Hedging Political Bets

Trading in political markets closely resembles trading in financial markets: Do the homework, make an educated decision and hedge.

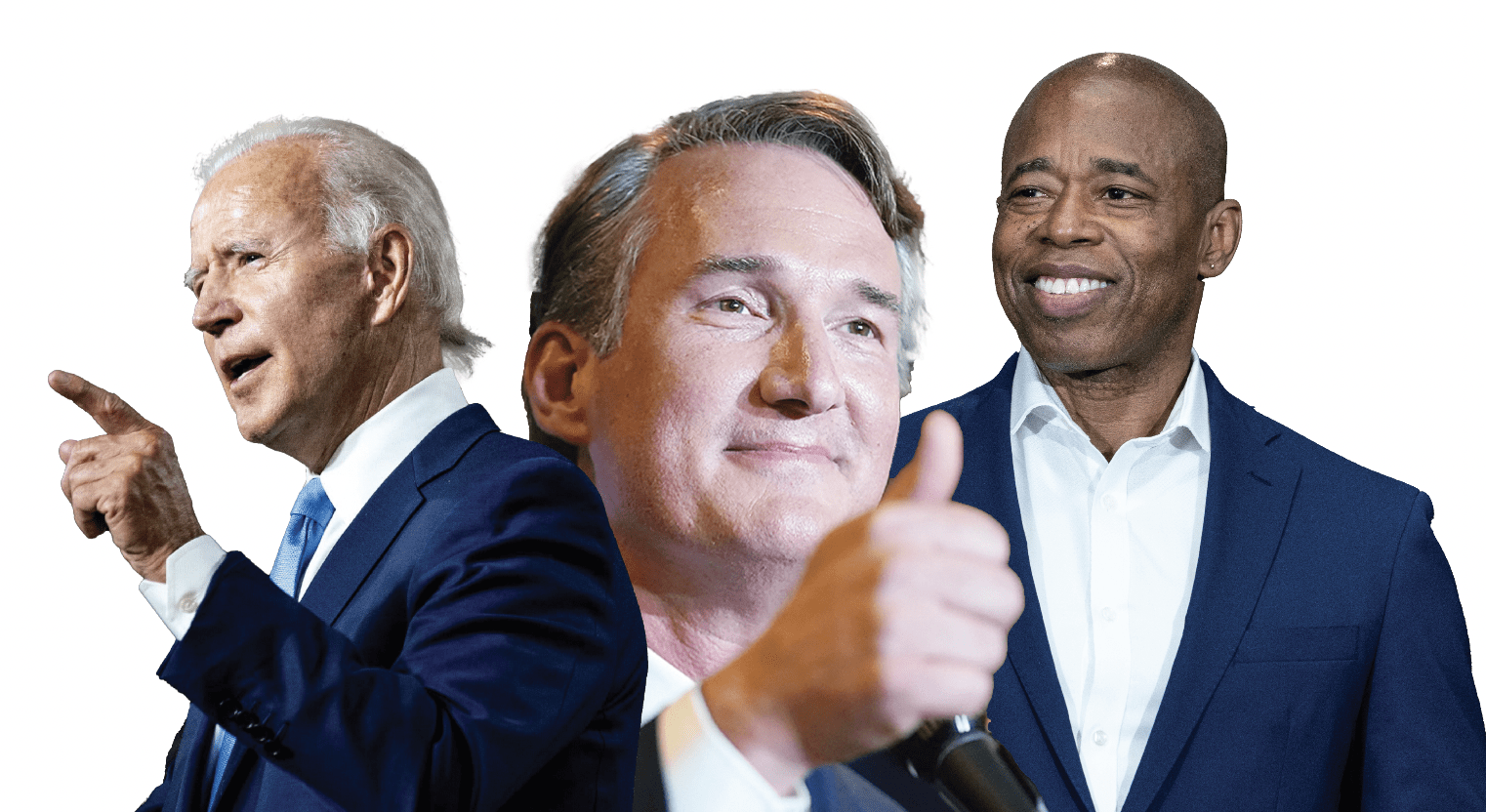

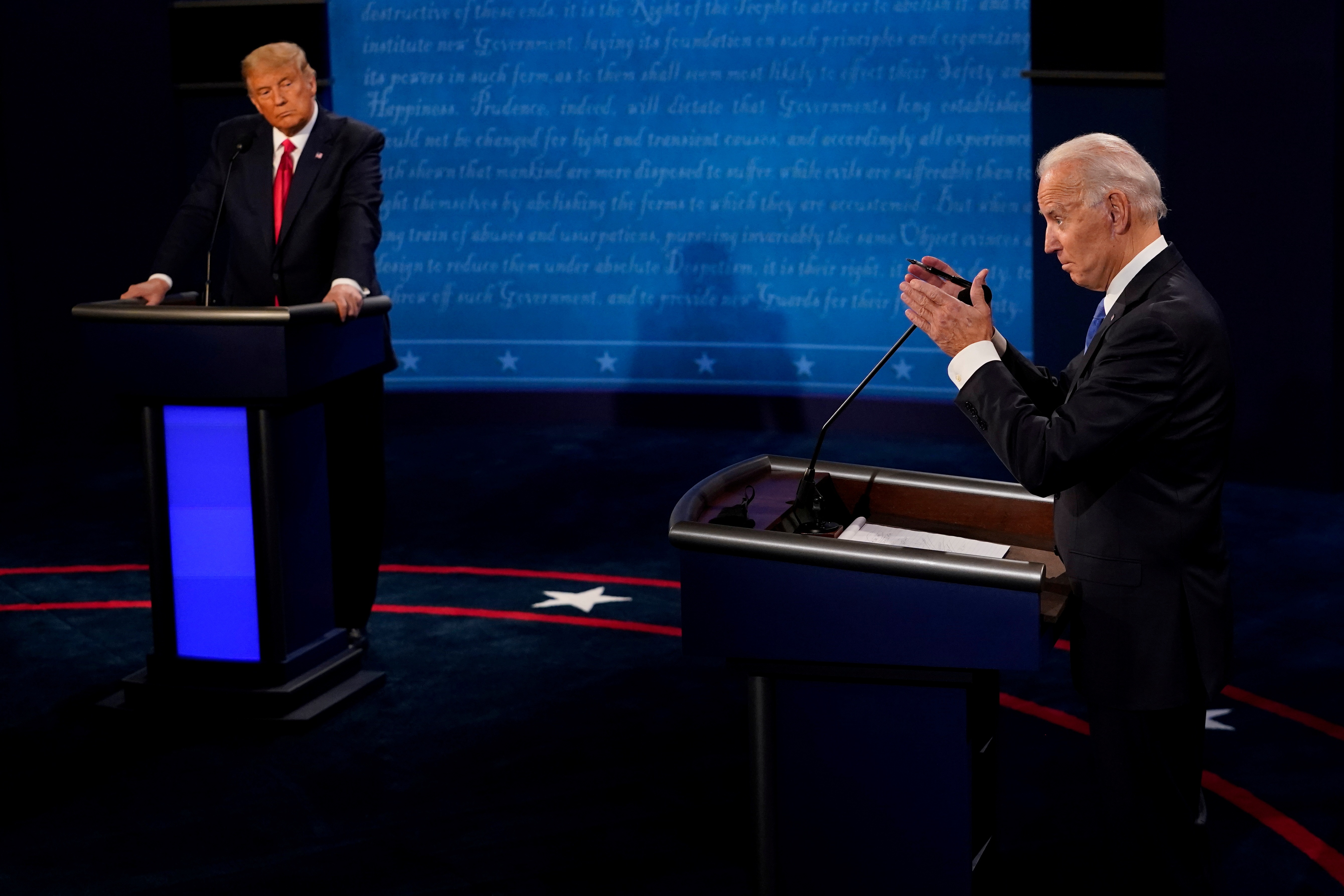

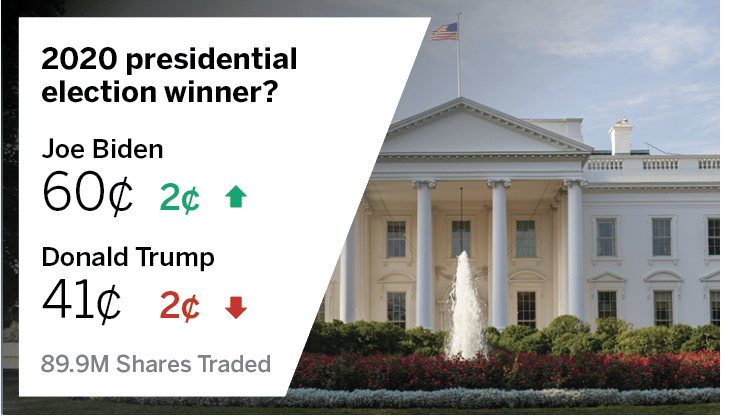

“Sure things” aren’t always so sure, and that lesson rings true to political traders’ ears. Fortunes were lost betting big on Hillary Clinton in the 2016 election. Now, in 2020, Joe Biden leads nearly every poll. But before betting the farm on Biden, consider the hedging advice of this prediction market super-trader.

