VIX Reversal: Is a 2025 Market Rebound Coming?

All three times the “fear index” has fallen from 30 to 50, the market has bounced back forcefully. Could this be the fourth?

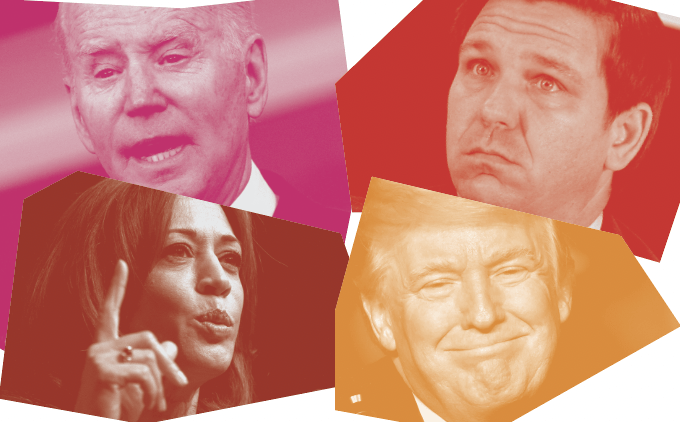

- Steep tariffs triggered the 2025 market sell-off, dampening investor sentiment and pushing volatility to levels not seen since 2020.

- Market valuations were elevated before the sell-off, as evidenced by a historically high reading in the Shiller CAPE Ratio.

- A sharp decline in the VIX, as observed in late April, has historically signaled a market recovery. That outcome seems more likely now if the tariff threat remains contained and the U.S. avoids a recession.

The 2025 trading year has been marked by extreme volatility and wild swings in investor sentiment. The turbulence arose with the Trump administration’s introduction of steep tariffs, a geopolitical shock that sent volatility soaring to levels not seen since 2020. The resulting panic triggered a sharp sell-off, revealing the market’s underlying vulnerability. This vulnerability was amplified by the historically high Shiller CAPE Ratio (a cyclically adjusted price-to-earnings ratio). It indicated valuations were stretched well above their long-term average—leaving the market susceptible to a sharp correction.

But amid the chaos, a signal has emerged that may indicate the worst could soon be behind us. The Cboe Volatility Index (VIX), a longtime barometer of fear in the market, recently shifted dramatically, falling rapidly from 50 to 30. Historically, such reversals have been followed by strong recoveries. If the threat of tariffs remains contained, and there’s no recession, this VIX reversion could herald a new bull market.

Volatility has mirrored or surpassed recent crises

The 2025 trading year is already etched in the history books.

The VIX hadn’t closed above 40 since the chaotic days of March 2020, yet it closed at 52 on April 8. In the 21st century, the VIX has closed above 50 during only three other periods—2002, 2008-2009 and 2020. Adding 2025 to the list makes four.

As most active investors are well aware, the VIX shares a strong negative correlation with the major market indices—meaning that when the S&P 500 drops sharply, the VIX usually shoots higher. That means the surge in VIX isn’t necessarily surprising, considering that 2025 has seen one of the worst starts to a trading year in market history.

Looking ahead, the big question is whether the VIX has already reached its 2025 high, or if it will set a fresh 52-week high in the months ahead. Predicting this is far from straightforward because it hinges on a couple of key factors—chief among them being the trade war and the broader economic outlook. First, let’s consider the tariffs.

As the “90-day pause” in trade discussions approaches its end (approximately July 9), markets will be bracing for what comes next. If the Trump administration reinstates the “reciprocal tariffs” at the levels originally outlined on April 2, expect a fresh wave of volatility. This could easily push the S&P 500 back toward 4,900, with the potential for even deeper losses.

On the other hand, if the U.S. successfully negotiates new deals with its largest trade partners—Canada, China, the European Union and Mexico—the worst of the market’s sell-off might already be behind us. In that more bullish scenario, the April lows could very well mark the 2025 bottom in the major stock indices.

However, another factor to consider is the direction of the broader economy. If signs of an impending recession begin to emerge, it’s likely the S&P 500 will revisit its recent lows, with the 4,800 level potentially being tested once again. Historically, recessions and market corrections are highly correlated—during the last 12 recessions, the stock market corrected by about 24%, on average.

Conversely, if the trade war de-escalates and the country avoids a recession, the outlook for the stock market improves significantly. A stabilization of global trade, coupled with a growing economy, could easily push the S&P 500 back above 6,000 and potentially to fresh all-time highs.

Historically high valuations susceptible to a pullback

The recent pullback in the markets has been painful, but one could argue it may have been justified. As we pointed out in a previous analysis, market valuations had gotten overextended in recent months. One indication was the historically high Shiller price-to-earnings (P/E) ratio, also known as the Shiller “cyclically-adjusted P/E” ratio (aka Shiller CAPE ratio). This metric offers a longer-term perspective on market valuations.

From November 2024 through February 2025, the Shiller CAPE P/E hovered above 37 (highlighted below). That level was more than double the metric’s historical average of 17. For context, the Shiller CAPE ratio adjusts for inflation and smooths earnings over 10 years, making it a better indicator of market valuation than the standard P/E ratio.

The extreme readings in the Shiller CAPE ratio underscore just how overpriced the market had become at the end of 2024 and into early 2025. These lofty valuations might have been justifiable if corporate earnings had continued to grow at an aggressive pace. However, in a stagnant or contracting economic environment, pricey valuations are rarely sustainable. Throughout the history of the stock market, there have been only a handful of instances in which the Shiller P/E has stayed above 30 for an extended period. The fact that the Shiller CAPE neared 40 shows just how unsustainable these valuations had become, signaling a correction was becoming increasingly necessary.

