Is Inflation Transitory?

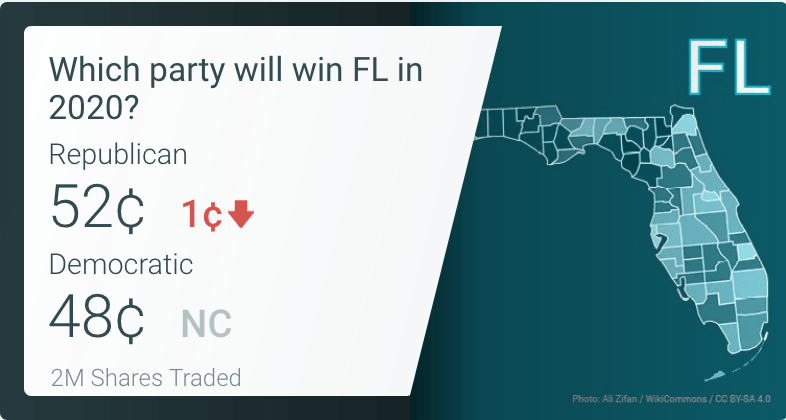

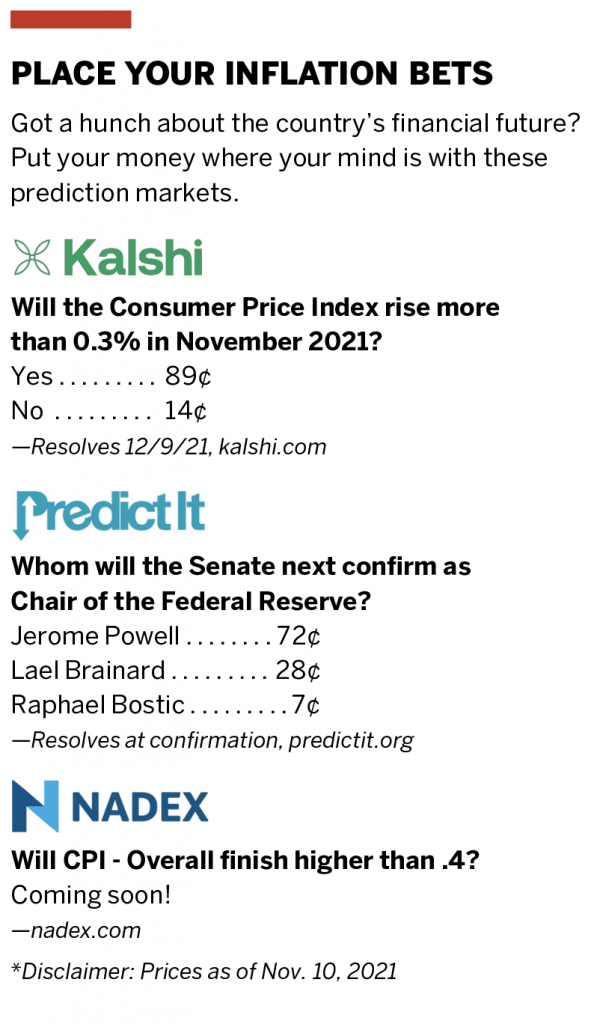

You can bet on it. Literally.

