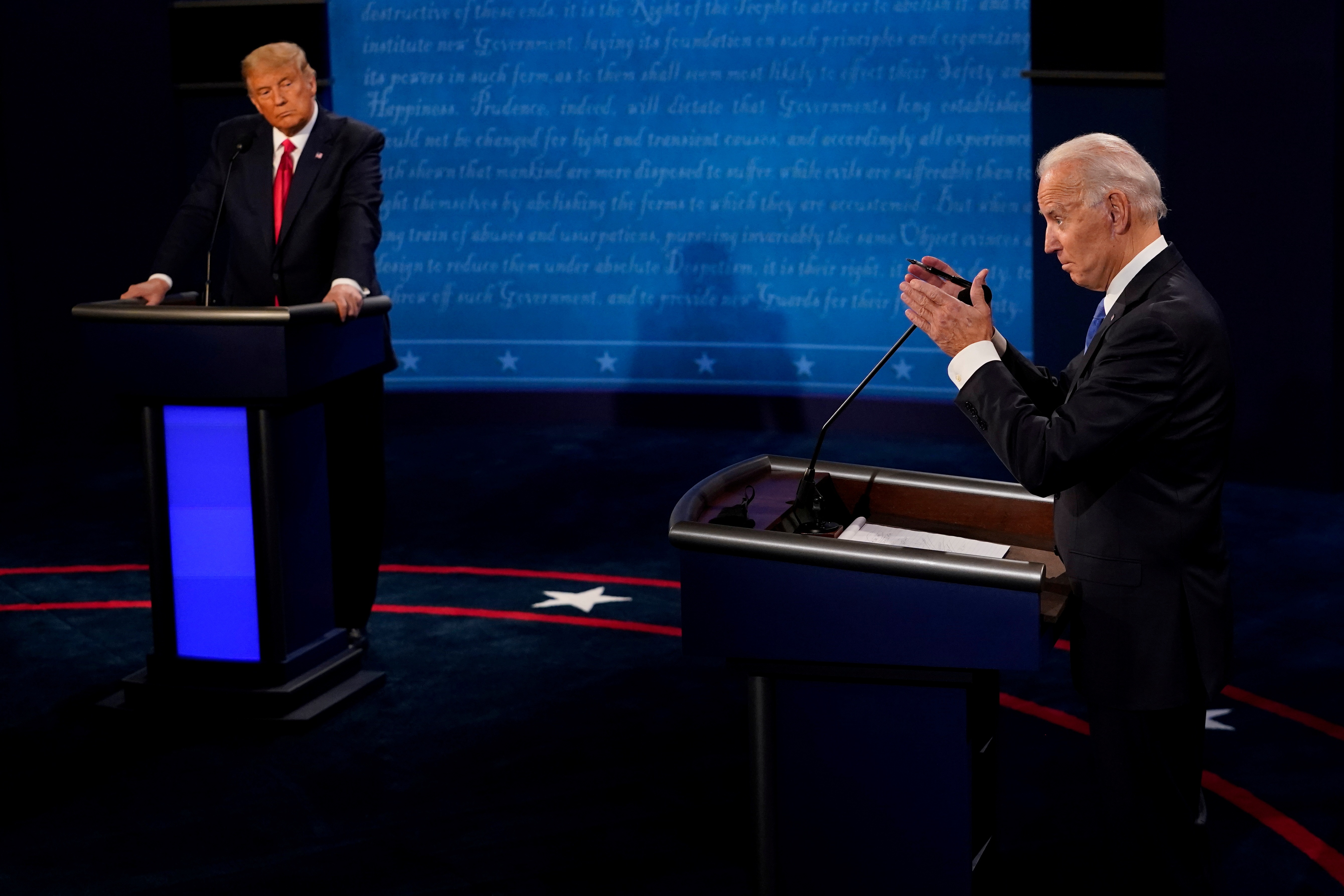

Biden’s VP: Buy the News, Sell the Rumor

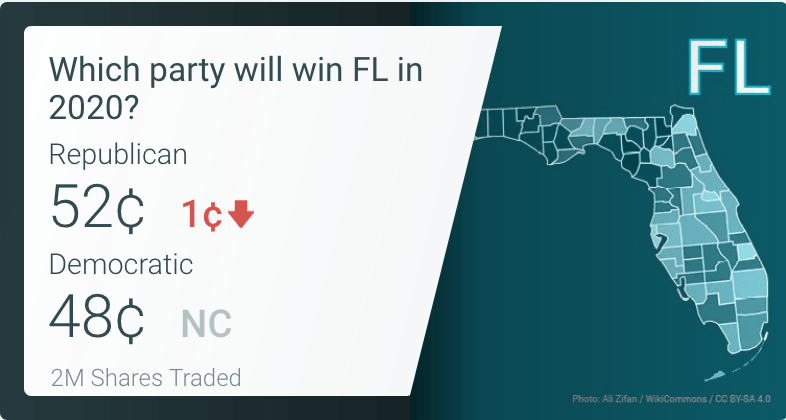

When it comes to betting on Joe Biden’s VP, prediction market prices tell one story. But the news can tell another.

