results in tripling my account in an early stage. But then I wandered into the tweet markets, and practically overnight through a series of horror stories I found myself back under my original starting point again. So I’m fascinated by the tweet markets for the simple reason, being a longtime student of games, Game Theory, probability games, math. I’ve developed expertise at bridge at backgammon, chess — tournament levels in those games that rely on math and probability. It is clear to me from my participation and my losses recently in the tweet markets, that once you master this, and these are all masterable, and you clearly have, based on projecting that 80% of your profits coming out of tweet markets that it is something you can master and that’s why I’m excited about our next segment. When we come back, you know, in every episode, we ask our expert traders to share and explain the trading tactic that they rely upon for the returns. But we’re gonna focus on the tweet markets again, it’s represented 80% of your income. It is the Wild West, but they can be mastered, and we’re going to be right back and you’re going to tell us how, so stay tuned. We’ll be right back. We’re back with the tactic segment of The Political Trade and Derek Phillips is our guest. He’s going to take us to school on the tweet markets, which he tells us accounts for the majority of his profits that he’s achieved as a political prediction market trader. Derek’s tactic is “Monetizing the Middle” in the tweet markets. Derek why don’t you explain that to us.

Derek OK, so with tweet markets, you have nine brackets, and the first bracket is a “less than” bracket, so it’ll be less than 100, for instance, and then the highest bracket is a “more than” bracket, more than 200, for instance. So what I like to do is, it’s kind of like an iron condor in options trading. I like to buy no on the first bracket and the last bracket and then kind of capitalize on a lack of volatility, so that when the tweets come between the the range of the entire market, you’re going to cash in on one of those interior brackets.

Jeff OK, well, there’s a lot to unpack there. So stepping back a little bit, we’re speaking about the tweet markets just because they are the biggest game in town on PredictIt.org, and they are the highest volume markets right? In fact, Mike did a little research for us. He said in the last week alone three of the seven most traded markets on PredictIt.org were the tweet markets. Two and a half million shares traded in the White House tweets market. Half a million shares traded in the POTUS market. Real Donald Trump had over 300,000 shares traded, that’s a lot of trading volume. That’s a lot of money running through those platforms, which means there’s a lot of rookies, there’s a lot of pros that are involved in that market. So when you speak to monetizing the middle, you’re talking about the brackets that exist. So a tweet market goes up, and it will go up and let’s say on Friday for POTUS for the week to come. And we’ll have nine different brackets there and the bottom bracket—B1 using the terminology of the site—would be, let’s say 100 or lower tweets, and let’s say hypothetically that B9, bracket number nine, is 200 or more tweets. So that establishes the parameter of the market and your tactic is to at the outset of that new market to buy NOs in both B1 and B9, and of course you can buy multiple NOs in the market, and tell us how that works and why that works.

Derek It works because more often than not, it’s going to fall in the middle. Sometimes people like to think it’s gonna fall below the the bracket and then they’ll go buy it up and it loses, but what I like about it is you can, if you’re staying on top of the market, you know when either your first NO or the last NO is about to fall off the table. You know when Trump is going on a bender and tweeting 30 times in a row that it’s time to sell your B9 NO, and you know that when he is not tweeting for an entire afternoon it’s time to sell that first bracket NO. So more often than not, it’ll fall in the middle. But if it doesn’t, if it looks like, you know, the winds are changing and it’s going to go to the top or he’s going to stay under that first bracket, you can just sell it and then cash out your winnings and the other one to make up if you have to take a small loss in the one that you do sell. And it’s just a way of creating a sort of Armitage with it with an option to dump where you’re losing for, you know, more often than not just a very small loss.

Jeff It’s interesting that you use the metaphor of an iron condor, and of course an iron condor is an options trading strategy. It’s a neutral trading strategy that allows the potential profit regardless of the outcome of the underlying security. So that alone, by definition, is what you’re saying you don’t know where it’s going to fall. B1 through B9, but the probability is you’re going to fall somewhere in the middle, you’re not making a directional commitment, as with a stock, if it’s gonna go higher or lower, in this case, you’re not committing to the underlying bracket, but you’re establishing the parameters of the trade of, it’s not going to be B1 and it’s not going to be B9.

