High Volatility in the Euro: There is a trade for that

Whether you’re trading equities, bonds, or commodities (or all three), there’s been a plethora of good opportunities to add currencies to the portfolio during the month of August..

And with volatility spiking in all of those markets, it’s likely traders have added at least a few new short premium positions in the last couple weeks—especially with the VIX finally popping back above 20.

If you’re looking for some new niches of the market to deploy capital, and also for ways that you can add some diversification to your portfolio in terms of both underlying and strategy, then the foreign currency markets may be worth a closer look.

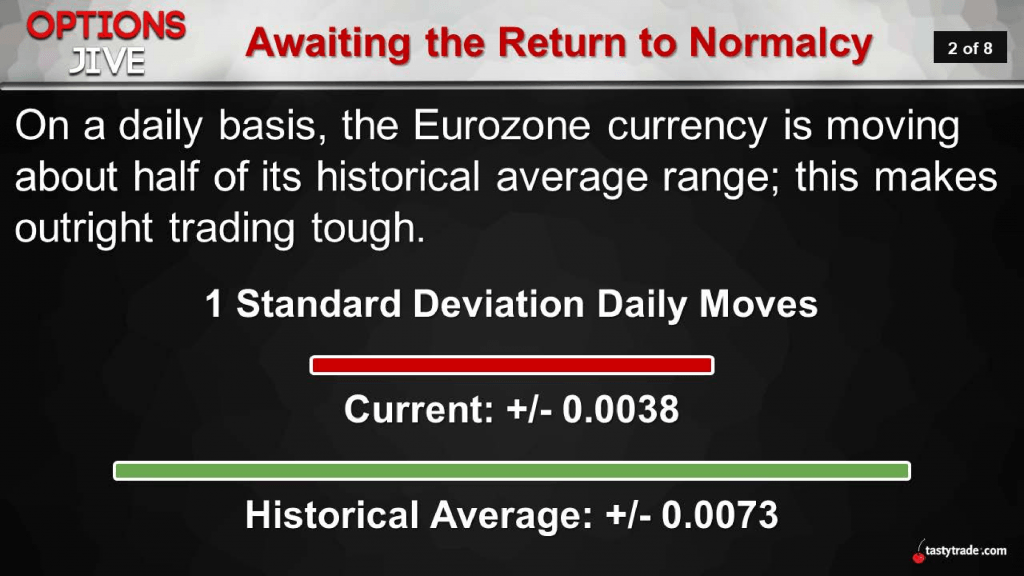

In particular, the Eurozone currency, commonly referred to as the “Euro,” has been exhibiting some interesting trading behavior. In this case, however, it isn’t due to the extreme movement in the Euro, but rather because of the lack therein.

Despite the fact that many niches of the global financial markets whipsawed through the month of August, the Euro has actually been trading in rather muted fashion. According to research conducted by tastytrade, the Euro (relative to the U.S. dollar) has actually been trading in its second-smallest range since 2005.

As one can see in the chart below, the current range in the euro/U.S. dollar (EUR/USD) currency pair is roughly half as wide as its historical average:

As a reminder, foreign currencies are always quoted relative to another currency. Meaning that the EUR/USD pair tells us how many dollars are needed to purchase a single euro. As of today, that number is about $1.10. This is referred to as the “exchange rate” between the EUR/USD.

And just for the purposes of completeness, the USD/EUR exchange rate (the reverse pairing), tells us how many euros are required to purchase a single dollar, and currently trades at about 0.91 euro.

While the exchange rate itself is worth highlighting, the current attraction to this specific currency pairing is related to the implied volatility of the futures options associated with EUR/USD (/6E). Implied volatility for the futures options of EUR/USD (/6E) currently stands at roughly 6.4%, which is well below the historical average of roughly 10.2%.

Given that Brexit is officially scheduled to take place at the end of October, muted levels of implied volatility in the options of the EUR/USD futures exchange rate (/6E) seem rather intriguing. Brexit of course refers to the proposed split of the United Kingdom from the Eurozone, a process which has been dragging on for over 3 years.

For further context on the relative volatility currently observed in EUR/USD, one can also refer to tastytrade’s IV Rank. Implied Volatility Rank (aka IV Rank), is a metric devised by tastytrade that compares current levels of implied volatility to the most recent 52 weeks of data. In EUR/USD (/6E) exchange rate futures options, IV Rank currently stands at around 40%.

As a reminder, IV Rank provides insight into how the current levels of implied volatility compare to the most recent 52 weeks of data. For example, if underlying XYZ had a range in implied volatility of 30 to 60 over the last 52 weeks, then a current reading of implied volatility at 45 would equate to an IV rank of 50%. And a reading of implied volatility at 60 would equate to an IV Rank of 100%.

Traders embracing the mean reversion trading philosophy often filter for short options opportunities when IV Rank jumps above 50%, and for long options opportunities when IV Rank drops below 50%. However, traders also need to be aware that the natural tendency of implied volatility to overstate actual volatility does provide sellers of options with a higher probability of profit than buyers of options (on average).

On the other side of the argument is the fact that diversification in the portfolio generally helps insulate traders from excessive volatility, which is why many investors/traders deploy both long and short volatility positions – assuming these exposures match their outlook, strategic approach, and risk profile.

Getting back to the EUR/USD, traders seeking to capitalize upon the current levels of depressed implied volatility could consider deploying a long straddle, long strangle, or long calendar spread in order to take advantage of the current situation. Such a position might be particularly attractive in portfolios that already have plenty of short volatility exposure, and might benefit from added diversification in terms of underlying (foreign currency) and strategy (long options).

Traders seeking to learn more about the current trading environment in EUR/USD as well as the historical performance of both long and short premium positions in the options of this exchange rate future should find a recent episode of Options Jive on the tastytrade financial network very compelling.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com. Additional information is also available in the tastytrade LEARN CENTER.