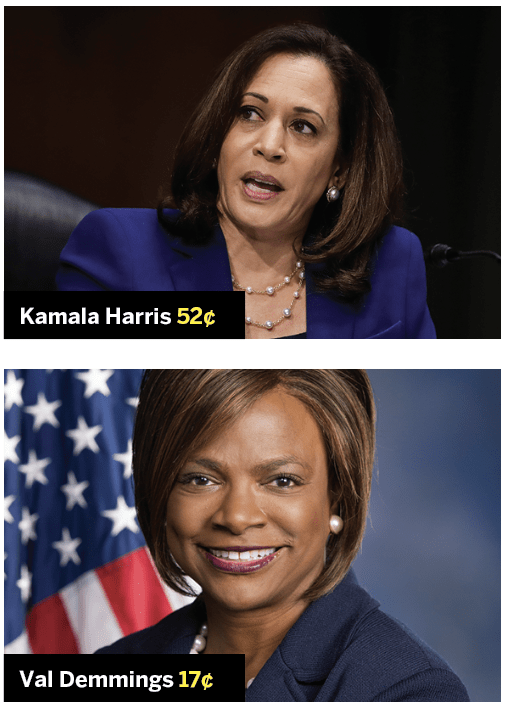

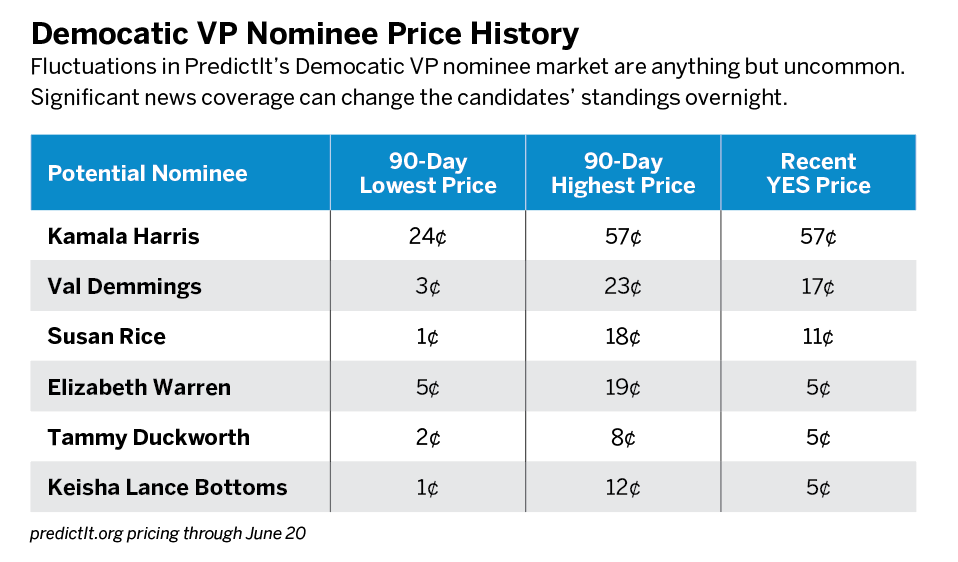

Political prediction market traders began betting on who will be the Democratic vice-presidential nominee long before the party settled on a candidate for the top of the ticket. In the markets, where cents represent the forecasted percentage of an outcome to occur, traders have narrowed the field to the six most-likely candidates, with Kamala Harris projected as the favorite. But making money in the VP market doesn’t depend solely on guessing correctly—sometimes it’s a matter of knowing how the news will move the market.

In the PredictIt market forecasting the Democratic vice-presidential nominee, fortunes rise and fall with global events. In a departure from the old model of floating a candidate’s name in the media to gauge public response, this year a person’s likelihood of being selected for the job will be determined mainly by how her story fits into the larger narrative of what is happening to the country.

Smart traders take long positions by determining whose stock appears likely to improve with each news cycle, selling at a high when rumors arise that presumptive Democratic presidential nominee Joe Biden is giving that candidate serious consideration.

Buying on the news, as it turns out, is much easier than the old (buy the rumor, sell the fact) model of reading the tea leaves of backroom deals and pseudo-psychological analyses of whose governing style and political ideology aligns best with the top of the ticket.

Many traders made the mistake of approaching the market the way it worked for Hillary Clinton and Donald Trump in 2016, only to get sucked in by rumors that Biden had made a deal with Amy Klobuchar or that Stacey Abrams was doing her best to show flexibility on issues where she once disagreed.