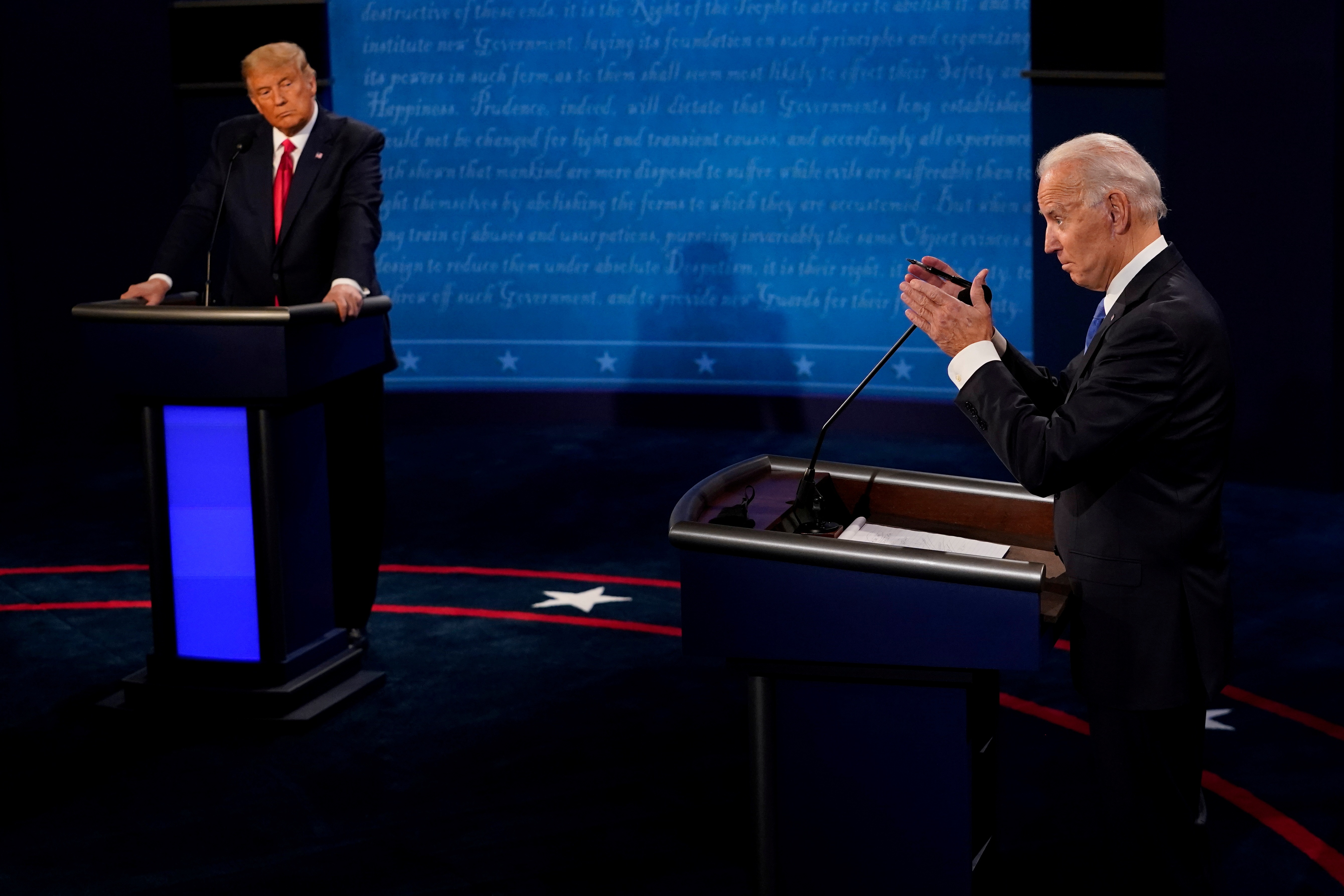

By now, just about everyone has heard about—if not felt—the rise of inflation. And as the top-of-mind question evolved from “Will inflation happen” to “How long will this last,” some were quick to offer answers.

“I believe, as we get beyond the pandemic, that these pressures release and, in that sense, I believe inflation is transitory and we don’t have an economy that is in a longer-run sense overheating,” U.S. Treasury Secretary Janet Yellen said at a November news conference.

But “transitory” merely means “not permanent,” and in an economy plagued with supply-chain disruptions, labor shortages and an ongoing global pandemic, who can predict what the future might look like?

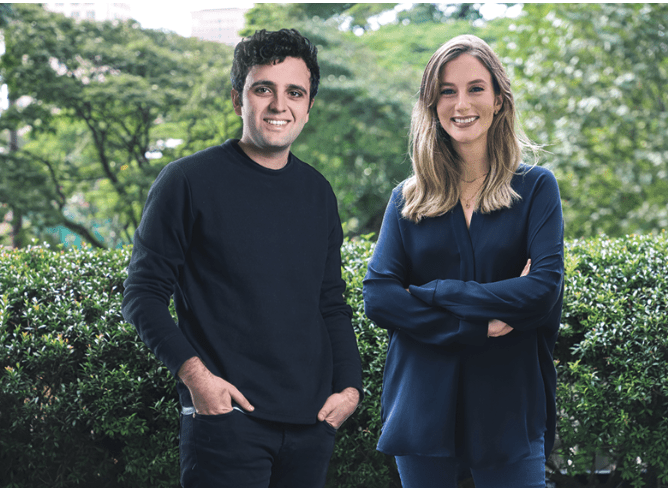

Well, Good Judgment’s more than 150 professional Superforecasters do just that—and with notable success for global corporate and government clients. In fact, UC-Irvine professor Mark Steyvers found that the Superforecasters anticipated events 400 days in advance as accurately as regular forecasters could 150 days ahead.

So Luckbox asked the Superforecasters if they believed the current pickup in inflation was transitory. Here’s what some had to say:

Inflation is transitory

“It’s easier to slow down production than it is to ramp it up. Demand does not have the same constraints, especially when backed by a vast expansion in the money supply that isn’t corralled by regulation. Production is tripping over itself to catch up.”

