Rate Cuts May Not be a Bullish Signal for the Stock Market

Many investors and traders pinned their hopes to rate cuts by the Federal Reserve, but history shows monetary easing cycles can weigh heavily on the stock market

- A so-called “freight recession” may have taken hold in the transportation and logistics sector.

- Freight recessions typically signal falling demand for commercial shipping and logistics services, and often precede full-blown economic recessions.

- If a recession materializes, history says the stock market will likely correct, even if the Federal Reserve aggressively cuts rates.

After many months of nervous anticipation, the jobs report in the U.S. finally came in worse than expected.

On Friday, May 3, the U.S. Labor Department announced that the economy created 175,000 jobs in April—about 65,000 less than analysts expected. Typically, that level of underperformance might be interpreted as negative. However, investors and traders appeared to view it as positive, pushing the major indices significantly higher to close trading during the first week of May.

So why was “bad” economic news interpreted as positive? That’s because Wall Street has become obsessed with interest rates. In the current market environment, a strong underlying economy is viewed as one of the biggest obstacles to reduced interest rates.

Inflation foils rate cuts

Case in point, the U.S. central bank elected not to cut benchmark interest rates at the end of April, indicating that inflation remained persistently strong. Speaking to that reality, the chairman of the Federal Reserve, Jerome Powell, said: “In recent months, inflation has shown a lack of further progress toward our 2% objective.”

Importantly, however, the Fed’s decision on rates was announced a couple of days before the April jobs report. And on May 3, investors and traders appeared to view the weaker-than-expected April jobs report as the first tangible sign that the U.S. economy is starting to cool.

A slowing economy is central to the interest rates narrative because the Federal Reserve traditionally cuts benchmark rates to help foster growth. And if the employment situation in the United States is finally starting to deteriorate. So, it may be necessary for the Fed to act soon. could be forced to act soon.

During the last quarter of 2023, the interest rates futures market expected the U.S. central bank to cut rates five or six times in 2024. But as of early May, that figure has shrunk to just two rate cuts.

Looking at the bigger picture, the market’s hopes for a rate cut may be misguided, especially if the economy weakens significantly. Historical data shows that the stock market can underperform during a rate-cut cycle, especially when the economy enters a recession.

Q1 earnings reflect a “freight recession”

In addition to the weaker-than-expected jobs report, other signs show activity in the U.S. economy is slowing. One of those relates to a so-called freight recession.

Freight recessions are characterized by falling demand for freight-related services, such as those offered by trucking companies, railroads and other logistics companies. During these periods, freight companies experience declining shipment volumes, which typically translates to lower spot rates for their services and reduced revenues and profits.

According to experts, freight recessions are highly correlated to downturns in the broader economy. Per a report from Reuters, there have been 12 freight recessions since 1972, and real economic recessions have followed six of those. Based on some of the data coming out of the transportation and logistics sector, a freight recession might already be here.

For example, in its mid-April earnings report, the well-known trucking and logistics company J.B. Hunt Transport Services (JBHT) reported its quarterly revenue and profits dropped about 9% and 35%, respectively, compared to the same period last year. Moreover, Shelly Simpson, president of J.B. Hunt, characterized the current environment as a freight recession.

Echoing that sentiment, Marty Freeman, CEO of Old Dominion Freight Lines (ODFL), recently said “challenges from the domestic economy have persisted for longer than we originally expected.” As a result, spot rates in the freight transportation industry have been under pressure. According to DAT Solutions, the company’s average contract rate has fallen from about $2.64 per mile last year, to $2.47 in 2024.

A recent earnings report from the railroad sector appears to corroborate the slowdown in the freight industry. On April 24, Norfolk Southern (NSC) announced that revenues and profits in Q1 of 2024 had fallen by about 4% and 25%, respectively, as compared to the same period last year.

Dovetailing well with data from the trucking sector, a new monthly report from the Association of American Railroads recently revealed that the number of freshly originated railroad carloads had dropped by 6.5% in May, representing the fourth consecutive month of declining volumes.