Unfortunately for those two candidates—and the traders they took down with them—timing is everything in politics. In 2020, if someone doesn’t offer a unique set of skills and experience to address the myriad crises the country is facing, there is no way that person will be chosen for VP.

Here are a few moves top traders made while buying the news in recent months:

Buying Gretchen Whitmer and Elizabeth Warren (YES) on news of the COVID-19 outbreak

As an example of the success Democrats enjoyed in the 2018 midterms, which was supported by the diverse coalition they are hoping to build again this year, Gretchen Whitmer was in demand even before the pandemic. But she was priced at only about 4¢ because of a lack of name recognition.

Knowing that a pandemic hotspot in her state would thrust Whitmer into the national spotlight netted traders about 10¢ per share.

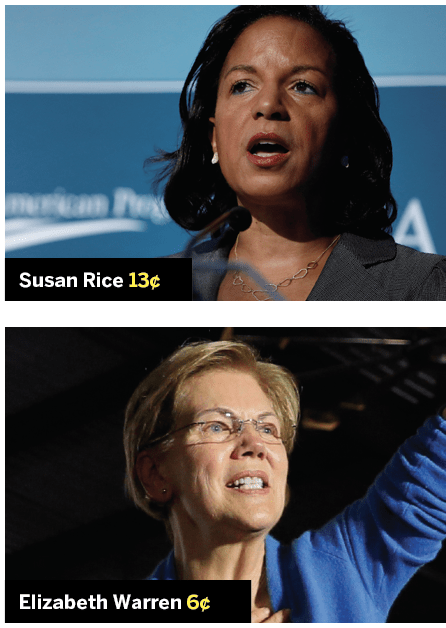

In a similar vein, traders who read the news immediately knew what Elizabeth Warren’s loss of her brother to COVID-19 meant for her likelihood to be selected. As someone who has now had personal experience with loss from the pandemic, Warren was instantly seen as someone who could help heal a nation desperate for empathy.

The predicted probability of Warren being selected moved 5¢ per share overnight.

Buying Amy Klobuchar (NO) on the news of George Floyd’s death and buying Val Demings, Keisha Lance Bottoms and Susan Rice (YES)

Nobody knew whose position would improve in the immediate aftermath of George Floyd’s death, but it was pretty clear Amy Klobuchar would fall.

Knowing Klobuchar was once the county attorney for Hennepin County, smart traders knew her connection to Minneapolis law enforcement would become a liability and that her troubles with black protest movements would be even worse. Klobuchar immediately lost half of her share value and then practically lost the remainder when news broke of her past unwillingness to prosecute officer Derek Chauvin.

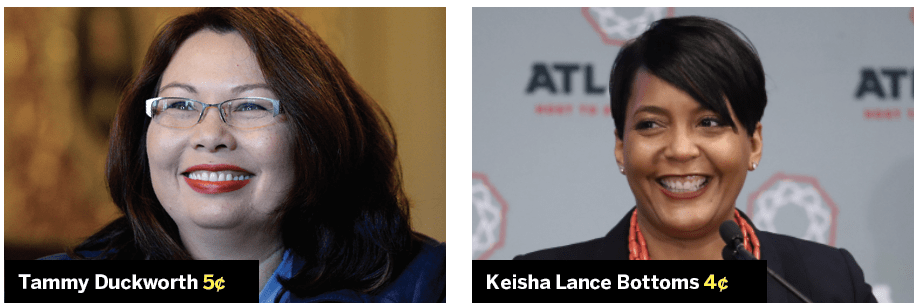

As for those whose stock improved, Val Demings, Keisha Lance Bottoms and Susan Rice were each valued at about 2¢ but rose dramatically.

With Demings and Bottoms, traders can find specific news events to correlate with their increased odds. As for Rice, sometimes it is as simple as having the instinctual knowledge that if news breaks about a crisis in race relations, the chances for the nominee to be a person of color increase across the board.

The challenge, of course, is knowing when to sell before their weaknesses become apparent.

And now we have Kamala Harris

Market pricing suggests that the larger bet is currently on whether another national news event will alter the race again. Other candidates have faded as the market reached a sort of consensus that Biden is comfortable with his lead in the polls and that Kamala Harris is the natural choice for a nominee who is both a person of color and has a national profile.

Harris currently sits at about 52¢ on PredictIt, suggesting the market is reasonably confident that nothing new will happen and that she represents the safe choice. For what it’s worth, rumor has it that Biden is leaning toward Harris, and if his decision were to come today, it would probably be her.

But in 2020, who would really want to bet against the news?

Click here to read “Derek Phillips’ Best Bets.”

Derek Phillips began trading political futures professionally during the 2016 election, turning $400 into $400,000 in four years. Phillips is a recurring guest on The Political Trade podcast. @dmpfrompi