“Excess savings are likely to be gone before the end of the year. Demand will stabilize, go back to normal. More people will be back at work. Supply chain issues will be mainly resolved by the first half of 2022. Commodity prices will also start normalizing.”

Inflation is not transitory

“The Fed knows how to fight inflation better than deflation, so the risks of a policy error are tilted toward inflation.”

“Supply chain issues are showing up in new areas, so there’s more going on than first appeared when inflation accelerated earlier in the year.”

“Many saw rampant inflation coming after the financial crisis, but much of the new money was locked up with capital requirements. That money couldn’t chase goods (nod to Milton Friedman). Now the trillions dumped by the Fed and Congress are chasing goods, leading to inflation, and trillions more to come.”

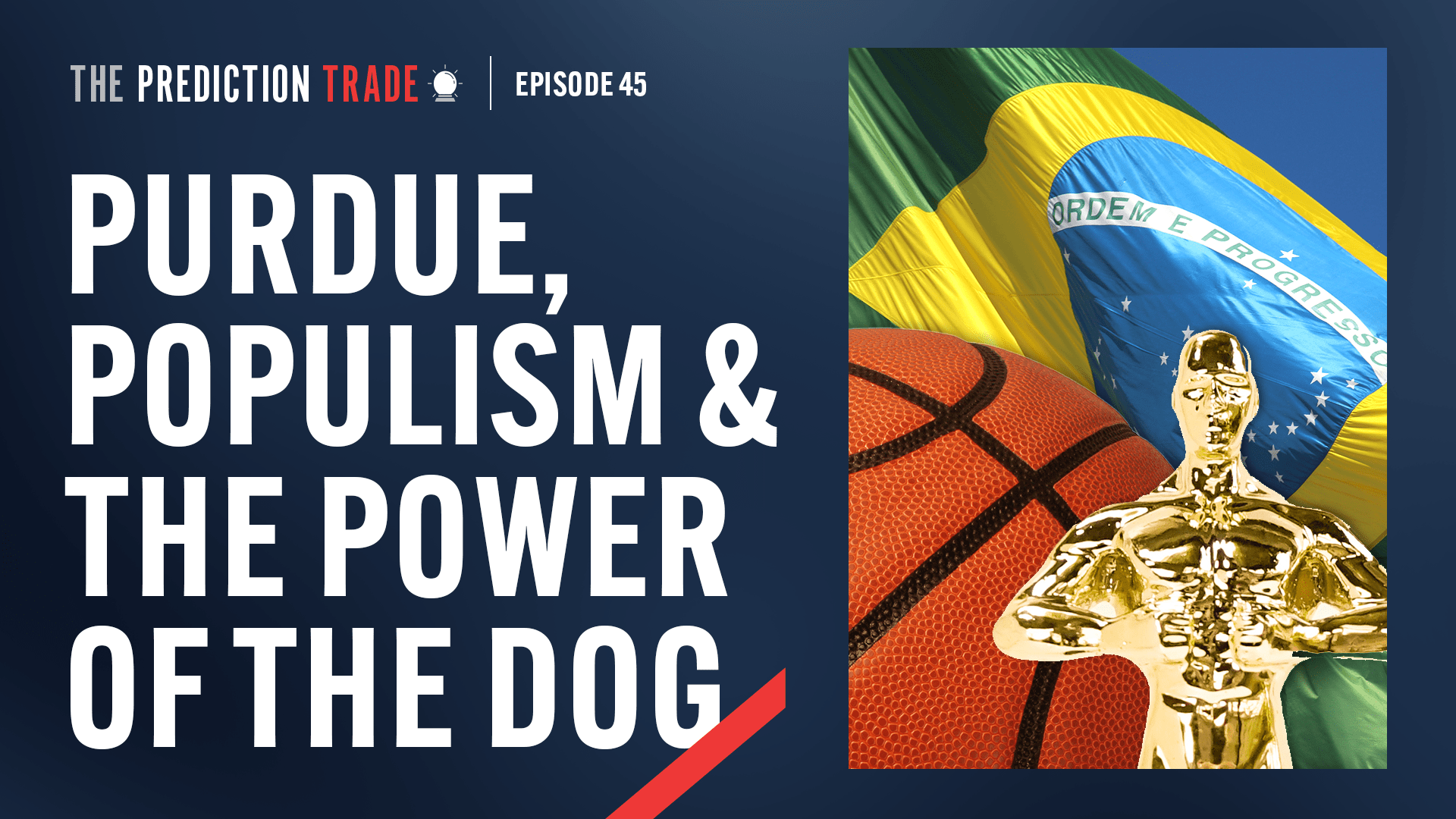

Tune in to Season 2 of The Prediction Trade podcast from Luckbox for all-new ways to make money forecasting the financial markets, politics, crypto, sports and other events.