Trading the Tire Makers Amid the Recent Rally in the Rubber Market

Tire manufacturers continue to benefit from shortages in the global rubber market, a situation which has pushed both rubber and tire prices higher in 2023

- Rubber prices have rallied by about 12% since mid-August.

- Rubber shortages have been a continuing problem in the industry, resulting a 20% increase in tire prices over the last couple years.

- Many global tire manufacturers have seen their shares rally in 2023, as higher prices have contributed to increased profitability.

Most investors and traders don’t wake up thinking about the price of rubber.

However, after the 12% run-up in prices over the last 40 days, that could change in the near future. Rubber futures are now trading near the highs of the year, at roughly $1.41/kilogram.

And for most Americans, higher rubber prices have translated to significantly higher tire prices. From May 2021 to May 2023, the average price for a tire in the U.S. rose by roughly 21%, according to ProPublica.

Even amidst record inflation, that type of price spike is out of the ordinary—tire prices have outpaced core inflation by about 70% since May of 2021.

Speaking to the current price dynamic in the tire industry, Kevin Cates—the owner of the Tire Town chain in Louisiana—recently said, “I’ll have a customer tell me he bought a tire a year and a half ago, and the price has gone up at least 30%—they can’t believe it. My guys on the counter see that every day.”

The aforementioned market dynamics help explain why shares in the tire manufacturer Goodyear (GT) are up nearly 30% so far this year. And as with many commodities-focused markets, the recent jump in prices appears to be linked to supply-side concerns in the rubber market.

Annually, end users in the rubber market demand roughly 14.5 million metric tons of rubber. However, much like the cocoa industry, rubber trees have been under constant threat from disease and extreme weather conditions, which has reduced the reliability of the global rubber supply chain.

Today, most of the world’s unrefined rubber comes from countries in Southeast Asia and West Africa, and the process remains extremely labor intensive. Farmers in these two regions harvest sap (aka latex) from rubber trees, and then shape it into sheets which are dried in the sun.

After that process is complete, the sheets are then refined into commercial-grade rubber, which is used to produce tires, shoe soles, seals, insulates, and even condoms. It’s estimated that small, regional farmers in Southeast Asia and West Africa produce roughly 85% of the world’s natural rubber supply.

However, due to the spread of white root disease, and the onslaught of both drought and flooding (e.g. El Niño), rubber farmers have consistently been under pressure to satisfy demand.

Unfortunately, an extended downdraft in rubber prices from 2017 to 2020 also catalyzed a shift among farmers, whereby many of them transitioned away from rubber harvesting and into palm oil. As a result, rubber production in 2019 was about 1 million tons short of demand, according to the International Tripartite Rubber Council.

Importantly, the market never adjusted to the supply shortage, because the COVID-19 pandemic struck shortly thereafter, and rubber demand temporarily fell off a cliff.

For a short period in 2020, “driven miles”—which is a key statistic in the rubber market—dropped precipitously. As a result, demand for new tires also plummeted, which caused rubber buyers to step back from the market.

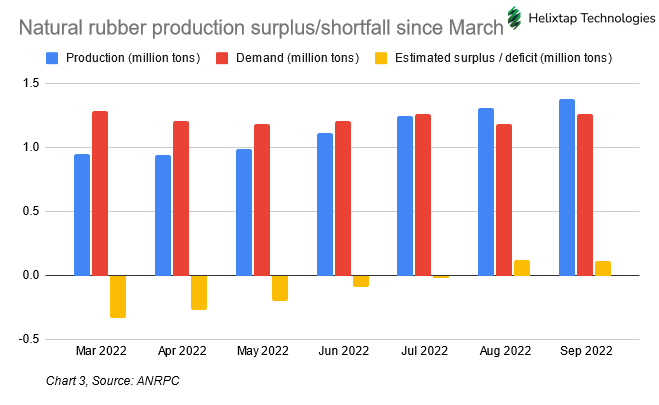

Fast-forwarding to the present, there’s now fresh concern that the same dynamics which created the rubber shortage in 2019 could once again develop in the future. The ever-shifting nature of supply-side dynamics in the rubber market is highlighted below.

Speaking to tightness in the rubber market, Robert Meyer—the co-founder of Halcyon Agri—recently said, “Demand has since eclipsed supply. Now there is an acute shortage in destinations, and inventory held by tire makers is very low.”

