Canadian-Australian Currency Reacts to Crude Spike

As evidenced by the big pop in OVX (CBOE Crude Oil Volatility Index) last week, volatility in the crude oil space is now trading at some of the highest levels observed in 2019.

Traders seeking to deploy short premium in underlying symbols with exposure to the energy sector have likely already jumped on newfound opportunity.

However, when developments such as these materialize, there are usually repercussions in other niches of the financial markets as well.

And because oil movement has arguably picked up due to intensifying geopolitical concerns in the Middle East, it’s no great surprise that some sovereign currencies with heavy exposure to crude oil have also popped up on the trading radar.

Two currencies that are traditionally heavily tied to the energy sector are the Australian dollar and the Canadian dollar. That’s largely due to the fact that the economies of both countries rely heavily on the bountiful supply of natural resources that lie within their respective borders.

Obviously, the currencies of Russia and Saudi Arabia are also heavily exposed to crude, but in both of those cases, they aren’t available to trade in the foreign exchange futures market. On the other hand, both the Australian dollar (/6A) and the Canadian dollar (/6C) can be traded as futures (in U.S. dollar terms).

Along those lines, a recent episode of Closing the Gap: Futures Edition on the tastytrade financial network points out that a “price extreme” has materialized in the relationship between these two currencies and may be worth a closer look.

As a reminder, pairs traders often filter the trading universe for two underlying symbols/markets which share an established, discernible, historical correlation. When that correlation breaks down, pairs traders often consider deploying a structure which theoretically benefits when the relationship returns to its “normal” state.

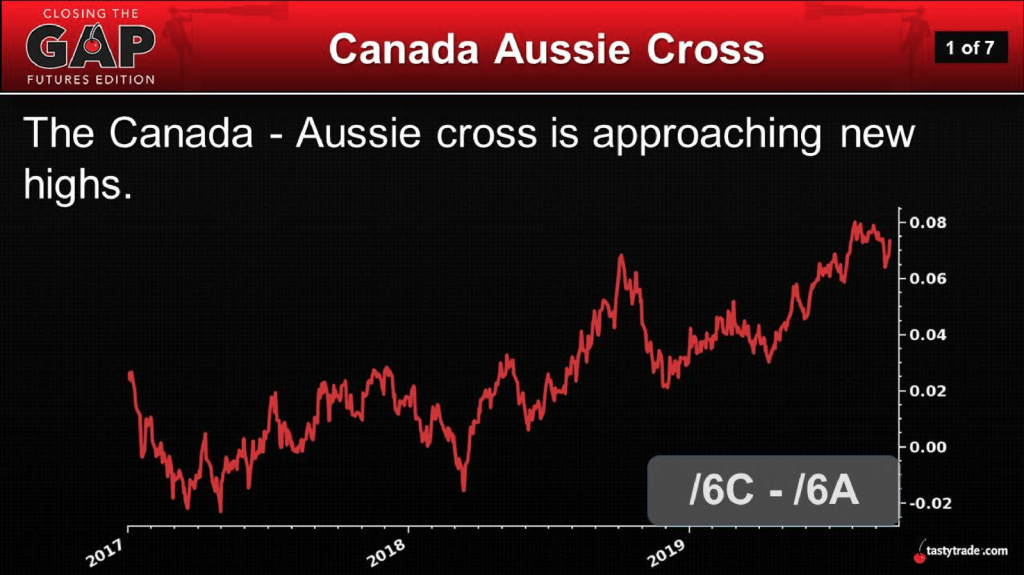

Circling back to the Australian dollar and the Canadian dollar, one can see in the graphic below that the price relationship between the two is currently trading at the higher end of its recent range (i.e. a “price extreme”).

While many historical trading relationships are analyzed through ratios such as the Gold-Silver Ratio, or the Soybean-Corn Ratio, some “pairs” are examined through the lens of a simple difference between the value of each—as shown in the slide above.

In this case, one can see above that the Canadian dollar has of late been appreciating at a faster rate than the Australian dollar, which has pushed the difference between them to the widest point in more than two years.

For reference, the current correlation between two currencies is roughly positive 0.69, which is within the range (0.65 or higher) that pairs traders usually use as a guideline for considering such structures.

At this time, the fact that the Canadian dollar is “richer” than normal, when compared to the Australian dollar, represents the basis for a potential pairs trade that would involve getting short the Canadian dollar versus long the Australian dollar.

Mechanically speaking, this position performs well when the Canadian dollar moves lower or the Australian dollar moves higher (but the ideal situation is when both occur). Another attractive scenario would involve the Australian dollar playing catch up with the Canadian dollar by appreciating more quickly.

The advantage when trading pairs like these is that the presence of a strong, long-term correlation theoretically provides protection against a scenario in which one of the currencies makes a gap move without the other following suit. On the other hand, the risk in the trade is that the “anomaly” in the price relationship widens further, which would push the pairs trade into negative territory from a P/L perspective.

Traders seeking to learn more about currency pairs are encouraged to review the entire episode of Closing the Gap: Futures Edition when scheduling allows.

As a reminder, foreign exchange rate futures listed in the United States are quoted in terms of U.S. dollars. At the time this episode aired, the AUD/USD exchange rate was 0.6811, while the CAD/USD exchange rate was 0.7548, equating to a spread of 0.0737.

Additional information focusing on futures trading is available in the tastytrade LEARN CENTER.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.