Derek Right. And I think what appeals to me is the sort of versatility for it, just knowing that you can sell the loser. Get out of that, and the one that is winning is going to pay you off whatever you’ve lost in the one that you’ve had to sell. So you do have to work, you know, to stay on top of it and to know if you’re in a bracket that’s going to go for a run, when to get out of that. And if you can do that, you’ll never lose doing this strategy.

Jeff Right. So what you’re referring to in trading is called legging out of the trade. And that does require a little bit more attention and risk. So if you have a spread, like what an iron condor is, essentially, employ out-of-the-money put spreads and call spreads at a predetermined width. And the ideal scenario is an outcome that falls within that range. So, and in the perfect world, you don’t have to pull off either one of those, but you’re saying if there’s a clear direction, you’re going to want to take off one of those NOs. But you can, you’ll see the pacing, you’ll see the trend and trajectory of that tweet count that will allow you to make that decision long in advance, as opposed to getting stuck in that position at the end. And then of course, the payoff— At the outset, when the market first comes up, when a tweet market comes up and you have these nine different brackets, typically, is it fair to say that the YESes are trading in the low teens then across the board in all the brackets or?

Derek Depends on the market, but certainly with the RealDonaldTrump market, I think most of them are at you know, between 10 and 12 cents opening up White Houses is a little bit more predictable and the range is still 10 tweets per bracket. So those are, you know, a lot of the time in the mid teens, but you never really see anything above 20 until maybe two days until market resolution.

Jeff And aside from the tweet markets, which other markets can you apply this tactic to? Because there are multiple markets on PredictIt that have multiple brackets. So, for example, a margin of victory market, which is, in a primary or an election within a state will the margin of victory be zero to half a percent, a half to one, one to one and a half, two, and it will have those various different brackets. There’s other markets that have multiple brackets on PredictIt, which ones can you use the strategy on?

Derek Certainly the margin of victory markets, as you said. I mean, it doesn’t always have to be the first and the last. You can buy the first three NOs and then the last three NOs for instance, and play it that way. There are markets on legislation. For instance, how many “yeas” will a certain piece of legislation get when it’s being voted in the House or the Senate? Those markets can certainly use this strategy. I mainly use it for tweets, of course, but margin of victory and legislation markets are two other places you can look.

Mike We’ve had a lot of guests in the past who have touched upon the tweet markets, and a lot of them have a bunch of different sources that they turn to for an accurate count of how many tweets these accounts are putting out there. Because obviously, if you’re going to go in the tweet markets, you have to be following the numbers, following the trends. So let me ask you this: What tool do you use? What resource do you go to for those counts?

Derek I use a service called pitwets. So that’s pi and tweets without the E—without one of the Es—and that actually is a membership. I think it’s a very small fee. I think you can get a lifetime membership for like $40 or something, it might even be less.

Jeff That’s right. It’s $40 for life, yeah.

Derek That’s a great service. The developer is a player in the market. His name’s Dave, and he’s a really good guy. And you know, he’s put a lot of work into it. So I don’t mind, you know, supporting local industry, so to speak. And he does a great job of staying on top of developments, you know, in this space. So, if the Twitter API is slow, he can put it on the Slack channel and make sure that you get it out as quickly as possible then, but for $40, I mean, you’ll make $40 using that in no time if you’re any good at this. And I think even if you play small and just kind of take free money when it’s on the table, it’ll pay for itself. So I use that Picount is another one that just kind of keeps track of the numbers. I have that on my desktop, and whenever I have a question, where we are in an account, I just click on that. And, you know, it’ll tell you real quickly.