Trading in the political prediction markets seems a lot like trading in the capital markets: Research, diversification and hedging pay off for anyone who wants to make money safely.

In political prediction market trading—where traders wager real money on specific political outcomes—noise from social media, political commentary and the opinions of friends and family can seem unavoidable and can drastically change a trader’s strategy or decisions.

Here’s one example of how things could go wrong:

A trader views the election as all but over. He believes Biden will win by eight to 10 points, the Democrats will pick up at least three seats in the Senate and they’ll expand their lead in the House.

Comfortable with the polling and anecdata he’s seen, he wants to put as much money on that prediction as he can. That brings him to the market forecasting whether Democrats will make a clean sweep of the White House, Senate and House.

“Yes” shares trade only a few cents less than they do in the market for Democrats to win the presidency alone. Although the trader knows of other ways to make the same bet more cheaply, he’s already maxed out in those positions. Besides, even though this market is overpriced, it still feels like a really good price for a “sure thing.”

After clicking a few buttons, his total investment in the Democrats is now up to about $10,000. But that’s when the regret sets in.

Looking at the calendar, he sees several months left in this election cycle, which can feel like a lifetime in politics. Memories of how wrong things went in 2016 flood back into his mind. He remembers that even runaway elections tend to tighten as voting nears.

Traders in this position are not alone. Fortunately, they can take action to calm their uneasy feelings without locking themselves out of their predictit.org accounts until November or continuing to suffer through the ups and downs of a volatile campaign season.

Insuring such a bet will take some work—and a little more capital—but if done correctly, it can drastically reduce exposure, guarantee fewer sleepless nights and possibly return some premium in November.

Here are some things to keep in mind for betting against swing shares:

1. If Donald Trump’s position improves before November, a ripple effect will appear in the outlook for Republicans in nearly every market. For instance, if Trump’s approval or head-to-head polling goes up nationally, that means he has a better chance of winning North Carolina, which means Republican Sen. Thom Tillis has a better shot at holding on. This affects House races and gubernatorial races, as well as delegate and popular vote markets, just to name a few examples.

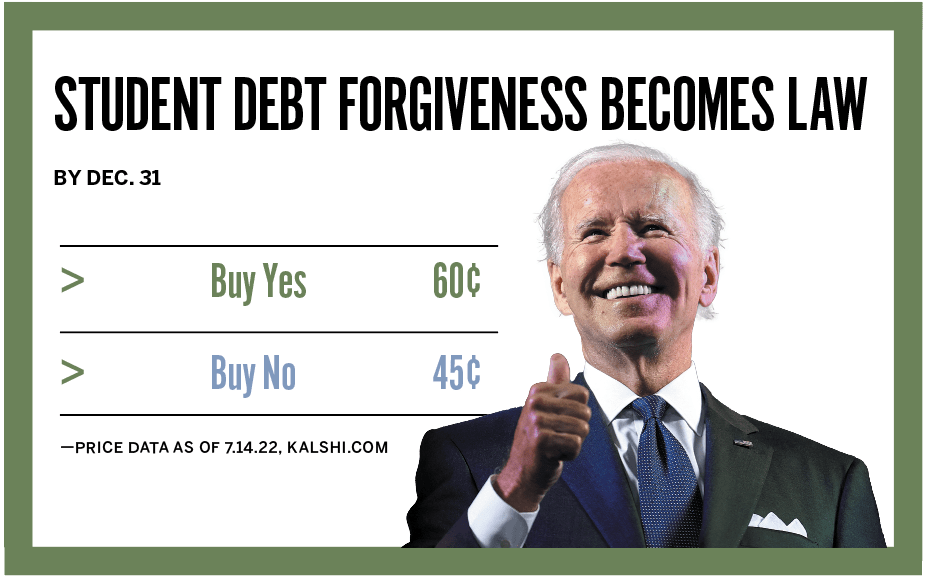

2. Some markets are simply bottomed out. Traders who have been on predictit.org for a while know there’s a limit to how low new information can push prices in certain markets. In the 2017 French presidential election, for instance, Emmanuel Macron consistently led the polls by about 20 points, yet some traders were still willing to pay north of 25¢ for his opponent until the minute before Macron won by 32 points. Overconfidence in certain Republican positions will not go away, no matter what happens between now and November.

3. Think of insurance as price control instead of as an additional bet to offset losses. That doesn’t mean roll the dice on a bunch of longshot Republican positions in addition to Democratic holdings. Holding through election night would mean that a good, but not amazing, night for Republicans would spell disaster.