Even after the April correction, the S&P 500’s Shiller CAPE ratio remains above 30. While this marks an improvement from February, it still indicates a market that may be overpriced. The persistently high P/E, combined with the continuing risk of re-escalating global trade tensions under the Trump administration, suggests further volatility could be ahead in 2025.

For investors, the lesson is clear: High valuations create a market more vulnerable to shocks—whether those shocks come in the form of geopolitical risks, economic slowdowns or changes in government policy. In a market with elevated multiples, even small catalysts can trigger sharp corrections, and the current tariff controversy serves as a good example.

While the recent pullback may sting, it could prove to be a much-needed reset, giving the stock market a reprieve from those lofty valuations, and regaining some much-needed balance. However, with the Shiller P/E still above 30, the risk of further declines remains, especially if corporate earnings start to deteriorate.

The 50-to-30 reversal in the VIX has historically been bullish

While 2025’s volatility has left investors on edge, a notable signal could point to a favorable outlook. Assuming reciprocal tariffs are not fully reinstated and the economy avoids falling into a recession, one indicator suggests the worst might be behind us—and that the market could have more room to run. That indicator is the recent reversion of the VIX from 50 to 30, which has historically been a precursor for a bull market.

In 2025, the VIX had its fastest drop from 50 to 30 in history. And since 1988 every time the VIX has fallen from above 50 to the 30, the S&P 500 has recorded positive returns within the next 52 weeks. The median return in these instances has been a robust 17.9%, as highlighted below.

The most recent example of this phenomenon came in spring 2020, when the VIX dropped from over 50 to 30. Following that shift, the S&P 500 surged by nearly 43% within 52 weeks. This pattern suggests the sharp reversion in the VIX in April 2025 could once again be a signal for future market strength—provided the broader economic and geopolitical headwinds cooperate.

Supporting this perspective, Charlie Bilello of Creative Planning recently pointed out that whenever the VIX has closed above 50 since 1990, the S&P 500 has delivered a return of 35% over the following 52 weeks (on average), with even more impressive gains over a five-year horizon—129%.

These historical patterns suggest that after extreme turbulence the market could be on track for a meaningful recovery. Of course, this data doesn’t guarantee volatility won’t surge again in 2025 nor that the lows of the year in the major indices are already in. Many learn the hard way that past performance is no guarantee of future results. But if the macroeconomic landscape remains favorable, the recent 50 to 30 reversal suggests bullish days may be ahead.

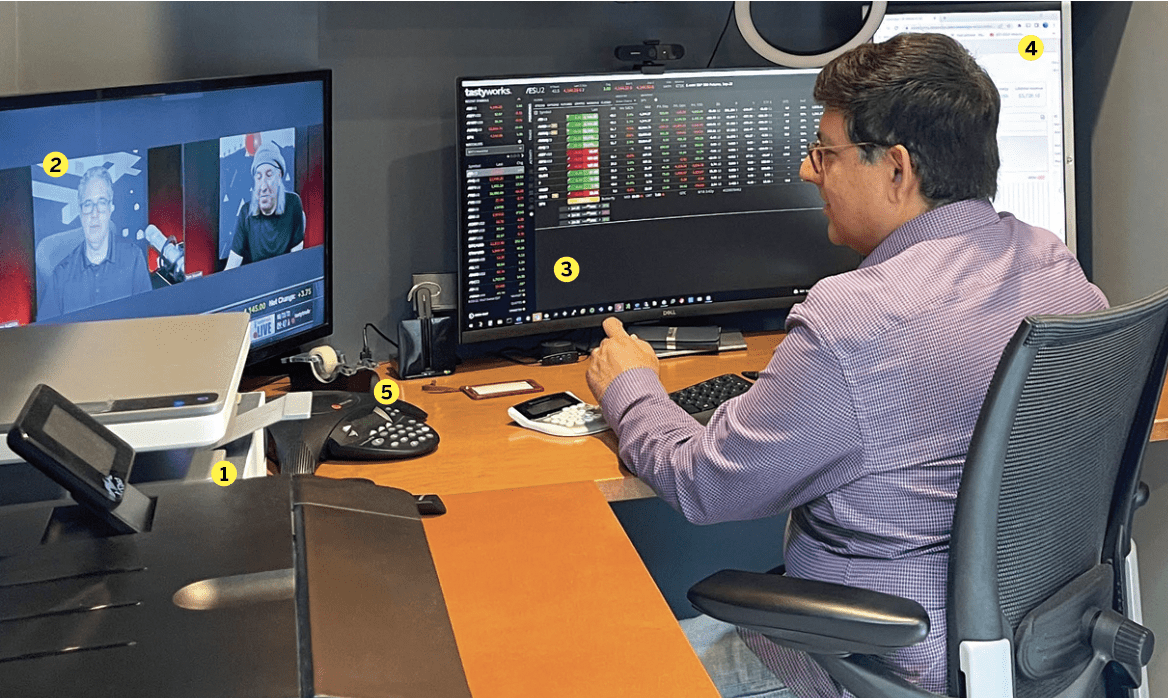

Andrew Prochnow, a frequent contributor to Luckbox, has traded the global financial markets more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.