Striking Pairs: Equity Indices

Today’s post outlines how pairs traders often utilize equity index futures. Read on to learn more...

Not long ago tastytrade took a closer look at equity indices as part of an analysis on “volatility arbitrage for retail traders.” Equity indices tend to share a high degree of positive correlation, which makes them good candidates for pairs.

In the previous analysis, the focus was on implied volatility, and how index pairs can be potentially traded against each other to establish a more balanced portfolio of long and short volatility. If you missed that, we recommend reviewing it when your schedule allows.

Today, we are taking another look at equity index pairs. However, in this case, we are focusing not on the options of these products, but the futures. Today, the “pair” refers to price relationship from a directional perspective, as opposed to volatility.

The graphic below, taken from Closing the Gap: Futures Edition, removes any doubt as to the positive correlation that exists between equity indices such as the S&P 500 (/ES), the Nasdaq (/NQ), the Russell 2000, and the (/YM):

As we can see in the data above, there are instances where the strong, positive correlation breaks down, but in the long run these products clearly move mostly together. This shouldn’t come as too much of a surprise, because there’s a lot of overlap in the construction of the indices, for example:

-

80% of the Nasdaq is in the S&P 500

-

100% of the Dow is in the S&P 500

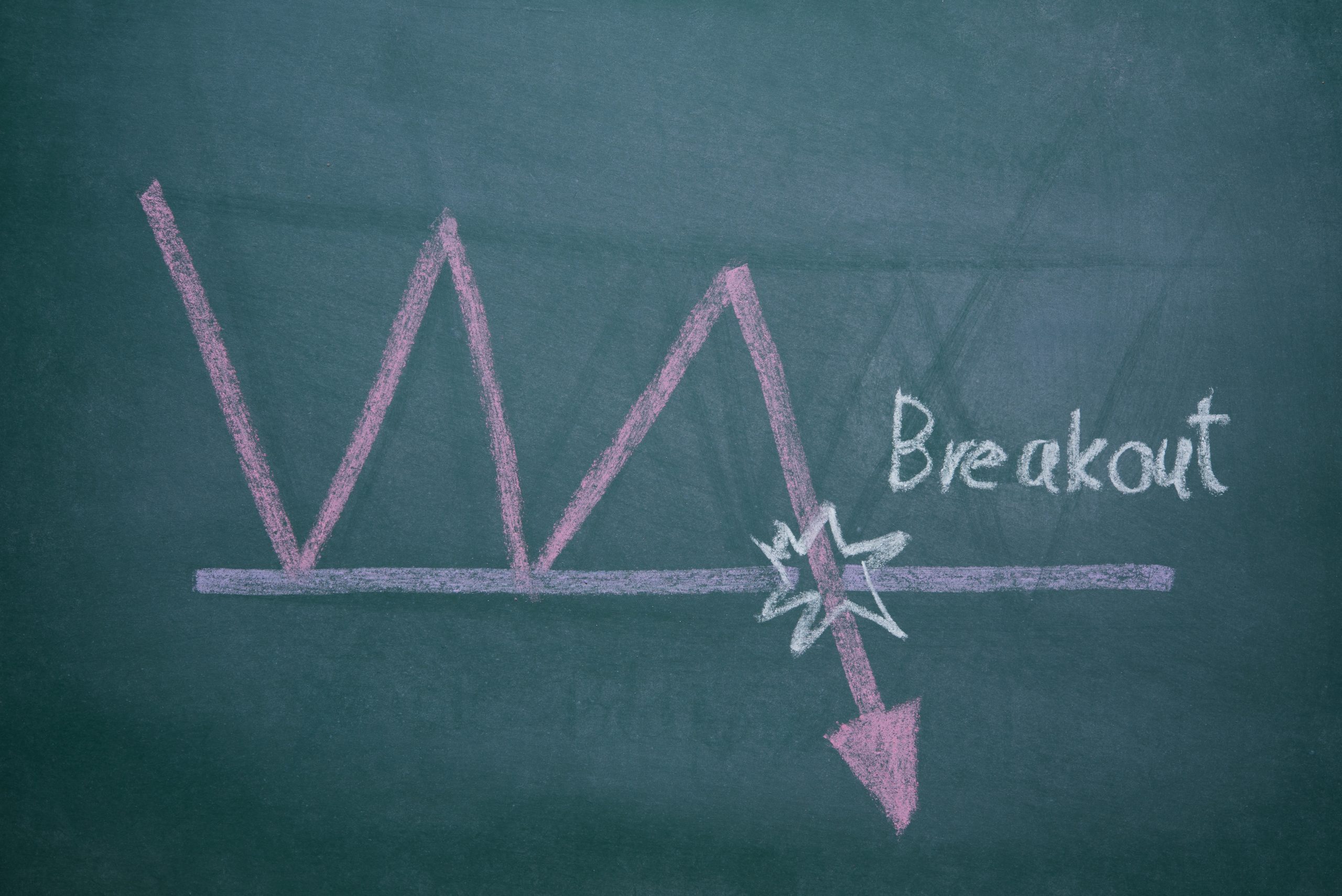

And while we often talk about “reversion” in terms of implied volatility, this concept is also applicable to direction. In the case of the indices price direction, reversion refers to a return to “normal” in the strong, positive correlation that exists between them.

While the big US equity indices were clustered together during the selloff in late 2018, there’s been a slight breakdown in that strong correlation in the first few months of 2019. For example, during the first quarter of this year, the S&P 500 (/ES) outpaced the mini-Dow (/YM) by a somewhat wide margin. Likewise, the Nasdaq (/NQ) has outpaced the S&P 500 (/ES), as shown below:

Looking at the data in the chart above, we can see that the gap between the prices of the four indices is at one of the widest points observed since the start of the year. It’s this type of breakdown in correlation that pairs traders often search for, and capitalize upon, when filtering for potential opportunities.

As a reminder, a pairs trade involves taking opposing positions in two different markets (i.e. two different underlying symbols/assets), but typically of the same expiration/duration.