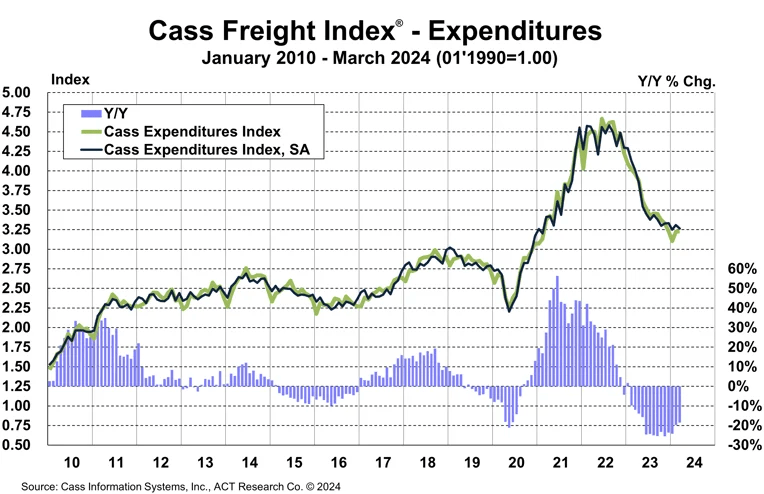

The Cass freight index is still in negative territory

In addition to the above information and data, the Cass Freight Index has also been signaling weakness in the freight sector. The Cass Freight Index measures freight activity monthly using shipments and expenditure data from several shipping and logistics companies.

In March of this year, the index indicated that shipments were down about 3.6% as compared to March of 2023. However, the expenditure data showed an even steeper decline, falling by 18.5% as compared to the same month last year. The spending metric considers all dollars spent on freight (including fuel and other charges) over a defined period.

Accordingly, the March Cass Freight data also indicates a freight recession playing out in the U.S. market, as illustrated below.

As shown above, the Cass Freight Index has been negative for some time now. However, larger players in the freight industry partially insulated from the downturn, because smaller, regional players absorbed the brunt of the negative impact early in the cycle.

Amid surging demand during the COVID-19 pandemic, a large influx of new entrants emerged in the shipping and logistics sector. But, because of slumping activity, many were forced out of the industry. According to The Wall Street Journal, roughly 325,000 trucking carriers have entered the industry since mid-2020 and—somewhat amazingly—231,000 have gone under.

That means a lot of the overcapacity has already been sucked out of the system. But despite that, the supply-demand dynamic still hasn’t found equilibrium. Major players in the industry are now facing increased financial pressure.

For example, shares of J.B. Hunt Transport are down about 25% since notching a 52-week high in February. We observe a similar trend in Old Dominion. That company’s stock is down about 19% since peaking in early April. And shares in Knight-Swift Transportation (KNX), another large U.S. trucking company, experienced a similar decline, dropping by about 22% since the middle of February

Rate-cut hopes could be misguided

Investors and traders appear to have pinned their bullish hopes on an expectation that the Federal Reserve will start cutting rates in Q3. That might be due to a scenario that played out about 30 years ago.

Back in the mid-1990s, the Federal Reserve raised benchmark interest rates to fight inflation, much as it has done over the last couple of years. And once it tamed inflation, the Fed proceeded to gradually lower rates back to “normal” levels. That period is often viewed as a “soft landing,” because the Fed successfully raised rates without crashing the economy. The central bank was also largely successful in its goal to rein in inflation.

In 2024, the Fed is attempting to thread the needle on rates and inflation for the second time in 30 years. And it’s a critical time for investors because the stock market has historically responded very differently to soft and hard landings. Jane Fraser, CEO of Citigroup recently underscored this sentiment. Fraser said: “It’s hard to get a soft landing, we’re hopeful, but it is always hard to get one.”