Having insurance provides flexibility—and an escape option—in the days before the election. If done correctly, portfolio value lost to price declines in Democratic positions should be roughly offset by gains in Republican positions, which can be sold if things get too uncomfortable. Remember, too, that the inverse should not be true: If Democratic polling continues to improve, insurance bets should not lose much value for the reason listed in point No. 2.

Keeping in mind that a rising Trump helps all Republicans, that the pricing can’t get much worse on certain Republican positions, and that Democratic slippage should result in Republican solidarity, traders can choose among hundreds of markets that offer varying degrees of low-risk/high-upside insurance.

The challenge is finding the ones that fit together at the best price.

Derek Phillips’ Best Bets

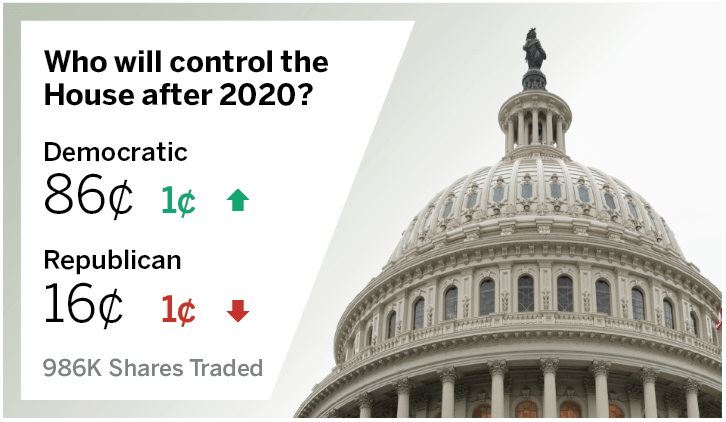

Which party will control the House after the 2020 election?

Buy YES on Republican as a hedge

It may require patience to get in on this, but the floor for the Republican contract is about 13¢. It shouldn’t be much below that on election day, no matter what happens, so traders have a lot of upside to the bet. If Trump pulls the race close to 50/50, this contract should trade around 25¢, so traders who max at 13¢ could cover about $650 in losses. If Trump becomes the favorite, it could increase to 40¢ here.

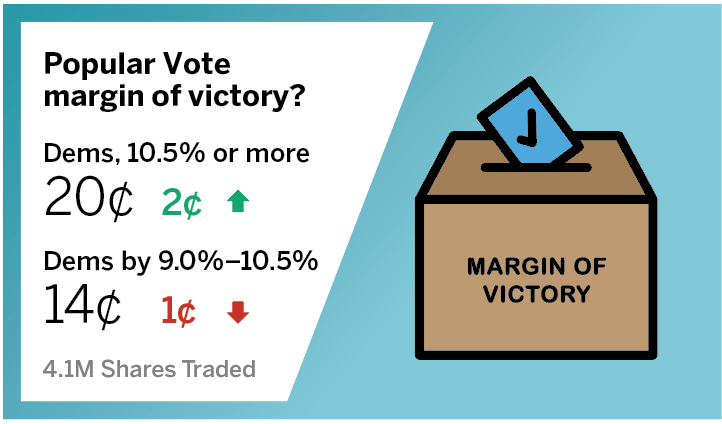

What will be the popular vote margin in the 2020 presidential election?

Buy YES on any contract for 1¢

Get anything here at 1¢. None of these brackets will be dead before election night, so traders won’t have a problem selling at cost if they want to. If there’s any kind of fluctuation, explicable or otherwise, traders are guaranteed to at least double their money. Be willing to pay 2¢ for some of the closer brackets and 5¢ for that first Republican bracket, which will see the sharpest rise if confidence starts to come back to Trump.

Who will win the 2020 U.S. presidential election?

Buy NO on Trump and Biden.

Buy “No” on both Trump and Biden as catastrophe insurance. Who knows how things will play out if something happens to Trump or Biden, but the free max payout on one position can cover the calamity going on elsewhere on the website. If nothing crazy happens to either, a trader isn’t out anything—maybe some fees, provided he paid less than a dollar for the two combined. Traders can probably cover the fees by tacking on the Libertarian and Green Party candidates at some point; as well as Hillary Clinton, who will probably still be there.

Derek Phillips began trading political futures professionally during the 2016 election, turning $400 into $400,000 in four years. Phillips is a recurring guest on The Political Trade podcast. @dmpfrompi

Want insight into wagering on political prediction markets? Check out The Political Trade wherever you listen to podcasts. Weekly episodes feature top prediction market traders and political insiders, including Anthony Scaramucci and James Carville.