For example, a well-known pairs trade in the world of precious metals involves Gold and Silver. Hypothetically speaking, a sample pairs trade using these two commodities would therefore involve getting long or short gold futures in one expiration month, versus doing the opposite in silver futures in the same expiration month.

One great benefit of a pairs trade is that they don’t require traders to take on a naked exposure (i.e. directional bet) in one market/asset. Instead, the position hinges on opposing directional bets in two underlying products with an established, long-term correlation. That means risk is theoretically reduced, because the historical relationship between the two suggests they won’t deviate significantly from the previous pattern.

Referring back to the chart shown above, we can see that the Nasdaq has outpaced the S&P 500 thus far in 2019. Based on the strong correlation between the two, a pairs trader might decide therefore to short the Nasdaq (/NQ) versus getting long the S&P 500 (/ES). The basis for this trade would be an expectation that the two revert to their “normal” behavior.

Playing out some “what if” scenarios, one can see how the risks in such a trade are reduced as compared to a naked bet in one or the other. For example, if you wanted to short the Nasdaq as a stand-alone position, the position is subject to substantial risk to the upside in /NQ. However, by layering in a long position in the S&P 500, one can see how the “pair” provides added protection through a natural hedge.

That’s because it’s extremely difficult to imagine the Nasdaq rallying to any great degree, without the S&P 500 following suit. Similarly, if the markets entered a correction, one could also see how the Nasdaq might be subjected to a deeper move down, relative to the S&P 500 – based on the fact that it had outpaced the other four indices so far in 2019.

While the example used in this post should be viewed as a sample trade for illustrative purposes, we think traders interested in pairs trades will benefit from a review of the complete episode of Closing the Gap: Futures Edition. Included on the show is a discussion on how to size each leg of the trade using “IV adjusted value” – a critical element when balancing the overall risk of the position.

If you have any comments or questions about this type of trade, or any other, don’t hesitate to leave a message in the space below, or reach out on Twitter (@tastytrade) or email (support@tastytrade.com).

Thanks for reading!

Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.