Jeff Yeah, so that’s a free platform picount.com. That’s right. And you can get push notifications to your desktop, perhaps even to your mobile phone from that platform, as well. And it does count the cumulative weekly total, using the PredictIt time period, it’s a PredictIt resource intended for PredictIt traders. It does provide that cumulative count in real time for each of the three White House-oriented Twitter platforms. Just as a follow-up question, too, so if you’re placing the NOs at the outset, at the early stages of the market being introduced, which means if the buys are running initially in the low teens up to 15 cents, the corollary for that would be the NO for each respective bracket B1 and B9 in this instance would be somewhere in the low 80 cents, let’s say 85 cents. So you’re essentially buying two NOs at around 85 cents at the outset. One of them’s going to resolve in your favor, you know that with absolute certainty. So you had that 15%, or that 15 cent profit there, off of that one, which favorably resolves. And then the second one, your contention is that you’ll have ample opportunity based on the projected trajectory of the tweet volume to be able to get out of that one if it looks as though it might be a contract that, you know, might not resolve in your favor. If that’s the case, does that mean you’re also then buying the other NOs as they start to roll out of favor? And how much would you pay for a NO in those circumstances?

Derek Well, I mean, I pay whatever they’re worth. If, for instance, you’re playing the RealDonaldTrump market and you can just tell that he’s going to be reeling off 60, 70 tweets in the morning, sometimes it’s obvious that he’s just in one of those moods. There’s nothing on the schedule, and he’s just gonna go. I have no problem paying 90, 95 cents to get that B2 if I already have B1, for instance, and then I’ve quickly sold my B9 NO because you’ve got to get out of the way of that train. So I don’t have any problem if a bracket is dying, you know, paying 90, 95 cents and just taking the small return there. But one thing I do want to clarify is that you can do this not just at the onset of the market. For instance, you know, the night before a market resolves, POTUS resolves tomorrow, you could buy it on the top and the bottom of what’s active. So if there are four brackets that people are still interested in, you could buy NO on the first one and then buy NO on the fourth one. And you’re getting a lot of times a lot better of a deal. So, you know, whereas when the market opens, you might be getting 85 cent NOs, you know, maybe now you’re getting 75 cent NOs, and it’s a little bit more profitable that way.

Jeff That is a great point. If you were to say, and I know there’s no flat rule, but so you’re saying, you know, further into the week, more markets, more brackets are going to be dead and eliminated. And you can establish a tighter range. Is there a good time, a sweet spot that you’d like to go into a tweet market?

Derek Yeah, I mean, I’m always kind of looking for opportunities. I like to play the White House market a little bit more than the Real Donald Trump market with this strategy. You know, just because Trump tweets a lot at night, and I’m usually asleep, and you don’t want to be sleeping through the activity when you need to make quick decisions to sell. But I think I make a lot of really complicated positions in the White House market, you know, where I’ll do what you said, which is to kind of add on to my NOs, you know, so if I bought B1 in the beginning of the week, maybe add B2 NO. And then B2 NO and then you know, maybe I’ve got my B7 NO and B9 NO at the same time. So by the end of the week, a lot of times it’s just limited down to maybe two or three brackets for me. And I’m just kind of building this complicated position over the course of the week.

Jeff All right. Well, thank you Derek, this has been an important episode, one I’ve been looking forward to for the reason that you shared earlier, that the tweet markets accounted for so much trading volume and, in your example, which is an extraordinary, aspirational one, so much profit potential that you really need to learn how to master this market. And it was about time to spend some considerable time examining the markets and the mechanics of it and how it works. It never shows up in our trade segment, which is coming up next, for the obvious reasons, it’s a fast moving target. So it’s not something you can say in advance, you know, buy B6 in the POTUS tweet market. That’s why we never talked about in trades. So I’m really happy we can devote this tactic section to the market that has the greatest potential. If you’re a trader in the stock market, understanding the tweet markets on PredictIt would be the equivalent of understanding the S&P 500. It’s the go-to market where the most volume is and the most opportunity, so thanks for sharing your wisdom with us on that. We’re going to be right back after a quick break. And we’ll ask Derek for his perspective on some specific PredictIt markets. We’ll be right back. Welcome back to The Political Trade featuring super trader Derek Phillips. We are going to jump right into his top trades on PredictIt today. Derek, what’s the first market we should pull up?

Derek Sure. So the first one I have is something that I wrote about in the most recent issue of the Luckbox. It’s the North Carolina market, the North Carolina presidential market. I have the Democratic candidate winning in North Carolina.