As a result, the industry may need to increasingly rely on recycled natural rubber, as well as synthetic rubber. Additionally, some industry participants are attempting to produce natural alternatives to rubber.

Recycled Rubber, Synthetic Rubber, and an Emerging Natural Alternative

Rubber waste has been accumulating around the world for many, many years, as evidenced by the piles of old tires stacked up at service stations and landfills around the United States.

Unfortunately, due to its durability and non-biodegradable nature, this material is ill-suited for landfills. So with the rubber market running into shortages, some industry participants have shifted toward recycled rubber.

In order to reuse rubber, the vulcanization process basically has to be reversed. To do so, old tires are shredded, frozen with liquid nitrogen, and then hammered down into very fine powder. This powder is then screened and cleaned with water and chemicals.

In 2023, companies such as Bridgestone (BRDCY), Continental (CTTAY), Goodyear (GT) and Michelin (MGDDY) have all announced initiatives to expand their use of recycled rubber.

Continental, for its part, already claims that 15-20% of the total material used in the tires it sells for passenger vehicles is composed of “renewable or recycled materials.” Continental hopes that by 2050 all of the material used in their tire making operations will be “sustainable”—referring to 100% recycled and/or renewable materials.

The French tire giant Michelin is likewise ramping up its tire recycling capabilities, and plans to “establish end-of-life tire recycling plants across Europe, with a total capacity to recycle up to 1 million tons of end-of-life tires annually by 2030.” The first plant is scheduled to go online in Sweden by the year 2025.

Over the last five years, Michelin has invested in several recycling-focused companies—such as Scandinavian Enviro Systems and Lehigh Technologies.

In addition to recycled rubber, the use of synthetic rubber is also expected to grow in the coming years. However, synthetic rubber is produced using petrochemicals, and doesn’t offer the same characteristics as natural rubber.

For example, medical gloves made out of natural rubber are less susceptible to tearing, as compared to synthetic rubber. And when it comes to the tires used in the commercial aviation industry, natural rubber is preferred, because it is more heat resistant, and has higher elasticity.

Moreover, petrochemicals are made from petroleum—the latter of which has also been getting more expensive in 2023.

Due to the expense and limitations of synthetic rubber, some companies in the rubber industry are currently working on producing commercial-grade natural alternatives. For example, during World War II the Russian military experimented with making rubber out of a species of dandelion native to Kazakhstan known as Taraxacum kok-saghyz (aka “TK”).

On a per acre basis, TK dandelions produce about a tenth of the latex when compared to rubber trees. However, the dandelions only take about three months to grow, and are easily replenished by the large number of natural seeds (i.e. the dandelion’s “fruit”) which are produced and spread during the growing process.

This particular approach has shown so much promise that the U.S. Air Force recently initiated a program to produce airplane tires from TK dandelions. The Air Force is currently collaborating with three different entities on the project, including BioMADE, Goodyear and Farmed Materials.

BIOMade is a research institute sponsored by the Defense Department that specializes in biomanufacturing. It has contracted with Farmed Materials to grow the dandelions, and with Goodyear to produce the tires.

Suitability and quality

Speaking to the suitability of the dandelions as a natural alternative to rubber, Angela Campo—a program manager at BioMade—recently told Stars and Stripes, “The quality of rubber is similar to what you get from the rubber tree. So that’s what made it particularly desirable for this project.”

If the project is a success, it will make the U.S. military less dependent on foreign suppliers, and also help insulate the military from supply disruptions and price volatility in the rubber market.

According to Stars and Stripes, the Air Force purchases upwards of 100,000 tires annually at a cost of roughly $100 million. At present, projections indicate that a single acre of dandelions could produce from 200 to 400 tires annually.

It’s possible that new approaches to producing rubber—such as the TK dandelions—could eventually help ease the tight supply dynamic in the rubber industry. But for now, it’s likely that natural rubber shortages and the rising price of petroleum (e.g. synthetic rubber) will dictate trading conditions in the rubber futures market.

To track and trade the tire/rubber market, readers can add the following symbols to their watchlists (sorted by year-to-date return).

- Sumitomo Rubber (SSUMF), +32%

- Goodyear (GT), +27%

- Bridgestone (BRDCY), +14%

- Continental (CTTAY), +12%

- Michelin (MGDDY), +9%

- Pirelli (PLLIF), -10%

- Titan International (TWI), -15%

- Myers Industries, (MYE), -20%

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.