Trading the Surge in Corporate Bankruptcies and Defaults

Elevated interest rates have been a burden for the corporate sector in 2023, which has resulted in surging bankruptcies and defaults

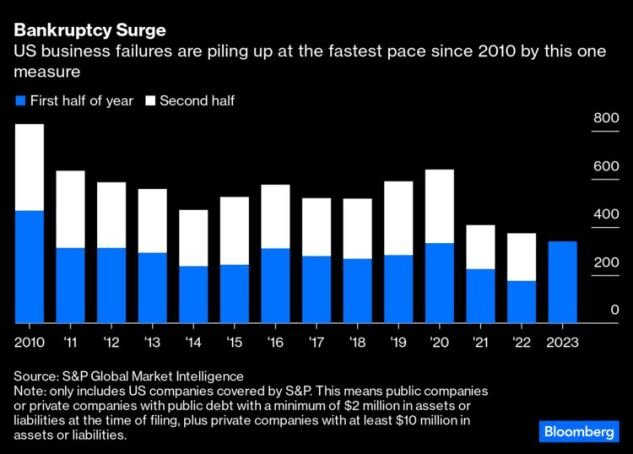

- Corporate bankruptcies in the U.S. are trending toward the highest levels observed since 2010.

- The U.S. has seen a rising number of corporate defaults in 2023.

- Moody’s recently downgraded the credit ratings of 10 regional banks in the U.S., and has indicated that further downgrades could be forthcoming.

The S&P 500 is up 17% so far in 2023, but that doesn’t mean there aren’t signs of trouble in the underlying economy—corporate bankruptcies have risen significantly this year and are now trending toward the highest levels observed since 2010.

Last month, 64 U.S. companies filed for bankruptcy, bringing the year-to-date total for 2023 up to 450. To meet the threshold for inclusion in this list, a company must have at least $2 million in assets or liabilities, or have $10 million in privately traded debt.

The bankruptcy narrative came into focus earlier this year when several large regional banks, such as Silicon Valley Bank (SIVBQ) and Signature Bank, became insolvent and were seized by regulators. More recently, companies like Yellow Corp (YELL) and Bed Bath & Beyond (BBBYQ) have followed suit.

According to data compiled by Bloomberg, the first half of 2023 saw the highest number of corporate bankruptcies since 2010.

So far in 2023, the vast majority of bankruptcies appear to be linked to higher interest rates, which have triggered a surge in corporate financing costs.

Speaking to the current environment, Mohsin Meghji, a founding partner at the restructuring and advising firm M3 Partners, recently told CNBC, “Look at the cost of debt. You could reasonably get debt financing for 4% to 6% at any point on average over the last 15 years. Now that cost of debt has gone up to 9% to 13%.”

Companies facing liquidity crunches, or those needing to refinance large portions of their debt burden, have been especially susceptible to bankruptcy risk in 2023. But according to one senior credit officer at Moody’s, Sharon Ou, the bankruptcies have been spread evenly across the major business sectors.

Ou told CNBC, “It’s not like one particular sector has had a lot of defaults. Instead, it’s quite a number of defaults in different industries. It depends on leverage and liquidity.”

Importantly, interest rates aren’t expected to come down anytime in the near future, which means the rate of corporate bankruptcies likely won’t slow down anytime soon, either.

Corporate default rate has spiked in 2023

In addition to the bankruptcy trend, the U.S. has also seen a rising number of corporate defaults in 2023.

A corporate default occurs when a company fails to pay an interest or principal payment on a debt obligation, such as a bond or loan. A technical default may also be triggered if a company fails to meet the reporting obligations required by its lenders.

According to data compiled by Moody’s Investor Service, there were 55 corporate debt defaults in the first half of 2023. Amazingly, that figure is larger than the total number of defaults from calendar year 2022.

In response to the rising number of defaults, Fitch Ratings recently raised its 2023 bond default rate outlook to 4.5-5%, from its earlier projection of 3-3.5%. The long-term average for corporate bond defaults is closer to 4.1%.

In a worst-case scenario, Deutsche Bank estimates that corporate defaults could rise to 11%, which would be just shy of the record set during the 2008-2009 Financial Crisis, when defaults topped out at approximately 12%.

One of the largest companies to default so far in 2023 was the KKR-backed Envision Healthcare, a provider of emergency medical services. The company possessed a debt burden of some $7 billion when it filed for bankruptcy in May of this year.

Much like the projected increase in bankruptcies in the second half of 2023, most experts in the credit markets expect an uptick in defaults, as well. According to an April survey by the International Association of Credit Portfolio Managers, 81% of credit portfolio managers expect to see defaults picking up in the next 12 months.

Underscoring the fragility of the credit markets, Anne Walsh, the CIO of Guggenheim, recently said on Bloomberg Television, “I don’t think the market is really pricing in the next shoe to drop, and that’s credit.” Walsh added that she believes the rate of bankruptcies and defaults will continue to increase going forward, especially if the Fed keeps benchmark interest rates at elevated levels.

Underscoring Walsh’s concerns, Moody’s recently downgraded the credit ratings of 10 regional banks in the U.S., and has indicated that further downgrades could be on the way.

Generally speaking, investors and traders can help minimize bankruptcy/default risk by trading highly reputable companies with long histories of consistent profitability, or by avoiding single stocks altogether, in favor of exchange-traded funds (ETFs).

To review the top-performing ETFs in 2023, check out this recent article from Luckbox. To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.