Jeff Democratic YES, currently trading at around 49 cents, so nice return there. It’s about a 50/50 probability according to the market. That’s what 49 cents is telling us. Say a little bit more. In 2016, of course, the Republicans won that state. Trump secured 49.8% of the vote to Clinton’s 46.2% What accounts for your current prediction?

Derek What I wrote about in the most recent issue of Luckbox is the power of incumbency. So Roy Cooper is one of the most popular governors in the country right now, he’s running for reelection. I think he’s the only swing state Democrat that’s running for reelection. In fact, I know he is. And I think being on the ballot with him, and with Cal Cunningham, who’s running against a very unpopular incumbent in Tom Tillis, should make a big difference for Joe Biden’s prospects in the state. I think that his VP candidate is probably going to help. I think the Obamas are probably going to focus more on North Carolina than most of the other states, I think it’s going to be a primary target for them. I just think that Biden’s going to have enough help coming from the ballot and coming from surrogates to pull him over the finish line here.

Jeff Well currently the corollary market to this, which is “Which party will win the U.S. Senate race in North Carolina?” has the Democrats at 61% probability, or 61 cents trading. So you feel as though that adds even further support? So there’s a little bit more value here basically with Democratic YES in the presidential election only trading at 49 cents as opposed to 61 cents?

Derek Yeah. So the Senate market, you’re correctly pointed out, is in the 60s for the Democrats. There’s also a market for who will win the governor’s race. And that one’s trading, I think at about a 90% probability. And most of the polls have shown Cooper winning reelection by about 20 points. So it’s kind of hard to see a Democratic governor winning by about 20 points, the Democratic Senate candidate winning by about five or six, which is what Cunningham is polling at, and then the Democratic president at the top of the ticket not winning. I don’t really see that scenario playing out. I think if Cooper is going to win by 20, and Cunningham is going to win by five, I don’t really see a scenario where Biden can lose.

Jeff So 49 cents to pay $1. Forty-nine percent probability that Biden wins North Carolina is your first bet. Well, we’re moving to Montana soon, which is, if there’s any Frank Zappa fans out there, they’ll recognize that refrain. But it’s going to be a dental floss tycoon in Montana. That’s your market. What do you like there? What are we looking at in Montana?

Derek This is another one I think I wrote about in a previous issue of Luckbox where I talked about picking up a NO on the Democrat to win this Senate race. That’s current Governor Steve Bullock running for Senate. I have him as a NO just because I’m using it as a hedge against some of my other senate markets which are a little bit more profitable, with the added benefit the the chances of me winning those other bets in North Carolina, Maine and Arizona and still winning this one betting against Steve Bullock, the chances of that are still relatively high. So I think it’s got a lot of upside there.

Jeff So “Which party will win the U.S. Senate election in Montana in 2020?”

Derek I have it as a NO for Democrats. So Republican YES, only as a hedge on my other bets. And then one thing that I’d like to add today is that I am picking up a hedge for my hedge by suggesting that the Democratic presidential candidate can win the state. So that said, nine cents, 9% probability, I think if Bullock does end up pulling it out, and I think everybody agrees that he’s a competitive candidate, that this is a serious race. I think the chances that he can pull Biden over are a lot better than 9%.

Jeff So Democratic YES at nine cents in Montana. And to be clear, this is a lower probability. More of a longshot hedge against your higher probability outcome bet.

Derek Correct.

Jeff So we’re going to move to the last trade, which is of course where most of the money is flowing in the PredictIt markets right now. It’s the Democratic vice presidential nominee. High-interest market. That’s the highest value market of the last month, over 36 million shares traded alone. So who are we looking at for Democratic vice presidential nominee?

Derek OK, and this requires a shout out to Scott Supak, who was a guest on your second show, I believe, and I had kind of forgotten that he chose this person as his long shot VP candidate, and I’m going with her today too. I think Tammy Duckworth is probably the best candidate. I don’t know if Joe Biden is smart enough to pick her, but if I’m buying the best candidate alone, I’m picking Tammy Duckworth of Illinois.