If the Fed can pull off a soft landing and avoid a recession, rate cuts could help propel further gains in the stock market. But if a recession materializes, historical data indicates that the stock market could be in for a rough ride. Speaking to those risks, Jurrien Timmer, director of global macro strategy at Fidelity, recently said: “If the Fed is pivoting because a recession is brewing, then earnings tend to decline, and the stock market can suffer a drawdown.”

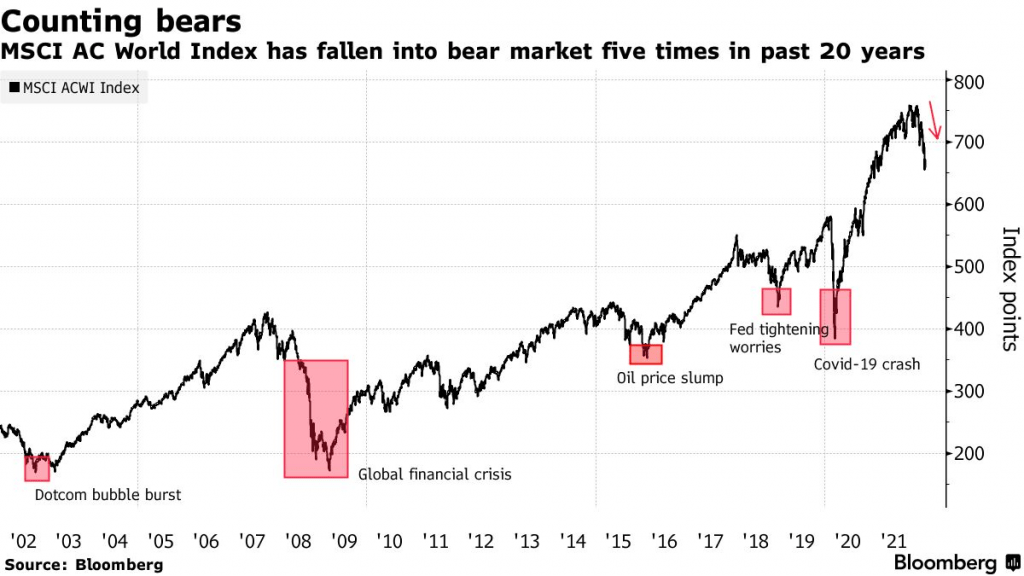

As highlighted by Timmer, a hard landing in the economy would almost certainly fuel additional volatility in the financial markets, and potentially trigger a correction in the stock market. At least that was the case in 2001-2002 and 2008-2009. During those hard landings, the stock market pulled back by -49% and -57%, respectively, as illustrated below.

Research from Comerica supports the notion that a rate-cut cycle wouldn’t necessarily be the best development for the stock market. According to John Lynch, Comerica’s chief investment officer, that’s because the Fed usually cuts rates due to a weakening economy. Speaking to this historical pattern, Lynch recently said, “the risk of recession was usually imminent, prompting monetary policymakers to ease conditions.”

Comerica research shows the period between the last rate hike and the initial rate cut has generally been good for the stock market, producing average gains of about 4.6% (using S&P 500 data from 1974 to present). But after the first rate cut, the performance of the stock market was far worse. On average, the stock market has corrected by about 20% in the wake of a first rate cut.

All told, the data suggest that the onset of a Fed rate-cut cycle may not be a bullish indicator. It all depends on how the underlying economy performs in the wake of those cuts. And with the transportation and logistics sector already facing a “freight recession,” there is a tangible possibility that a broader economic recession may follow. Importantly, corrections in the stock market often accompany recessions.

Of the 13 major bear markets since 1946, 10 coincided with economic recessions. As such, investors and traders should avoid succumbing to record levels of complacency and instead remain vigilant, adhering to disciplined risk management strategies and tactics.

For more background on trading bear markets, readers can check out this installment of From Theory to Practice on the tastylive financial network.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.