Jeff Tammy Duckworth, Illinois senator, she checks a lot of boxes for the Democratic Party. She’s a woman. She’s a woman of color. She’s a military veteran. She lost a limb, she’s disabled as a result of her military experience. She has a solid progressive record. She has been smart in her utterances. She’s avoided some of the controversies like perhaps Governor Whitmer has waded into in the race during the recent pandemic. I like the trade, I liked it when Scott first introduced it to us. I, in disclosure, I own Tammy Duckworth at the current levels at around five cents as well and recognize it’s a long shot. We had a guest on not too long ago, he’s our super trader from Britain who’s also a sports gambler, and he had a strategy basically geared toward trading to the shortlist, identifying a small batch of candidates and purchasing more than one. You would have an opportunity once a shortlist might be identified to trade out of that, if you’re not successful. What is your thinking at this point now? Recently, Joe Biden has uttered, as Mike came up with his own research, that he intends to announce his vice presidential pick somewhere around August 1, and as you know, a PredictIt market has even evolved now which has multiple brackets that is wagering on when he will make his a vice presidential nomination known. But what is your sense of that timeline? And what is your thought to that? And do you think that he’ll be announcing a shortlist, or are we now in it for the winner take all?

Derek I think he’s kind of listed a shortlist already. And I actually think that the market has done a pretty good job of kind of limiting it to candidates that are actually really realistic. A lot of times in these markets, you see some kind of off-the-wall candidates in there, and I think this market is pretty sober in who they have at least, you know, limited it down to. I don’t think that there’s going to be anybody coming in off the list, which is, you know, kind of different from what we had in 2016 where new names would be added every week for the Republican market. And you know, it’d be hard to kind of narrow it down. But I think Biden’s been pretty selective about his leaks. I think he’s done a good job of keeping his actual thinking under wraps, but floating a lot of these names, just to see what the media response is going to be. And I think it’s probably going to be one of the maybe top six that are in the market now. And I’m pretty sure it’ll come around about the same time that he suggested, which is August 1.

Jeff All right, well, for our lightning round, I’m going to go down the list right now and ask you for a quick response on them. Kamala Harris is the frontrunner with a 39% probability, 39 cent trade. Kamala Harris, what do you think?

Derek I like the pick. I think if I had to take two, if I wanted to fill out my holdings beyond Tammy Duckworth with somebody that’s a little bit more expected, I think Kamala is probably the choice. I think Kamala does a good job of not alienating some of the important groups that he is trying to solidify with his VP choice. I just think that Duckworth does a little bit better job of touching all of those without, you know, pushing people away.

Jeff Well, Elizabeth Warren has seen an uptick today; she’s trading up to 18% up 3% from yesterday, and even Amy Klobuchar is up to 15%, up a couple pennies on the day. Val Demmings is up one cent to 9% probability. So our top four are Harris at 38, Warren at 18, Klobuchar at 14 and Demmings, who I have a position on as well, which I purchased at four cents, is moving up a little bit to nine cents. Do you feel any of those are shortlist candidates or make the final round here?

Derek Well, I’ll just kind of explain my big picture thinking on the VP choice. I think Joe has to appeal to each of four specific demographic segments of his coalition, those being the older and moderate independent seniors. Second group is minorities. Third group is young professionals. So that means Warren supporters who are more often college educated women and the less-educated male segment of the Bernie Sanders supporters. And then the last one being suburban women, which was kind of the cornerstone of the 2018 midterm victories for Democrats. I see each of these candidates touching one segment or another of that coalition, but in some other ways turning off some voters. Klobuchar, for instance, really appeals to the older and more moderate wing of the coalition, but she has some serious problems with the black community. Elizabeth Warren does really well with young progressives, but older Americans are kind of leery of her more progressive stances. Demmings, I think she kind of has a lack of experience that isn’t gonna appeal to older Americans or suburban women that are looking for more security for Joe Biden since he’s a bit older. And they’re concerned about, you know, his health and the ability for the vice president to take over, so I like components of each of these candidates, but I don’t think that they all check all of the boxes the way that I see Tammy Duckworth doing

Jeff Well, Tammy Duckworth at five cents, 5% probability, which would pay 20 to 1—would be an extraordinary return. So we’re gonna hold your feet to the fire on this one. And certainly this is the market that everyone’s most interested in. So great trading ideas. Thank you so much. We are going to take a quick break, and we’re going to come back with our last segment where we get another idea from you. We’re going to look for the Luckbox Lockbox. And that is your sure bet right now that’s the gimme on the site that you can just pick up a couple of easy, easy dollars. So we look forward to coming right back with your thoughts on that. And we’re back. Most gamblers and traders know what a Luckbox is. It’s an undeserving recipient of a favorable outlier outcome. And fans of political rhetoric will remember the term “lockbox” which Al Gore popularized in his 2000 presidential run.

Al Gore SNL I would put it in what I call a lockbox.

Jeff Okay, well, I’m not sure that was Al Gore, that could have been Saturday Night Live. But a lockbox was a term that came into our vernacular back in 2000. So over at Luckbox, we put Luckbox and Lockbox together to represent what a sure thing is. This is a gimmie sitting on the site. And there’s so many of them. And it’s one of the things that new traders when they come on to PredictIt.org they’re like “Seriously, I couldn’t buy a NO on Michelle Obama to be the vice presidential nominee right now for 97 cents and make an easy three cents between now in August 1 when the nominee is going to be declared?” So because of that, we thought it’d be important to identify some of the general themes about these lockboxes on the site, and we’re going to go to our super trader Derek. Derek, what should we be looking at when we’re looking to pick up Luckbox Lockbox trades?

Derek So traders on PredictIt know that there’s an ATM machine out there named Hillary Clinton. Just type her name into the search function on PredictIt, you’ll find Hillary all over the place. In our last segment, we were talking about some of the NOs that I have in the vice presidential market. And I’ve got Hillary Clinton too. I got her at 90 cents. And she’s still trading at 98 cents. So there’s people out there that think that there’s a 2% probability that Joe Biden is going to pick Hillary Clinton as his running mate. And, you know, just look all over the site. The Democratic nomination, she’s still there, President she’s still there. There’s still several states out there. I wouldn’t be surprised if you could buy her there too. But you could always pick up some Hillary and make some small change on it.

Jeff And also specifically, and you’re right, she is the ATM on the site. “Will Hillary Clinton run for president in 2020,” in the presidential market, she’s trading at 90 cents for NO. 90% probability that she will not run. And we all know it’s pretty much 100% probability. So there’s a 10 cent opportunity right there in that market. If you look at the “Who will win the 2020 Democratic presidential nomination” market, Hillary Clinton NO there is 95 cents. So you’re right. It’s a simple search, type in Hillary Clinton, and you’ll see some of the gimme trades that represent the Luckbox Lockbox opportunities that we just talked about. So we want to thank you for that, Derek, because you’re 100% right. These are such an important part of the portfolio, picking up these gimmies when they’re out there. And this has been a lot of fun. It’s always great to have you on. You’re one of our favorite guests. So thanks so much, and of course, we expect to have you back again, right?

Derek Of course.

Jeff Good, and we look forward to that. And thanks again to everybody for tuning into The Political Trade. And if you’re not holding an account on PredictIt.org right now, there’s still an opportunity to make a quick $20. We have a promo code for you, just simply go to PredictIt.org/promo/TPT20 open up your PredictIt trading account with $20, and we’ll match that first $20. That’s $40 to trade with, and you’re off and running using some of the trading ideas from the best traders on the platform, like Derek Phillips. Our guest for next week will be the most in-demand modeler of the moment. A self-described election whisper and data maven Rachel Bitecofer. From the moment we saw Rachel on Real Time with Bill Maher we were looking forward to having her join us on The Political Trade. She recently released her forecasts for this November’s elections, and we will be talking to her about her latest report, “Negative Partisanship and the 2020 Congressional Elections.” So check out ThePoliticalTrade.com to subscribe to our newsletter, find us on social media, or send us a message. It’s all there on ThePoliticalTrade.com. This is Jeff Joseph.

Mike And I’m Mike Reddy

Jeff And remember to still wash your hands, believe in math, and join us next time on The Political Trade.